Accounting CPE Courses for CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

In general, every active CPA needs to obtain at least 40 CPE credits every year to fulfill their CPE requirements. However, earning and managing this amount of credits isn’t an easy task. You need to decide which accounting CPE courses to take, ensure they meet your requirements, work them into your busy schedule, complete them, and finally, report your credits.

Managing all these things can be overwhelming, particularly if you’re a new CPA and have just started your CPE journey. To help you out, we’ve created this page where you’ll find all the information relevant to CPE accounting courses.

Let’s start with the basics.

The fields of study that qualify for CPE are divided into two categories: technical and non-technical. CPE courses in accounting come under the technical field of study. Whether you want to take accounting CPE courses for free or by paying a CPE sponsor, they need to cover the topics related to any of the two subfields of accounting.

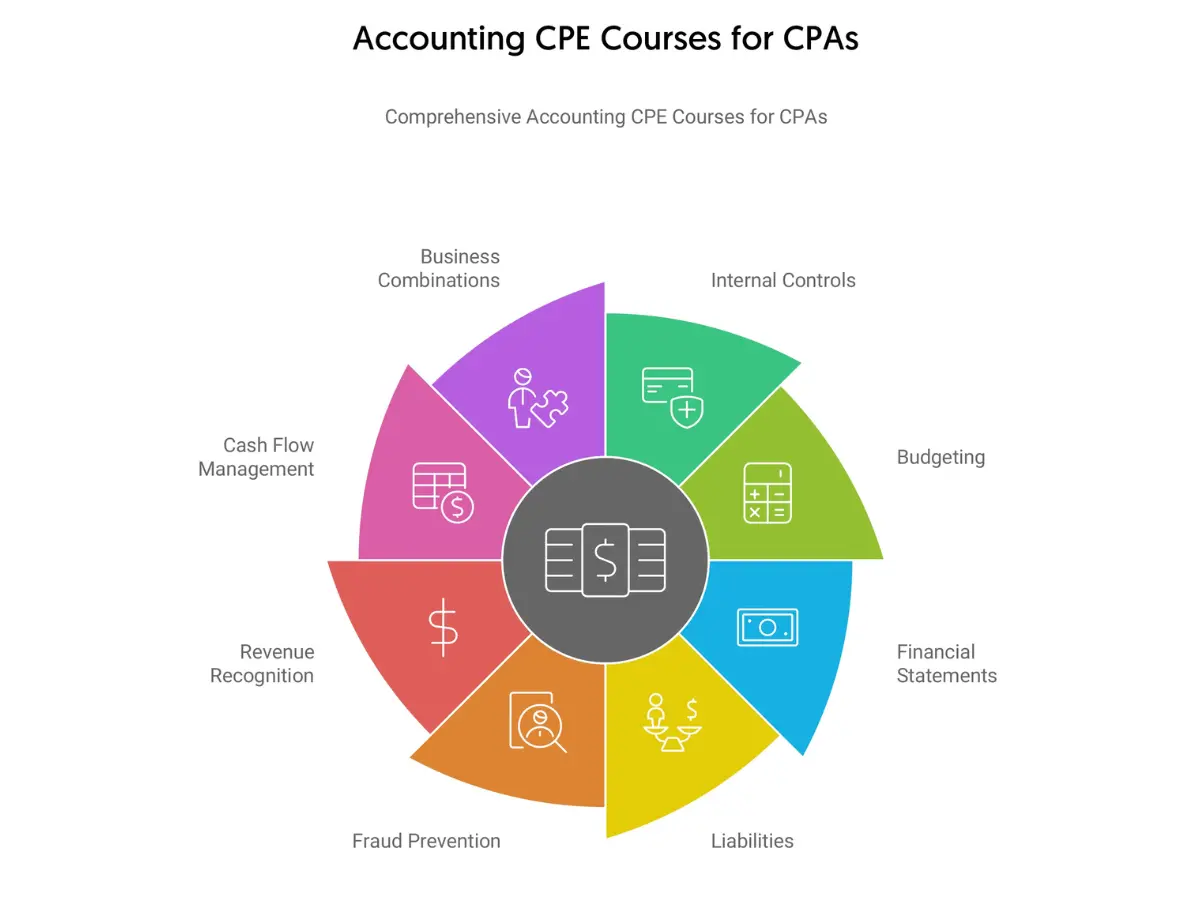

Here’re the types of accounting CPE courses you can choose from when you want to enhance your knowledge and skills in NASBA’s accounting field of study.

