Finance CPE Ethics Courses for CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

The finance world goes through rapid changes which makes it essential for finance professionals to stay up-to-date with the transformation of financial practices. Whether you specialize in personal financial planning or work for a corporate organization, you need to have a robust comprehension of the latest financial guidelines so that you can serve your clients in the best possible manner.

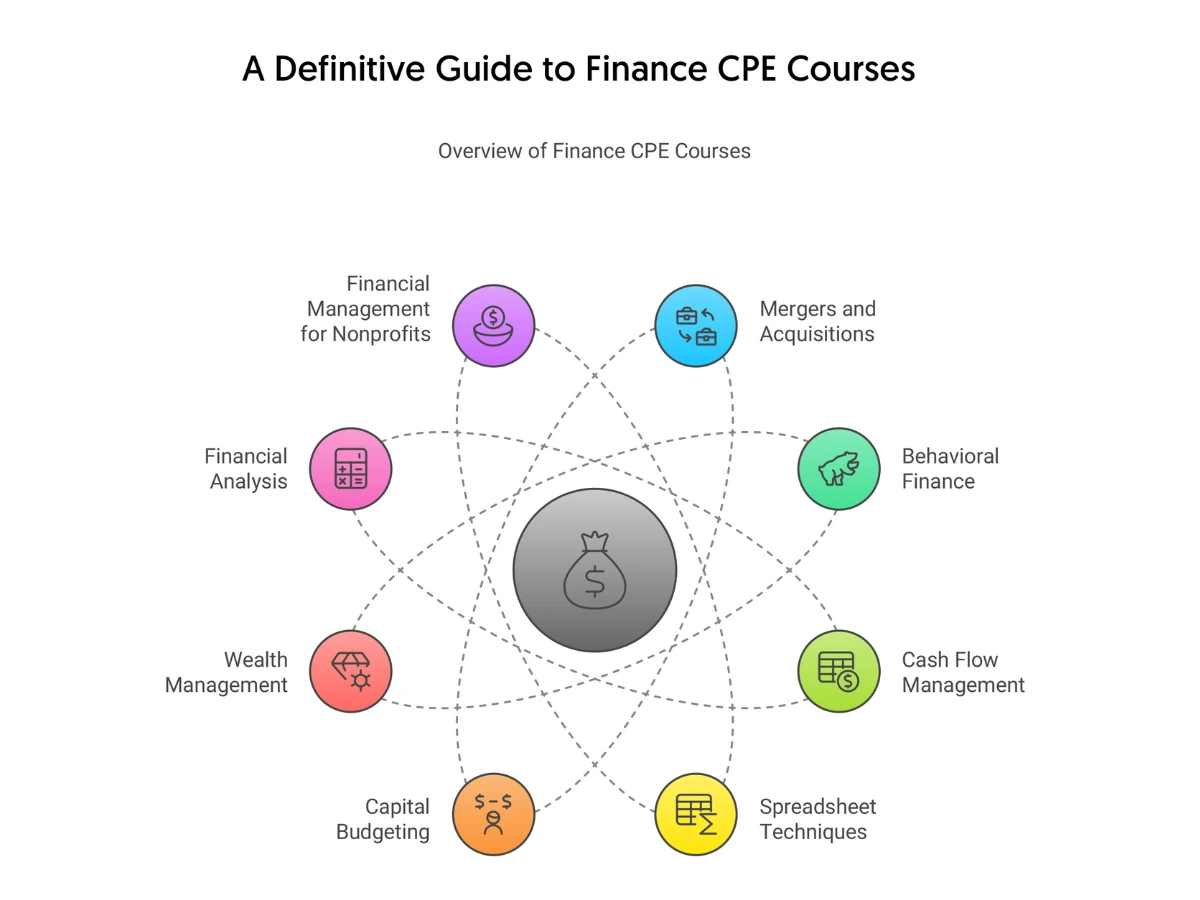

If you’re wondering what can be the most effective method to keep abreast of the latest changes in the domain of finance, the answer is to take finance CPE courses. We’ve created this page to equip you with all the vital information related to CPE finance programs. From the definition of corporate finance CPE to CPE finance meaning and more, we’ll discuss all the important things to help you become an all-round finance professional.

