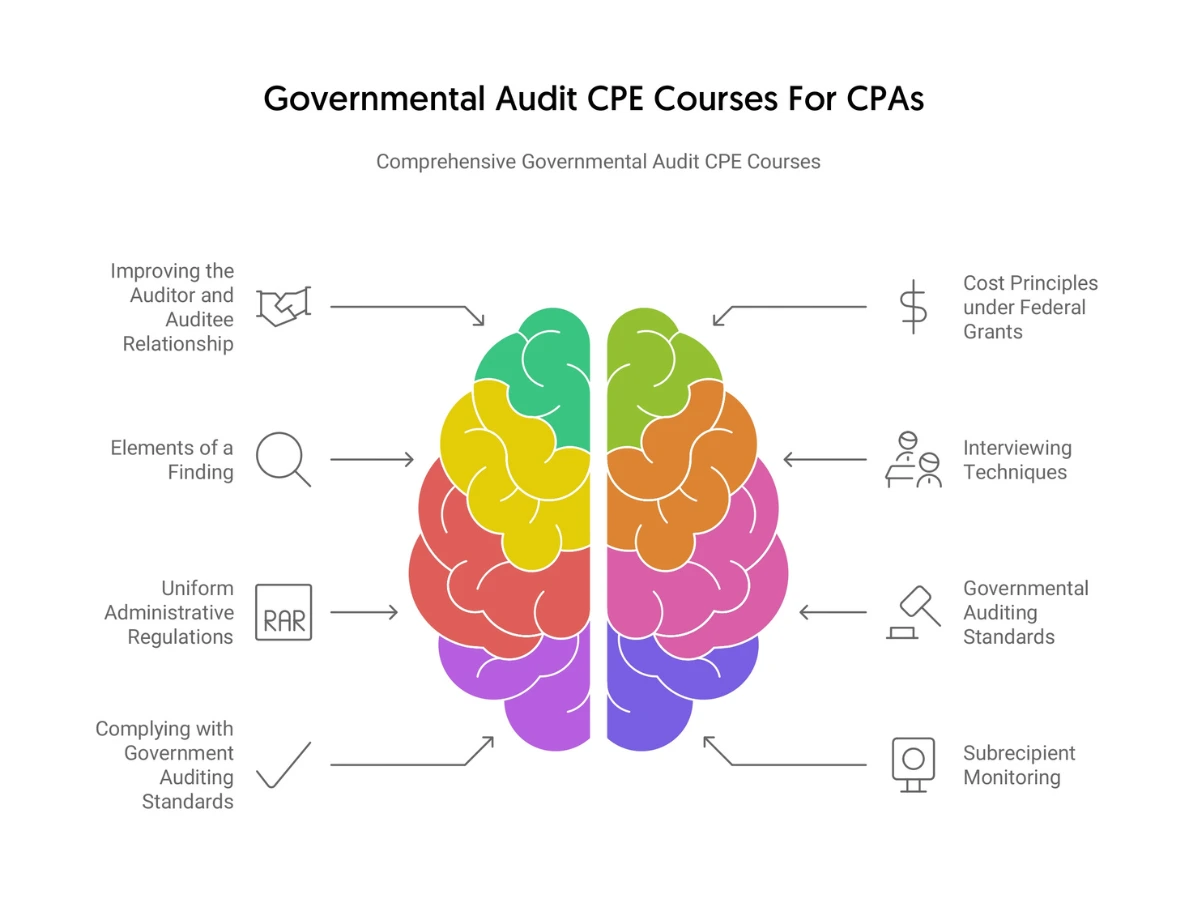

Governmental Audit CPE Courses For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

Are you planning to work for government entities as an auditor after obtaining your CPA license? Or, already working as an auditor who needs to follow GAGAS which is also known as the Yellow Book? If your answer is a “yes” to any of these, then you must pursue governmental auditing CPE to maintain your credentials and enhance your professional competence.

However, pursuing governmental audit CPE is slightly more difficult than meeting fulfilling the general CPE requirements for CPAs. This is why you need to have a clear comprehension of governmental auditing CPE requirements and other critical aspects associated with governmental auditing CPE.

