Cash Flow CPE Courses For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

This page offers a curated list of Cash Flow CPE courses specifically for CPAs, accountants, and financial professionals seeking to enhance their ability to analyze and manage business cash flow. With up-to-date 2026 content and flexible self-study options, these online courses help professionals gain practical skills to improve client advisory outcomes and meet their continuing education goals efficiently.

1. Who is this list of CPE courses for?This list of Cash Flow CPE courses is designed for CPAs, accountants, and IRS Enrolled Agents who want to deepen their understanding of cash flow management and strengthen their financial advisory skills.

2. What is this list of CPE courses about or what problem does this course solve?These courses focus on helping professionals differentiate between cash flow and profit, perform cash flow analyses, and apply this knowledge to improve financial decision making and business performance.

|

3. Why is this list of CPE courses important to a CPA, Accountant, or IRS Enrolled Agent?Mastering cash flow concepts allows financial professionals to better advise clients, identify liquidity issues, and ensure sustainable business operation, core responsibilities in accounting and finance roles.

4. When is this list of CPE courses relevant or timely?These courses are particularly relevant in 2026, as they include updated material on FASB standards, SEC filing requirements, and current financial reporting developments that affect cash flow management today.

|

5. Where can this list of CPE courses be found and accessed?All courses are available online at cpethink.com, offering convenient access to self-study materials, video lessons, and downloadable content tailored to professional schedules.

6. How is a list of CPE courses like this consumed or used?CPAs can complete these self-study courses or video modules at their own pace to earn CPE credits, enhance their technical expertise, and fulfill continuing education requirements through an accredited CPE sponsor.

|

Cash is what drives a business, makes it successful, and helps it remain profitable. And cash flow refers to the money that’s coming in and going out of a business during a particular period. Unfortunately, many business owners consider cash flow as the same as profits and that’s exactly where problems like insufficient cash reserves start gaining momentum.

CPAs, being expert financial advisors, are expected to help business owners gain clear insights into the actual financial health of their business. Cash flow CPE courses help CPAs master different aspects of cash flow and help improve their professional expertise.

Check out the Cash Flow CPE coursees below and improve today!

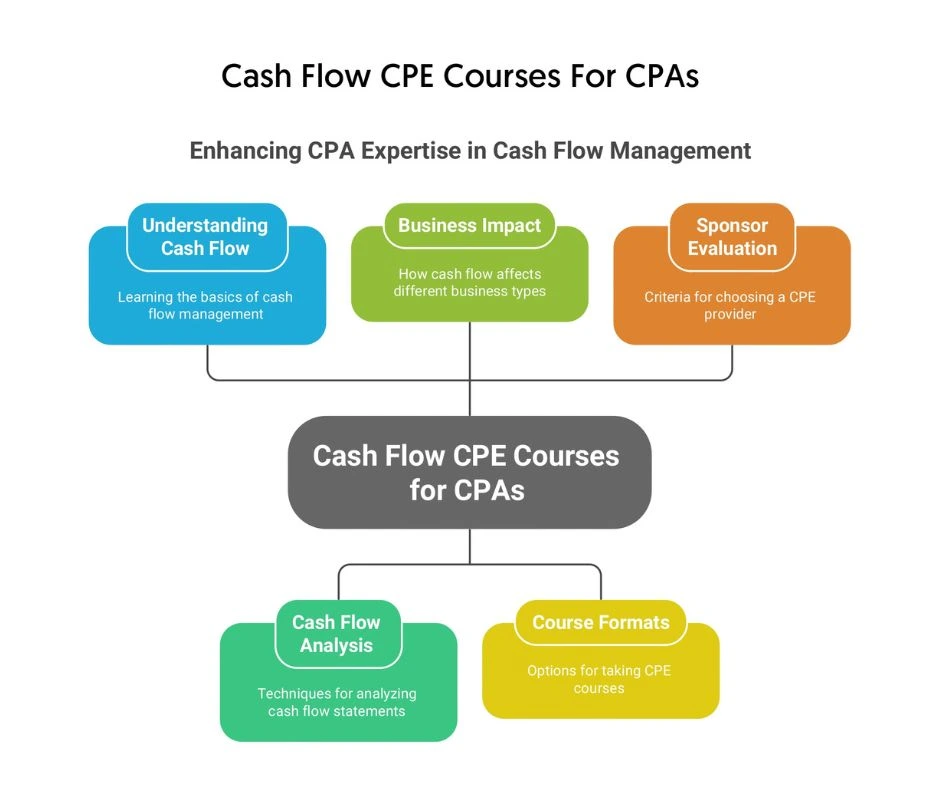

By taking cash flow CPE online or through other formats you can understand the differences between profit and cash flow. You’ll also learn how to perform a cash flow analysis using a cash flow statement and its different activities namely operating, investing, and financing.

Online cash flow CPE courses also cover the importance of cash flow in a business setting and how it impacts different kinds of businesses such as startups, seasonal businesses, etc.

As you can see, by developing a solid understanding of cash flow, not only you can expand your client base but maximize your income potential as well. While there’re several ways to take cash flow CPE courses for CPAs, the most prominent ones include self-study courses, webinars, and conferences.

If you choose any of the first two methods, be sure to check some essential factors before making any final decision. These include checking the CPE sponsor’s accreditations and approvals, reviewing the relevance of your chosen cash flow CPE courses, researching the quality of instructors, and assessing the quality of the sponsor’s customer support.

You can do these by taking a thorough look at the sponsor’s website and its “customer reviews” section. To understand the relevance of your chosen course, you should keep an eye on the latest trends in the world of business.

These are reviews many of our recent and previous clients have left.