Let’s get started.

As the name suggests, finance CPE courses are designed to help finance professionals obtain the knowledge and skills they need to elevate their professional competence. With the help of CPE finance programs, you’ll also earn the CPE credits you need to fulfill the CPE requirements of the IMA.

Therefore, by pursuing CPE in finance, not only will you be able to reimagine your role as a finance professional but will also be able to stay compliant with your CPE requirements simultaneously. Additionally, it’s important to mention here that meeting your CPE requirements on time will demonstrate your professionalism and commitment to enhancing your competence to your clients. These things will essentially help you stay ahead of your peers and speed up your professional growth.

Now that you know what’s CPE meaning in finance, let’s see the top benefits of taking quality finance CPE courses.

If you want to serve your clients in an efficient way, you need to have a solid understanding of current trends in the field and be able to spot the upcoming ones. And this isn’t possible without completing quality CPE finance programs. By obtaining the required finance CPE credits on time, you’ll be able to keep abreast of industry developments while building an environment of excellence and growth.

The IMA requires their CMAs to get a certain number of CPE finance credits to maintain their certification. By taking the right finance CPE courses, you’ll be able to meet this requirement efficiently. It may seem like additional work after passing the CMA exam, but ultimately, it’ll help boost your career growth.

When it comes to knowing what is CPE in finance, it’s vital to know that the IMA approves certain subjects that are eligible for CPE. This means that you can master your favorite topics easily by pursuing finance CPE from a reputable sponsor. By getting a choice of which finance CPE courses to take, you’ll be able to prioritize things that match your work as a finance professional.

Before we delve deeper into corporate finance CPE, it’s important to know what corporate finance is about. In short, corporate finance refers to the branch of finance that concentrates on the ways corporations address accounting decisions, investments, capital structuring, and funding sources. Often, it also deals with enhancing shareholder value by implementing different financial strategies and long- and short-term planning.

Pursuing corporate finance CPE is synonymous with taking finance CPE courses that help improve your knowledge of the vital elements of this subfield. Here’re the vital areas of corporate finance that you can focus on when choosing CPE finance programs.

By completing a finance CPE course in capital budgeting, you’ll be able to help a corporation spot capital expenditures, compare planned investments with potential financial benefits, estimate upcoming cash flows from investment proposals, and decide on the projects that it should invest in.

Capital budgeting is probably the most vital element of corporate finance because poor capital budgeting can trigger severe business implications. For instance, it may compromise the financial position of a corporation, either because of insufficient operating ability or increased financing costs.

This focuses on sourcing capital in the form of equity or debt. By pursuing offline or online CPE finance in this area, you’ll be able to help a corporation make the right decisions regarding the appropriate amounts of equity and debt. Ultimately, the goal of capital financing is to provide a company with the capital it needs to make capital investments.

This area deals with ensuring that a company has enough short-term liquidity to continue its day-to-day operations. By pursuing CPE finance online or offline in this field, you’ll be able to help a company manage its working capital, current liabilities and current assets, and cash flows efficiently.

Publicly-owned companies need to pay dividends to their shareholders. This plays an important role in corporate finance because generally, shareholders are the owners of these companies and want returns for their investments.

By pursuing corporate finance CPE from a premier sponsor, you’ll be able to enter the dynamic world of corporate finance easily. While the job titles vary from one corporation to another, some of the popular ones include:

There are different ways to meet your CPE finance requirements. Let’s take a look at the sought-after ones.

Many finance professionals attend seminars to meet their CPE requirements and network with fellow attendees simultaneously. Seminars hosted by reputable organizations typically have qualified speakers on different subjects in the field. So, you should be able to learn the latest changes and trends in your preferred topics.

However, you should note that the costs of attending these seminars tend to be quite high. Therefore, if you’re a cost-conscious finance professional, it may not be a budget-friendly option for you.

If you’re looking for a cost-effective method to pursue CPE finance, you should opt for self-study finance CPE courses. With these programs, you’ll get unequaled flexibility to fulfill your requirements at your own pace. By choosing the right CPE sponsor, you should be able to take quality courses within your budget.

