A Definitive Guide to Auditing CPA Courses |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

Are you a CPA looking for the most effective method to stay up-to-date with the latest standards in the field of auditing? If so, taking auditing CPA courses from a reputable sponsor is unquestionably your best option.

All auditing practitioners need to complete auditing CPA programs not only to meet their state board’s CPE requirements but also to stay current on the AICPA auditing standards and the standards set forth by other governing bodies.

Additionally, if you’re about to carry out an AICPA audit, taking auditing CPA courses beforehand will help you ensure that your services are offered to the highest standards.

If you want to get more information about auditing CPA, you’ve come to the right place. On this page, we’ll discuss all the vital things associated with auditing CPA courses so that you can make an informed decision.

Let’s start with the basics.

Completing auditing CPA programs is a mandatory requirement for many auditors. For instance, if you carry out work under GAGAS, you must pursue CPE to maintain and enhance your professional competence. Here’re the CPE requirements you need to meet if you belong to this group.

With the help of auditing CPA programs, you can meet these requirements efficiently. Additionally, as per the CPE requirements of your state board, you may need to earn a certain number of credits in auditing-related subjects.

Apart from these, you can enhance your competence to carry out quality audits by taking particular auditing CPA courses. For example, you can learn about audit software for CPA firms by taking relevant courses and improving audit quality.

When it comes to enrolling in CPA audit courses, you need to keep several important things in mind. To make the section easily comprehensible, we’ve divided it into three categories. Let’s take a look.

The AICPA auditing standards refer to the standards that are issued by the ASB (Auditing Standards Board). By taking auditing CPA courses related to AICPA audit, you can learn the attestation, auditing, and quality control standards and get practice guidance to carry out and report attestation and audit engagements. Note that these standards don’t apply to the entities that come under the jurisdiction of the PCAOB.

The ASB creates, updates, and communicates practice guidance and comprehensive standards so that audit practitioners can serve the public interest when delivering professional services. By completing relevant courses on the AICPA audit guide, you can offer quality audit and attestation services to entities that don’t come under the jurisdiction of the PCAOB.

In this section, we’ll take a close look at why you should prioritize using audit software for CPA firms. The advancements in tech and AI have significantly changed the way CPA firms carry out business operations. Here’re the real-life benefits of using audit software.

One of the key features of audit software for CPA firms is that it’ll automate time-consuming tasks, improving your overall efficiency considerably. You won’t have to spend hours obtaining and assessing relevant information. Instead, you’ll be able to concentrate on critical areas that require in-depth examinations.

Manual audits sometimes come with subjectivity and guesswork. However, audit software has the ability to spot trends, outliers, and exceptions that may get overlooked during manual audits. Therefore, you’ll be able to carry out more precise risk assessments and offer quality audits.

With the help of audit software for CPA firms, you’ll lower the risk of inaccuracies. It’ll consistently apply audit standards and methodologies, helping you maintain audit quality easily. Whether you need to generate an AICPA audit opinion, an AICPA audit report, or perform any other audit-related activity, your job will become significantly easier compared to manual audits.

When it comes to meeting your CPA audit CPE requirements, you can choose from different methods. You should choose the right method as per your needs and preferences.

These activities may be subject to certain limitations according to the CPE requirements of your state board.

AICPA audit guides refer to the AICPA Accounting and Auditing Publications that are used by professionals in the fields of accounting, audit and attest, financial reporting, and compilation and review services to get guidance and enhance their skills for correct reporting.

Whether you want to improve your knowledge of governmental auditing, purchase the AICPA audit and accounting guide not for profit entities, learn the critical roles of the AICPA Auditing Standards Board, or enhance your proficiency in other audit-related aspects, you should be able to do it with the help of the right AICPA audit guide.

Notably, these guides are available in print formats, online subscriptions, and eBooks. This means you can easily choose the right learning format according to your needs and preferences.

In the context of audit reporting, an auditor needs to mention their opinion related to the audit results. This opinion is about the financial performance of the audited organization and whether or not it adheres to financial reporting regulations.

Every audit report has a section called “audit opinion” that explains the audit results. An auditor can choose from four types of audit opinions. Let’s take a look.

An unqualified opinion refers to the fact the auditor doesn’t have anything adverse to share and they’re satisfied with the organization’s financial reporting. According to the auditor, the organization adheres to the applicable laws and governance principles. Such a report is considered free from material misstatements by the organization, its investors, the auditors, and the public.

When an auditor feels unsatisfied with any particular transaction or process of an organization, they tend to give a qualified opinion. In such a report, the auditor needs to mention the reasons they aren’t able to give an unqualified opinion. Investors of an organization don’t want to accept qualified opinions because they depict a negative opinion about the financial status of the organization.

A disclaimer of opinion is given by an auditor when they don’t want to give any opinions about the financial statements of an organization. When auditors don’t get the opportunity to review specific procedures or observe operational procedures, they may not be able to give a definite opinion, and hence, issue a disclaimer of opinion.

When an adverse opinion is issued by an auditor, it generally indicates the organization’s financial reports contain significant misstatements and have the probability of fraud. Investors and financial institutions take this opinion very seriously because it indicates that the organization’s financial statements have considerable irregularities or material misstatements.

As you can see from the above sections, selecting the right auditing CPA programs is of paramount importance as long as you want to enhance your professional competence and make the most out of your effort, time, and money. After all, CPE is an extremely valuable learning experience that can not only help you stand out from your competitors but can also speed up your professional growth.

In this section, we’ve jotted down a few important things that should help you find the right auditing CPA courses.