By taking paid or free accounting CPE courses in this field of study, you gain the knowledge to maintain, prepare, or report an entity’s financial records. You’ll also learn the methods to verify, analyze, and report those records.

No matter if you take accounting CPE courses online or offline, they’ll generally encompass a broad range of subjects. Some of these include:

You can also take other accounting CPE courses related to the non-governmental subfield. For instance, if you want to build investigative skills to identify financial misconduct, you can take forensic accounting CPE courses. However, if you’re unsure of whether or not a particular course will help meet your requirements, you should consult your state’s Board of Accountancy.

With the help of CPE accounting courses in the governmental subfield, you can improve your skills and knowledge to maintain and prepare financial records related to a governmental contract or entity. Here’re some of the subjects that can be covered by government accounting CPE courses.

Similar to non-governmental accounting courses, different subjects, other than the above ones, can be covered by governmental accounting CPE courses. If you’re in a dilemma about a particular course, you should contact your state accountancy board.

Searching the web using something like “CPE courses accounting” lets you see a large number of results from many different CPE providers. If you take a closer look, you’ll see that CPE courses for accountants are divided into two categories depending on their delivery methods. These include online CPE courses for accountants and in-person accounting CPE courses.

While you can choose any of these methods according to your preferences, there are some vital things you need to know about each of them. Since both methods come with some pros and cons, knowing them beforehand will help you make an informed decision.

Flexibility is perhaps the biggest reason countless CPAs choose to take online accounting CPE courses. When you’ve got a hectic schedule and need to obtain a significant number of CPE credits, you want to have full control over your study schedule.

And that’s exactly where the importance of accounting CPE online courses comes into the picture. You can access the course materials anytime from anywhere with the help of a steady Internet connection.

Notably, when you take CPE accounting courses online, you can revisit a particular chapter as many times as you want to internalize the concepts properly. This is something that you cannot even imagine when taking in-person accounting CPE courses.

Although you can take some accounting CPE courses for free, you’ve to turn to paid courses to fulfill your CPE requirements. When it comes to the costs of CPE courses for accountants, online programs, in most cases, tend to be significantly cheaper than their offline counterparts.

Maintaining self-discipline and self-motivation is typically the biggest challenge to completing accounting CPE online courses. If you think that maintaining these things will be difficult for you, you may not be able to get the most out of these courses.

If you want to harness the power of face-to-face interaction, in-person accounting CPE courses may be the right option for you. During these programs, you can interact with both your instructor and fellow attendees.

It has two notable benefits. First, if you have questions about the topic, you can get the answers from your instructor immediately. And second, you can build your professional network quickly by interacting with other accountants present in the class.

The main downside of in-person courses is they often require traveling to another location. This may not be a feasible option when you’ve got a full-time job to do. Additionally, if you need to travel to a distant location to attend them, your overall CPE cost will also increase.

Here, it’s also important to mention that you may not be able to find many different types of in-person CPE courses for accountants. Most providers of these programs mainly revolve around some specific topics. For instance, you can find a large number of in-person accounting and auditing CPE courses but you may have difficulty finding offline accounting CPE ethics courses.

So, basically, with in-person courses, you may find it difficult to enhance your professional competence as quickly as you would with online CPE courses in accounting.

As mentioned above, online accounting CPE courses tend to be cheaper than in-person accounting CPE courses. However, you should also remember that with thousands of CPE sponsors, the costs of online courses vary greatly.

While some providers offer online courses with steep price tags, there are others that maintain a balance between quality and affordability. In this section, we’ll discuss two effective methods to lower the costs of online CPE courses for accountants.

When your goal is to take online CPE accounting courses and obtain your required credits within a reasonable budget, you’ve to join the right sponsor. Here, it’s important to understand that if a sponsor has courses with surprisingly low prices, it may not necessarily be the right one for you. You should also try to avoid providers that are new in the field.

