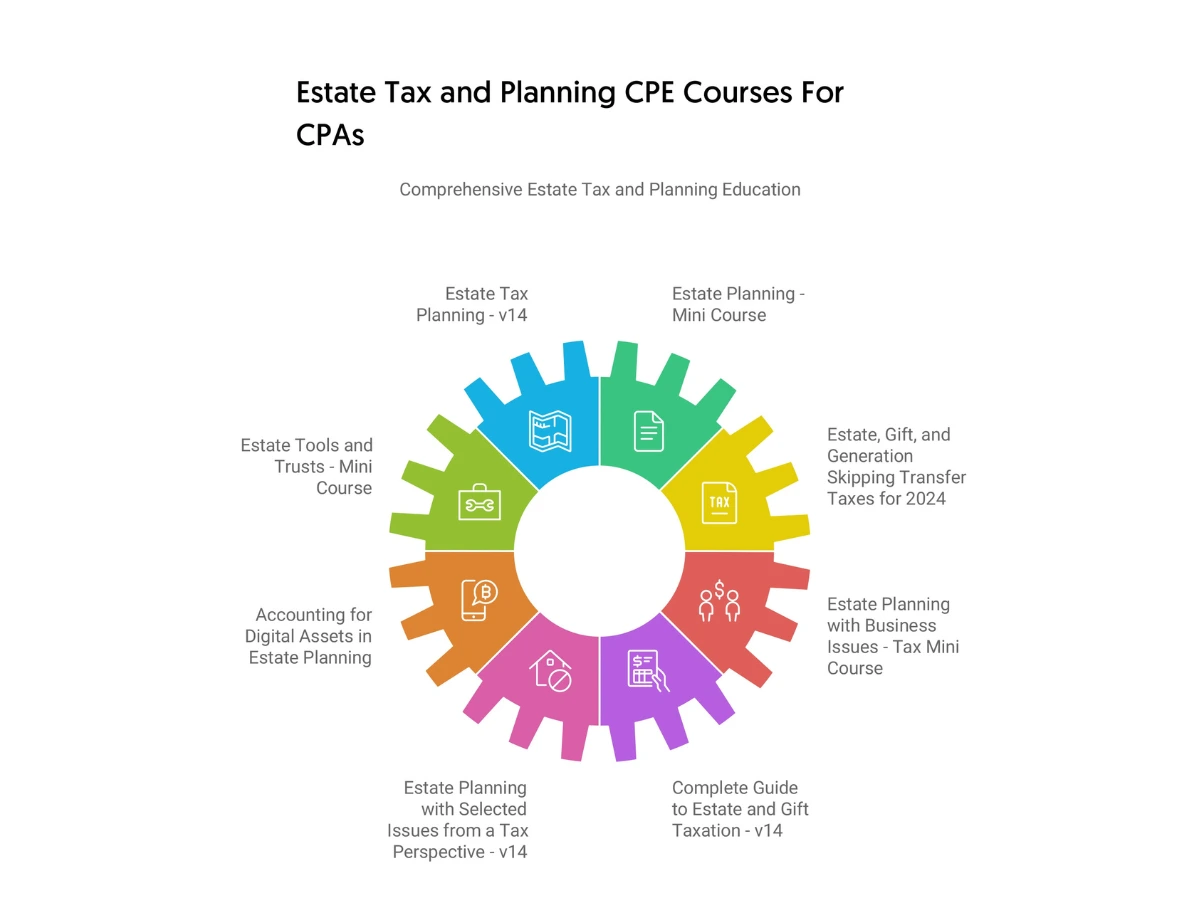

Estate Tax and Planning CPE Courses For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

Even if you offer financial advice to the middle class only, you might have heard of the federal estate tax. This is the tax that only multi-millionaires and billionaires need to pay that too when they’ve got an estate worth more than $11.7 million.

However, even for those, who’ve amassed that much of fortune, there’re ways to avoid paying the tax. Feeling interested to learn more about financial estate planning and taxes? Simply go for estate taxes planning CPE. Here’s a snapshot of what you’ll be able to learn by completing estate taxes planning CPE courses.

The federal estate tax is the tax that the estate of a deceased person pays on that person’s right to transfer the estate to the heirs. Note that in 2018, the TCJA (Tax Cuts and Jobs Act) doubled the exemption amount to $11.18 million from the pre-2018 number of $5.49 million. As of 2021, the exemption amount stands at $11.7 million per person or $23.4 million per married couple.

However, it’s anticipated to sunset on 31st December 2025 and return to the old basic exemption amount of $5 million, indexed for inflation. Basically, this temporary increase lets very wealthy Americans leave a lot more assets to the heirs without having to incur a “death tax”. However, as the exemption amount is expected to return to the old numbers on 1st January 2026, someone, even with a taxable estate worth below $11.7 million, should start estate taxes planning.

There’re several ways to minimize or avoid federal estate tax, which you’ll be able to learn by taking estate taxes planning CPE courses.

Among the available options, many people prefer gifting money to the heirs in form of gifts. As of 2021, for an individual, the annual tax-free limit stands at $15,000 per donee ($30,000 if married and files joint tax returns).

These gifts won’t be counted toward lifetime exemption. As there isn’t any restriction on the number of donees, an individual can pass on his/her assets to the heirs to gradually bring down the net worth of his/her assets below $11.7 million. It’s important to remember that the current $11.7 million exemption limit applies to both estate tax and gift tax simultaneously.

However, if someone has an estate which is valued far beyond the exclusion limit, this option isn’t much effective.

Setting up an ILIT (Irrevocable Life Insurance Trust) is another option that some people opt for. They establish a trust and transfer its ownership to someone else. As the founder won’t be able to make any modifications to the trust in the future without having the consent of the beneficiary, it remains irrevocable.

In a life insurance policy, the death benefits of the insured get included in his/her estate, which becomes subject to estate taxation. However, when the ownership of a life insurance policy is transferred to an ILIT, the proceeds don’t get included in the gross estate of the insured and hence, aren’t subject to estate taxation.

An individual may need to face both federal and state estate taxes in case he/she resides in one of those states that impose one. State estate taxes vary greatly in whether and the way they get imposed. As some states don’t impose any estate tax, moving to one of those might help an individual minimize his/her estate taxes burden.

Due to the complexities involved in estate taxes planning, wealthy individuals typically take the help of an expert financial advisor to optimize their strategy. If you want to become one of the most trusted advisors to these people, consider joining one of the online estate taxes planning CPE courses today.

Check out what other customers are saying.