The absence of a live instructor or qualified speaker may be a constraint for those who internalize concepts better in an online or offline classroom setting. However, if you’re self-diligent and can stick to a regular study schedule, then these courses should be the best option for you.

Since webinars are accessible from anywhere, many finance professionals choose them to meet their personal finance, public or government finance, or corporate finance CPE requirements. By attending webinars that are run by skilled instructors and cover the right topics, you’ll be able to enhance your professional competence from the comfort of your office or home.

It’s important to make sure that you have the right device and stable Internet connection if you want to take this route. This is because failure to participate in the compulsory activities may not get you any finance CPE credits.

If you search online using the phrase “finance CPE courses,” you’ll see that they’re offered by a large number of sponsors. While some of them are a NASBA Approved CPE Sponsor, not all of them are and their costs and quality of study materials may greatly vary. We are a NASBA Approved CPE Sponsor and have been for over a decade.

Needless to say, if you want to make the most out of your time, money, and effort, choosing the right CPE provider is of paramount importance. To help you out, we’ve jotted down a few tips in this section.

This is perhaps the first thing you need to make sure of as long as your primary goal is to improve your knowledge and skills efficiently while avoiding the hassle of joining multiple sponsors. When you join a sponsor that offers finance CPE courses covering many different topics, it’ll help enhance your professional competence efficiently.

Joining a sponsor that has expensive courses will eventually make your CPE cost go high quickly. On the contrary, a provider with cost-effective CPE finance programs will help you stay within your budget efficiently.

Not everybody learns in the same way. Some individuals learn better using text-based content while others may prefer to choose video-based content. Additionally, depending on the topic, a program’s format may significantly impact the way you benefit from it. So, it’s always advisable to join a provider that offers a blend of different formats.

In the competitive world of CPE providers, it takes consistency and a lot of hard work to obtain good user reviews and ratings. When you see that a sponsor has received a large number of good reviews and ratings from its past customers, you can rest assured that you’ll be able to make the most out of your effort, money, and time by joining it.

If you want to reduce the cost of finance CPE courses considerably, it’s best to choose a provider that has CPE subscription packages. Some leading CPE sponsors, including CPEThink.com, offer limited and unlimited packages. With a limited subscription package, you can obtain a certain number of CPE credits. An unlimited package lets you get a virtually unlimited number of credits.

In case you’re at the beginning of your CPE renewal period, an unlimited package should be the right option for you. If you only need to obtain a certain number of credits to fulfill your requirements, you should opt for a limited package.

While pursuing CPE in finance is certainly the best method to keep pace with the latest changes in the finance industry, there are also several other things that you can do to maximize the efforts. Doing these things simultaneously while taking CPE finance programs will help you become successful in the field.

By subscribing to newsletters from authoritative sources in the finance industry, you’ll make sure that you always stay up-to-date with the latest information. From getting information about new trends to learning about important topics and more, this will help you in several ways.

Several reputable organizations in the world of accounting and finance regularly hold conferences and other events. By attending some of them, not only will you be able to connect with other finance professionals but will also be able to learn about the latest developments in the industry.

There’s no shortage of professional organizations for finance professionals. Having memberships in these organizations will let you access exclusive resources and pieces of valuable content. Additionally, some of these organizations hold conferences and other events that you’ll be able to attend.

Another effective method to spot new trends and learn about the latest developments in the industry is to follow thought leaders in the accounting and finance domain. This will help you get a clear idea of the direction in which the industry is heading.

These days, new financial software and technologies are emerging continuously. If you want to stand out from your peers, try to learn them.

As you can see, taking quality finance CPE courses from a leading CPE sponsor is the ultimate option to become an all-round finance professional. Whether you want to pursue public or government finance, personal finance, or corporate finance CPE, you’ll be able to do that easily by joining a premier CPE provider.

At CPEThink.com, we’re committed to offering quality CPE finance programs at affordable rates. If you want to embark on your CPE journey right away, start browsing them. In case you need more information about our courses, feel free to contact us.

Check out what other customers are saying.