To help you out, we’ve created this page where you’ll get the all information relevant to this specialized field. From the definition of governmental auditing CPE to tips to select the best governmental auditing CPE courses and more, we’ll discuss everything.

Let’s get started.

Governmental audits serve as an extremely important tool for maintaining accountability and good governance in the public sector. Governmental auditors carry out independent assessments and examine different aspects of government activities. Mainly, governmental audits have three components: compliance audits, financial statement audits, and attestation engagements.

These auditors must perform their duties in compliance with governmental audit standards. According to the Yellow Book, every CPA or auditor, who performs governmental auditing as per these standards, must pursue governmental auditing CPE.

Since governmental audits are complex processes, a governmental auditor must have a robust understanding of the different governmental audit standards that apply to local governments, states, nonprofit organizations, and certain other entities.

By fulfilling governmental auditing CPE requirements on time, not only can you maintain your specialization but can also expedite your career growth.

Here are the top reasons you should prioritize pursuing governmental auditing CPE diligently.

In the field of auditing, performing activities as per ethical standards is of paramount importance. By mastering the Yellow Book, you’ll be able to make the right decisions in the events of ethical dilemmas. You’ll be able to maintain the trust of your clients and stakeholders by following ethical principles when delivering professional services.

No matter if you only do governmental auditing or offer other services in this field, pursuing governmental audit CPE diligently will help your overall knowledge and proficiency as an auditor. Over time, you’ll be able to gain the skills and knowledge necessary to handle complex audits, which in turn, will help speed up your professional growth significantly.

One of the most important responsibilities of any governmental auditor is to maintain public trust in government activities, assuring citizens that government institutions are working in their best interest. By ensuring that every governmental audit is carried out as per the governmental audit standards, you can make significant contributions toward maintaining public interest.

Non-compliance with governmental auditing CPE requirements may cause some significant damage to your professional career. These may include disciplinary actions and legal consequences, any of which can severely damage your professional reputation. Additionally, your audit reports may be rejected by the regulatory bodies.

On the contrary, pursuing governmental auditing CPE not only helps you maintain your license but also demonstrates your dedication to enhancing your professional competence.

As a governmental auditor, you’re required to fulfill these requirements:

As mentioned above, you need to get at least 24 CPE credits in subjects that revolve around different aspects of governmental audits. In this section, we’ll discuss which governmental auditing CPE programs you may want to focus on when getting your remaining 56 credits.

Think about your future career goals and try to identify the areas where you can improve your skills. Try to figure out if you want to serve as a governmental auditor or branch out into a different area of auditing in the future. Aligning your governmental auditing CPE courses with your future career goals will help accelerate your professional development.

Considering the complex nature of governmental audit standards, it’s extremely important to enroll in high-quality courses. Ideally, your focus should be on programs created by renowned authors and instructors. It’s vital to remember that experienced authors and instructors come with the ability to explain complex auditing topics in an easily understandable way.

Obtaining 80 credits every two-year period involves a significant amount of time, effort, and money. Therefore, it’s strongly advisable to select learning formats that are aligned with your learning style and study schedule.

When it comes to fulfilling governmental auditing CPE requirements, the most common options include self-study programs, live webinars, and in-person conferences. Each of these options has its advantages and disadvantages. We’ll discuss these in the next section so that you can make an informed decision.

You should never prioritize cost over quality when it comes to selecting governmental auditing CPE courses. Choosing a sponsor that offers low-quality programs at considerably low prices won’t help you much in enhancing your professional competence.

You should also note that if you choose a provider that doesn’t have the necessary accreditation, the regulatory bodies may not accept your credits. This may make you non-compliant with your governmental auditing CPE requirements if you fail to get the credits to cover the shortfall.

While there are several options available to get governmental auditing CPE credits, live webinars, in-person conferences, and self-study programs have emerged as the sought-after options for most governmental auditors. Let’s see the upsides and downsides of each one.

