Reviewing the Role of CPA CPE Ethics in the CPA Profession |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

In the ever-evolving accounting field, rules and regulations keep on changing regularly. Add to it the emergence of advanced technologies like artificial intelligence that facilitate the automation of fundamental accounting processes.

All these together have made it a must for every licensed CPA to have a thorough understanding of their ethical responsibilities. Moreover, without pursuing CPA CPE ethics, CPAs cannot meet their CPE requirements, which may ultimately lead to an inactive status of their license.

As a leading CPE sponsor with nearly two decades of industry experience, we often receive several queries regarding ethics CPE for CPA. Instead of publishing many short posts on them, we decided to create this definitive guide to ethics CPE CPA.

Here, we’ve discussed every important thing related to CPA ethics CPE that you may ever want to know. We hope that this guide will help you build a strong foundation for the ethical journey throughout your professional career.

Let’s get started with the basics.

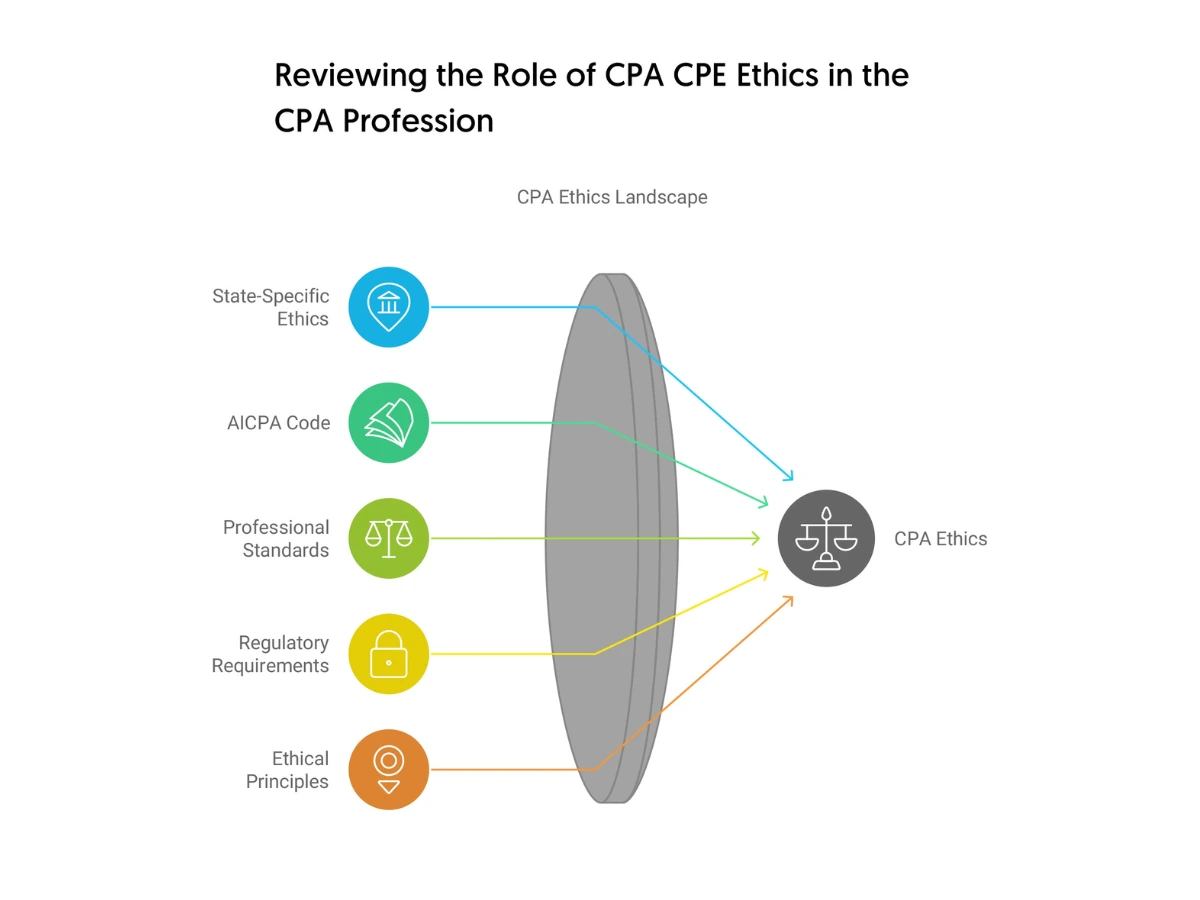

CPAs frequently deal with sensitive information and are viewed as trusted financial advisors. To maintain the trust of the public, CPAs must follow ethical principles and demonstrate ethical behaviors when offering professional services.