CPE sponsors with a good reputation in the industry typically have experienced authors and instructors and offer quality courses. Therefore, even if a reputable provider seems like slightly more expensive than one with an average reputation, you should join the former. If you want to evaluate a sponsor’s reputation efficiently, simply check its website’s customer review section. You may also want to see its reviews on third-party review websites.

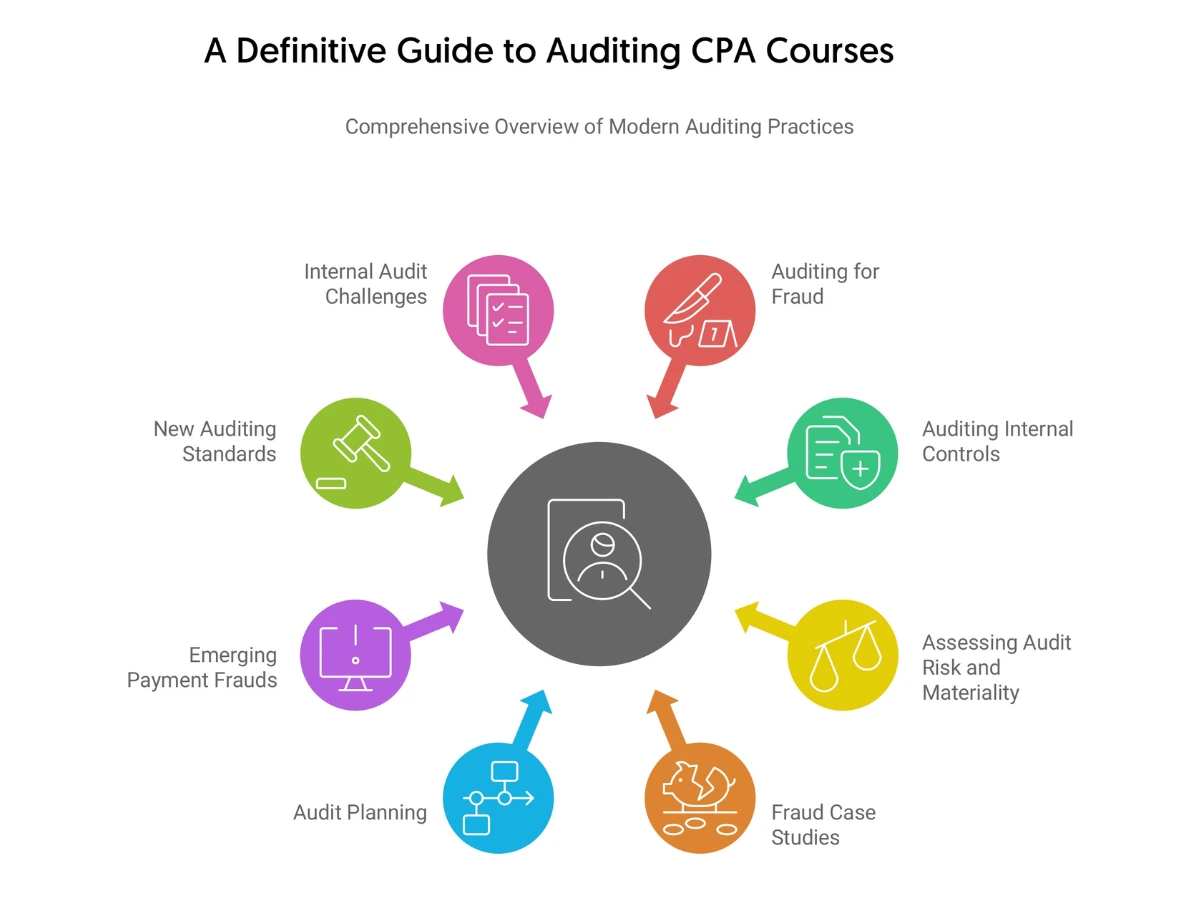

When it comes to the field of auditing, you can complete different auditing CPA courses as per your exact needs and preferences. Continuing education should not only help you meet your CPE requirements but it should also help you improve your professional competence. And you can only achieve this by joining a sponsor that offers courses on different auditing CPA topics.

The available formats of CPA audit courses are another key thing you need to consider before enrolling in them. If a good course is taught miles away from where you live or work, it may not be the best option for you. Therefore, select a sponsor that offers courses in multiple learning formats, such as self-study programs and webinars. If you want to get unequaled flexibility when taking auditing CPA courses, you may want to opt for self-study programs.

You should consider the cost of the courses if you want to maintain a moderate budget. There are CPE providers that offer courses at high price points. If your firm or organization doesn’t bear the cost of your CPE, joining one of them may not be the right option for you. So, it’s advisable to find a sponsor that has quality auditing CPA programs at affordable prices.

In addition to these, you should always research multiple CPE sponsors before making a final decision. This will help you get a clear comprehension of the quality of the auditing CPA courses offered by different providers and whether or not they match your needs and budget.

We hope that this page has given you enough information about auditing CPA courses and has equipped you to make informed decisions. At CPEThink.com, we offer a broad variety of high-quality auditing CPA programs at reasonable prices. If you want to start taking them right away, browse our catalog. In case you need more information about them, reach us today!

Cpethink.com offers the finest online credibility and reputation and reviews of any on-line CPE sponsor. But don't believe our word for this, go to https://www.cpethink.com/cpe-reviews or see here for some of our more recent customer testimonials.

These are reviews many of our recent and previous customers have left.