You can meet your governmental auditing CPE requirements by attending live webinars. These events are offered by different sponsors and don’t need you to pass an exam to get your credits. This can be an attractive option for those who internalize complex topics easily in virtual classroom settings.

On the downside, many sponsors host live webinars during business hours. This may mean that you need to keep aside some time from your working hours to attend them. It’s also important to ensure that there won’t be any technological glitches during the events.

When attending live webinars, you’re required to prove your active participation. In case you fail to do it, you won’t get any credit for attending them. This simply means all your effort and time will be a complete waste.

Some leading organizations host in-person conferences that you can attend to complete your governmental auditing CPE hours. Some auditors prefer to attend them because they get to obtain several credits in one go. They also get the opportunity to expand their professional network quickly by interacting with other auditors face-to-face.

Just keep in mind that the participation fees of in-person conferences tend to be significantly high. So, unless you have a large budget or your organization doesn’t pay the cost of your governmental audit CPE, it may not be the right option for you.

By enrolling in self-study governmental auditing CPE courses, you get several benefits. First, you get unequaled flexibility in terms of completing the study materials at your own pace. Second, you can complete them from wherever you want. Whether you’re at home, in the office, or on vacation, you can finish the study materials with the help of a stable Internet connection and a desktop or laptop.

The cost of self-study programs also tends to be considerably lower than the costs of live webinars and in-person conferences. In fact, by choosing the right sponsor, you may be able to meet all your governmental auditing CPE requirements within a few hundred dollars.

In terms of drawbacks, you don’t get an opportunity to clear your doubts instantly with self-study programs. In addition, there’s no opportunity to interact with other auditors and expand your professional network. Finally, every self-study program comes with a final exam that you must clear to get your credits.

As a governmental auditor, you’re required to obtain credits in different subjects. Managing and tracking all your governmental auditing CPE credits can be a difficult task without having a proper system in place. Here are a few methods that you can try to do this efficiently.

Some sponsors offer CPE tracking tools as part of their CPE programs. Perhaps the biggest benefit of using one of these trackers is that you only need to upload the documents relevant to your governmental audit CPE to them. Whenever you need to check the status of your CPE, you just need to log into them.

Using an Excel file is another effective option to manage and track the credits you obtain from governmental auditing CPE courses. Ideally, you should store this file locally and in the cloud simultaneously. In case the local file gets corrupted, you’ll still be able to access the one stored in the cloud.

If you want to use this method, it’s vital to have a separate place to store all the physical copies relevant to your governmental auditing CPE courses. Here are the documents that you must need to maintain.

Whether you want to maintain an Excel file or keep physical documents, make sure that you have these pieces of information:

These pieces of information will be extremely crucial in case you need to prove compliance with your governmental auditing CPE requirements.

First of all, you aren’t required to report your governmental auditing CPE hours to any governing body. However, individuals such as internal quality control reviewers and external peer reviewers may want to check whether or not you’re meeting your governmental auditing CPE requirements on time. This is because they need to ensure that the governmental auditors appointed by them are qualified enough to carry out their duties.

The internal quality control reviewer makes sure that you’ve obtained the required governmental audit CPE credits and the external peer reviewer makes sure that you maintain proper records and comply with the rules accurately.

It’s important to note that if you’re a CPA, you may need to report your CPE credits to your state board as per your reporting cycle. However, your board isn’t responsible for checking whether or not you’re fulfilling your governmental auditing CPE requirements regularly.

Even though you don’t need to report your governmental auditing CPE credits to anybody, you must keep all the relevant documents for a minimum of five years from the programs’ dates of completion. In case you’re selected for a CPE audit, these documents will serve as pieces of evidence that you’ve diligently fulfilled your governmental auditing CPE requirements.

By pursuing governmental auditing CPE diligently, you can bring a wealth of expertise and knowledge to the table while ensuring that all your professional services comply with the auditing standards. If you desire to pursue governmental audit CPE efficiently, browse our collection of quality governmental auditing CPE courses and embark on your journey to become a proficient auditor.

Check out what other customers are saying.