Ideally, you should join a provider that has been in the field for many years and has garnered a strong reputation for offering quality online CPE courses for accountants at affordable prices.

Going through the reviews from past customers of a sponsor can certainly help you get a clear idea about its quality. You can also see its ratings and reviews on reputable third-party review websites. If the sponsor has received a large number of positive ratings and reviews, you can confidently take its accounting CPE courses.

Probably the best thing about CPE subscription packages is that they allow you to access many courses by charging a one-time fee. And when you take online accounting CPE courses using a subscription package, you get them at prices significantly lower than their listed ones.

Additionally, you won’t have to join multiple sponsors to fulfill your requirements. The process of verifying the credibility and quality of several sponsors is a difficult and time-consuming task.

Depending on your chosen sponsor, you may also be able to obtain a virtually unlimited number of credits. Therefore, buying one of these packages can help you meet your CPE requirements efficiently while providing you with the opportunity to absorb content in different formats.

If you choose a leading CPE sponsor like CPEThink.com, you’ll get unlimited attempts to pass the final exams to obtain your credits along with benefits like unlimited prints of your certificates of completion.

Some trustworthy CPE providers, including CPEThink.com, offer free accounting CPE courses. Considering the number of CPE credits you need to earn every year, you should try to take free CPE accounting courses.

However, you should keep the following things in mind when doing so.

First of all, it’s nearly impossible to free accounting CPE courses on trending topics. Free courses tend to cover general topics or give an overview of a hot topic. When you want to learn a hot topic in detail, most likely, your only option will be to take a paid course.

Moreover, it’s very hard to find free accounting CPE ethics courses, especially the state-specific ones. Therefore, if your state board requires you to complete a state-specific ethics course, most likely, you’ll have to buy that.

Not all, but some CPE sponsors offer accounting CPE courses for free that come with one or two CPE credits. So, if you’ve met the mandatory requirements of your state board and only need to obtain a couple of credits to fulfill the remaining requirements, taking free accounting CPE courses should be a wise decision.

Free courses can also turn out to be highly effective in letting you evaluable the quality of the instructors and course materials of a sponsor. If you’ve shortlisted a few CPE sponsors and each of them offers free courses, you can take them to see which one suits your style the best.

When searching for free courses, try to join an experienced and credible sponsor. This is because while you don’t need to pay anything for these courses, you still have to invest your time and effort to complete them. Therefore, even if you don’t get any credits, you should get to learn something valuable.

Again, you can read the reviews from a sponsor’s past customers and check its ratings and reviews on third-party review websites to get an understanding of the quality of its free CPE accounting courses.

Apparently, it may seem like managing the credits you obtain from accounting CPE courses is an easy task. However, in reality, it’s quite a complex thing to manage a large number of credits earned from different courses.

Here, our experts have jotted down two effective methods to do it.

By monitoring your credits periodically, you can efficiently track the number of credits that you’ve already earned and how many are still remaining. In case you find that you still need to earn a significant number of credits, you’ll be able to plan your CPE accordingly to meet your deadline.

CPE trackers can be very useful for those who find it difficult to track their credits manually. All you need to do is upload all the details of your CPE accounting courses to the software and it’ll automatically track your CPE. Just remember to upload the details to it as soon as you complete a course. The tool may also send you periodic reminders or alerts about your CPE requirements.

At CPEThink.com, we strive to provide every CPA with top-quality accounting CPE courses at reasonable prices. All our CPE accounting courses are developed by a team of highly experienced authors, meaning you can rest assured of getting the latest and most relevant information from our courses. By choosing us as your CPE sponsors, you’ll also get a 100-day, 100% money-back guarantee, which is simply the best in the industry.

Want the Best Accounting CPE Courses anywhere on the Internet? You have found them right here and to prove it see what our current and past customer say about us online. Go to https://www.cpethink.com/cpe-reviews and see why we are the most prefered and have the most return visits of any CPE provider.

Reviews are given by customers only after they have made a purchase and completed one of our courses.