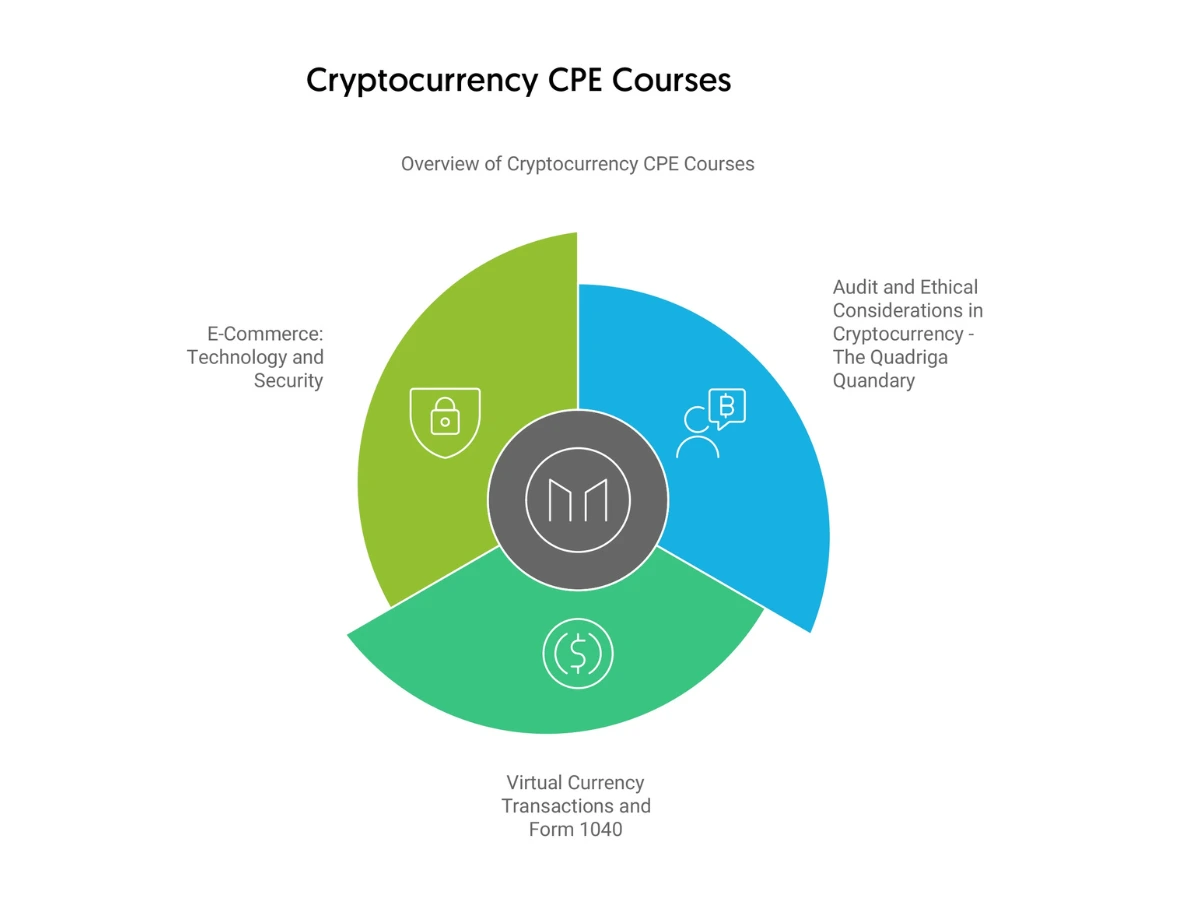

Cryptocurrency CPE Courses |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

For some years now, the concept of cryptocurrency has been in the limelight for a few reasons, especially around the volatile valuation of the assets. Although the concept has been around for over a decade, its popularity has increased notably in recent years.

These days, people across the globe (in countries where it’s legal to buy, sell, and use cryptocurrencies) are considering it an investment opportunity and using it as a payment method. As a result, today’s CPAs are working with this technology more frequently.

However, the fact is a cryptocurrency, being a relatively new concept, still comes with lots of unknowns. So, to master it and gain proficiency in dealing with it, CPAs need to depend on cryptocurrency CPE.

In this article, we’re going to discuss all the vital aspects related to crypto CPE and CPA cryptocurrency courses to help you understand their true importance in the field of accounting.

To understand cryptocurrency CPE, we need to understand cryptocurrency first. Basically, a cryptocurrency refers to a digital asset (in the form of coins or tokens) that’s primarily created to operate as a medium of exchange. As of March 2022, more than 18,000 cryptocurrencies are there in the market.