Basically, ethics CPE for CPAs helps CPAs understand a framework of principles that they should follow to strengthen their position in the industry and maintain the respect of the accounting profession.

In the U.S., the AICPA is the standard-setting and rule-making body of the CPA profession. Many states utilize AICPA’s Code of Professional Conduct to establish their ethics CPA CPE requirements.

However, there are several other states where CPAs need to earn CPE credits in ethics by taking board-approved ethics courses. Failure to do this will make a CPA non-compliant with their CPE requirements.

You already know that it’s mandatory to earn a specific number of CPE credits in ethics to keep your license active. No matter if you pursue free ethics CPE for CPA or take paid CPA CPE ethics courses, you must earn the credits.

But ethics CPE CPA isn’t only meant for helping CPAs keep their licenses active. It has some real-life benefits as well. Let’s take a look.

· It makes you more efficient in dealing with sensitive information

From bank account information and transaction details to a business’s books and other financial data, CPAs need to deal with different types of sensitive information regularly. Failure to keep these pieces of information secure and confidential not only can greatly damage your reputation but may lead your client or organization to trouble as well.

When pursuing ethics CPA CPE, you get to learn the ethical best practices and how to follow them to stay ethical when you’re dealing with confidential accounting information.

· It compels you to stay up-to-date with the latest accounting rules

When you aren’t aware of the latest rules and regulations in your field, it’s simply impossible to maintain accounting ethics while offering professional services. Therefore, to avoid consequences in the future, you’re compelled to prioritize ethics CPE for CPAs, while meeting other CPE requirements.

· It helps you become a valuable asset to your company

Accountants are the backbones of any organization. When you start adopting unethical accounting practices, it’ll likely come back with consequences. And if you get too comfortable with these practices, your organization will suffer the consequences.

On the contrary, by applying the knowledge gained by pursuing CPA CPE ethics, you can guide your company in the right direction and become part of its success story.

· It helps you avoid legal trouble

When you don’t adhere to ethical accounting practices, sooner or later, you’ll get into some kind of legal trouble. It may begin with a couple of unethical accounting practices, but ultimately, it may lead you to major problems.

Ethics CPE for CPA helps you get familiarized with ethical accounting practices and understand what types of accounting practices put you at risk.

As mentioned above, the majority of state accountancy boards utilize AICPA’s Code of Professional Conduct to establish CPE ethics requirements for their CPAs. CPAs need to take CPA ethics CPE courses related to the Code of Professional Conduct to earn their required ethics credits.

Although some state boards have made it mandatory for CPAs to take state-specific ethics courses to fulfill their CPE requirements, you must develop a clear comprehension of the key principles outlined in the Code of Professional Conduct.

Here’re brief overviews of the six most important principles you should know about.

· Integrity

According to this principle, accountants should discharge all professional responsibilities while maintaining the highest degree of integrity. Integrity should be considered a benchmark when accountants make decisions. They should remain honest and candid and put their best foot forward to make the right decision, even when facing a conflict of interests.

· The public interest

In this context, “the public” refers to any entity that receives professional services from accountants. This principle defines that accountants should always act in a manner that’ll maintain public trust and serve the public interest.

In situations where an accountant may face conflicting demands from different entities, they need to act with integrity. When pursuing CPA CPE ethics, you’ll also realize that by maintaining public trust and serving the public interest, you can help all interested parties gain benefits from your decisions.

· Responsibilities

According to this principle, accountants have an obligation to all entities that receive professional services from them and an obligation to maintain the standards of the accounting profession. They should always apply their professional and moral judgment when offering professional services.

· Due care

This principle notes that accountants should always try to follow ethical standards and improve their ethical and professional competence. They should utilize proper planning and supervision to ensure that professional responsibilities are being performed in an ethical manner, both by themselves and their team members.

· Objectivity and independence

To maintain objectivity, accountants need to remain free of conflicts when carrying out their professional responsibilities. They also need to maintain independence in both appearance and fact when serving their clients professionally.

By pursuing ethics CPE for CPA, you’ll understand that objectivity and independence build on each other. You cannot maintain independence without maintaining objectivity. You should also constantly evaluate your professional responsibilities and relationships to make sure you’re holding yourself to the highest degrees of objectivity and independence.

· Scope and nature of services

This principle defines that when offering professional services, accountants should assess whether those services can be performed while complying with the principles mentioned above. If it isn’t possible, they should exclude those services from the scope of work.

Although it’s possible to earn CPA ethics CPE free credits, they may not be for every CPA. To understand the reason behind this, we need to take a look at the methods to pursue free ethics CPE for CPAs.

Before delving deeper into the methods, it’s important to note that it’s very difficult to find a reputed CPE sponsor that offers CPA CPE ethics free credits through self-study courses.