Cryptocurrencies exist on a decentralized control system, and they’re independent of any institution. Blockchain is the technology that powers cryptocurrencies. It’s a shared ledger with open access that maintains a record of every transaction between users and lets them agree on its contents.

Considering the massive popularity of cryptocurrencies, it isn’t hard to anticipate that the concept is here to stay. In fact, many governments have already acknowledged and legitimized the use of cryptocurrencies as payment vehicles.

Essentially, with the growing adoption of cryptocurrencies by the business world and the increasing use of accounting systems utilizing blockchain technology, CPAs will be required to focus their time and energy more on interpreting information and helping in the decision-making process.

Additionally, with the help of blockchain technology, measuring the accuracy of data will also become easier for accountants. This means the technology should help make accounting errors disappear and minimize fraud.

In the context of CPE, sponsors separately offer CPA cryptocurrency courses and CPA blockchain courses. You can also find some basic-level courses that provide overviews of both cryptocurrencies and blockchain technology.

If you don’t have any fundamental knowledge of these, it’s best to start by pursuing a basic-level course. If you know the concepts already, you can choose advanced-level cryptocurrency CPE courses or blockchain CPE programs.

Cryptocurrency is a vast, complex field with many layers of difficulties. So, the exact topics covered by a cryptocurrency CPE course typically depend on the level of the program.

However, most of these courses cover subjects that’ll help you with these things, among others.

· Gaining familiarity with the basic components of cryptocurrency

· Comprehending the fundamental elements of blockchain technology, along with how it’s used and its limitations

· Understanding similarities and dissimilarities between cryptocurrencies and flat money

· Learning about the latest developments in the field

· Comprehending the ethical concerns related to advising your clients on using cryptocurrencies

· Understanding tax requirements for cryptocurrency investors

· Evaluating how taxes work in the context of cryptocurrency mining

· Learning about tax planning opportunities in the field of cryptocurrency

· Comprehending the present outlook for cryptocurrency taxation

· Exploring blockchain use cases, particularly the way the technology facilitates smart contracts

Now that you have a basic idea of cryptocurrencies and what you can learn by pursuing cryptocurrency CPE, let’s see why it’s important to take CPA cryptocurrency courses.

· Cryptocurrencies build a new form of the traditional financial market

Perhaps the biggest reason why CPAs need to pursue cryptocurrency CPE is that together cryptocurrencies are building a new, secure form of the traditional financial market. Before the inception of cryptocurrencies, major financial institutions such as banks carried out authoritative roles where they regulated all kinds of credit and debit cards.

However, by utilizing cryptocurrencies, today’s buyers and sellers can overlook the dominance of banks as the middlemen. Now, they can complete transactions with each other directly by utilizing blockchain technology.

This massive advantage of this system convinced millions of users across the globe to join the bandwagon of focusing on crypto-based assets. And when it comes to managing the financial implications of assets of whatever kind, there’s always a steady demand for proficient accountants.

Now, you might be thinking, why should I take CPA blockchain courses? If yes, then it should be helpful to know that according to an old report created by the World Economic Forum, 10% of global GDP (Gross Domestic Product) should be stored on blockchain-related technology by 2027.

This signifies that the way transactions get recorded and communicated will fully transform between these days and then.

So, if you want to grow your practice and strengthen your position in the industry in the long run, you must include cryptocurrency and blockchain technology knowledge in your resume.

· Cryptocurrencies bring massive auditing opportunities

Often, auditing engagements act as the key sources of annual revenues for a lot of accounting firms. The key objective of carrying out auditing activities is to review an organization’s financial statements and verify that all the numbers are accurate.

If the organization reports everything correctly, the auditors sign off on the financial statements. Many times, potential investors of the organization review those statements before making a final decision.

As crypto-based ventures are capturing more attention from the business world, the number of organizations requiring audit services is growing rapidly as well. Remember the mind-boggling fact that today more than 18,000 cryptocurrencies exist.

To CPAs or other accountants planning to enter the field, this means over 18,000 coin offerings that they may need to audit and report on.

· Cryptocurrencies have tax implications

Although cryptocurrencies appear with massive power to build a new form of the financial market, they also play vital roles in the investing world. For example, every single cryptocurrency comes with a digital token/coin that one can utilize as a store of value.

To imagine its role in the investing world, think about how Bitcoin, the leader in the cryptocurrency pack, started 2021 with less than $30,000 per coin, and in November 2021, it went over $68,000, reaching an all-time high.

For investors, who bought Bitcoin, such a massive increase in value signified huge gains if they sold their assets. According to the IRS (Internal Revenue Service), digital coins have to be taxed, similar to any trading gain, including stocks, bonds, etc.

It’s also important to understand that even the transactions that an investor makes utilizing cryptocurrencies might be subject to tax. This happens due to the changes in the values of digital coins.

For example, imagine an investor has purchased a digital coin for $200. After a couple of months, the value of the coin presumably grows to $250 because of favorable market conditions. Then the investor decides to utilize that coin to buy another digital asset that costs $250.

The fact is, as the investor could spend an additional $50, it’s considered a taxable gain by the IRS. This means the investor needs to pay tax even though they used the coin to buy something rather than trading it.

For accountants who deal with taxation-related matters, it brings another opportunity since they can take relevant CPA cryptocurrency courses to expand the scope of their practice.

While cryptocurrencies appear with a massive amount of potential for organizations and investors, they trigger several challenges, especially for accountants. This is because the financial reporting for these assets doesn’t fit comfortably into present guidance under GAAP or under IFRS.

At this moment, the most appropriate guidance on cryptocurrency accounting originates from the IRS and other global tax offices. However, even they haven’t given clear instructions because while crypto isn’t considered a flat currency or similar, in some cases, its use becomes subject to income tax based on the nature of the transaction.

In this situation, the only way to acquire crypto skills is to focus on pursuing cryptocurrency CPE. Here, we’ve assembled a few things that you should try to achieve when taking CPA cryptocurrency courses.

· Improve your knowledge to deal with the evolving market

By default, the crypto market is ever-evolving in nature, and we can see decentralized finance (also known as DeFi) as its prime example. With DeFi, investors can utilize liquidity pools to organize a massive variety of transactions that include trading, lending, yield farming, liquidity mining, and more.

It’s important to note that the working method of each DeFi protocol is slightly different, which means the tax implications may become complicated quickly. Since the IRS or other tax authorities are yet to provide straightforward guidance on these transactions, accountants need to interpret the present crypto tax rules by themselves and apply them to decentralized finance transactions.

Similarly, many different types of cryptocurrency coins/tokens exist in the market, from security tokens and utility tokens to non-fungible tokens, asset-backed tokens, and more. Each of these tokens may come with a slightly different tax implication.

So, when pursuing crypto CPE, try to thoroughly understand the working method of each different transaction and the way it’s taxed.

· Improve your tax knowledge as much as you can

We’ve already mentioned that the IRS doesn’t provide straightforward guidance on the majority of crypto transactions. Apart from the lack of clarity on DeFi tax, other common transactions such as staking, NFTs, etc. don’t have any tax guidance.

Therefore, it’s up to accountants to interpret and apply the tax rules as clearly as possible when doing cryptocurrency accounting. Needless to say, you have to choose the right CPA blockchain courses to improve your knowledge of crypto-related tax matters.

· Develop your skills to combine transaction data efficiently

Another major challenge in crypto accounting comes from siloed transaction data. A lot of crypto investors use multiple crypto wallets and exchanges, both centralized and decentralized, together with potentially several specific DeFi protocols.

Due to these, merging transaction data to generate a coherent financial report often becomes a challenge. Every crypto exchange only maintains records of the transactions that were carried out using that platform. In some cases, accountants may get access to this data easily, but on some other platforms, it may get quite difficult to generate a report of the transaction data.

All these make it a challenge for accountants to track crypto assets to do calculations of fair market value, cost basis, and any associate capital gains/losses. To simplify the process, you may need to use third-party applications or software. See if you can find a relevant cryptocurrency CPE program that’ll help you become proficient in using such applications.

· Build your skills to calculate the fair market value

As the values of cryptocurrencies are volatile in nature, tracking and identifying their fair market value on particular days with regard to client transactions often becomes a time-consuming task. Moreover, sometimes, there are slight discrepancies between individual crypto exchanges and different crypto indexers’ websites.

Without clear guidelines from the IRS and other tax authorities regarding how to identify crypto assets’ fair market value, crypto accountants need to use a fair, consistent approach when doing calculations for fair market value.

Again, you may need to use a third-party application for this purpose. Even if you don’t find a relevant crypto CPE program, you can try to register for a free version of a crypto tax application to enhance your skills.

Due to the rapid growth, massive volume, and complexity of crypto transactions, improving your cryptocurrency accounting skills may seem to be a difficult task at first. However, you can make the journey a bit easier by partnering with a reputable cryptocurrency CPE sponsor and choosing the CPA cryptocurrency courses.

If you want to know how CPEThink.com can help you with this, be sure to check our CPA blockchain courses. If you have any questions regarding crypto CPE, contact us to talk to a crypto expert.

Check out what other customers are saying.