Now, let’s see the methods.

· Webinars

Sometimes, large accounting firms or organizations offer free webinars on ethics. However, there’s one important thing you should know before taking this route.

Even if these webinars let you earn CPA ethics CPE free credits, they may not always get accepted by your state accountancy board. Therefore, it’s a must to check with your state board to ensure that the credits earned from those webinars will get counted toward meeting your CPE requirements.

However, if earning CPA CPE ethics free credits isn’t your priority, you should always try to attend those webinars as they tend to cover a diverse range of topics.

· Membership of a state society of CPAs

Some state societies of CPAs offer free ethics CPE for CPAs together with other CPE courses. To get this benefit, you’ve to be a member of your state society of CPAs. And these membership fees tend to be quite costly.

Take the CalCPA (California Society of CPAs) for example. As part of its member benefits, CalCPA offers a 4-hour ethics course for free to help its members fulfill the state’s ethics CPE requirements.

However, it offers free memberships only to licensed CPAs who’re employed as educators. For other licensed CPAs, its membership fees start from $365 per year.

These are the reasons countless CPAs choose inexpensive CPA CPE ethics courses instead of opting for free ethics CPE for CPA.

Since taking courses on ethics CPE for CPA is mandatory for CPAs to meet their CPE requirements, there’s no shortage of providers offering ethics CPE CPA programs.

Here, we’ve reviewed the top seven sponsors (in random order) of CPA CPE ethics programs to help you make an informed decision quickly.

· Becker

Becker offers both general and state-specific ethics CPE for CPA programs. Their costs range from $29.00 (1.5 credits) to $89.00 (4 credits). You can also take these courses at discounted prices by choosing one of its subscription packages.

Becker’s subscription packages that let you access ethics CPE CPA programs are priced at $404.10 and $699.00. To get a refund, you must make the request within 10 business days of completing the purchase.

· myCPE

myCPE also has both state-specific and general CPA CPE ethics programs. However, to take any of these courses, you must purchase one of its annual subscription packages, which are priced at $199 and $299.

It’s important to note that myCPE doesn’t offer any refund once you’ve purchased or renewed a subscription automatically unless there’s an issue on its side.

· AICPA

THE AICPA helps you pursue ethics CPE CPA by offering webcasts and self-study courses. The costs of these programs range from free to $273 (for nonmembers). These programs let you earn 4 to 15.5 CPE credits. Note that all these paid courses are available at different price points for members and non-members.

It’s also very important to note that AICPA doesn’t offer any state-specific CPA ethics CPE program. So, if your state board needs you to take one, you’ve to join another sponsor to meet your CPE requirements.

You may receive refunds for these courses within 30 days of making the purchase.

· CPA SelfStudy

You can pursue ethics CPE for CPAs from CPA SelfStudy within a price range of $19.99 to $119.00. You can 2 to 6 credits as per your requirements. You can also purchase its one-year unlimited subscription plan ($149) to take these courses at reduced prices.

CPA SelfStudy has a 30-day, 100% money-back guarantee.

· Surgent

Surgent offers both webinars and self-study ethics CPA CPE programs within a price range of $49.00 (1 credit) to $159.00 (4 credits). It also offers three types of subscription packages: only webinars, only self-study courses, and webinars plus self-study courses. As per your learning style, you can choose one of them to meet your CPA CPE ethics requirements.

You need to raise a refund request within 10 business days of completing your purchase to get a refund from Surgent.

· American CPE

American CPE has both general and state-specific ethics CPE CPA programs, letting you earn 1 (14.95) to 4 ($59.00) credits. It also has two unlimited packages (1-year and 2-year) available at $169.00 and $278.00.

You may get a full refund from American CPE by sending the refund request to the team within 30 days of completing your purchase.

· CPEThink.com

At CPEThink.com, we currently offer 126 CPA CPE ethics programs on both general and state-specific topics. The costs of these programs range from $12.95 (1 credit) to $129.95 (20 credits).

We offer two unlimited subscription packages (one-year and two-year) priced at $199.95 and $299.95. We also have four one-year credit-based subscription packages. These are available at $145.95 (45 credits), $129.95 (40 credits), $99.95 (30 credits), and $69.95 (20 credits).

Regardless of the subscription package you choose, you’ll be able to access all our self-study ethics CPE CPA courses along with other courses and free webinars.

Finally, we offer the industry’s best 100-day, 100% money-back guarantee.

Now that you know all the essential aspects of CPA CPE ethics, it’s time to embark on your ethical journey to stand out from other CPAs and maintain the respect of your profession.

To pursue ethics CPE for CPA in the most efficient manner, start browsing our courses now!

Check out what other customers are saying.