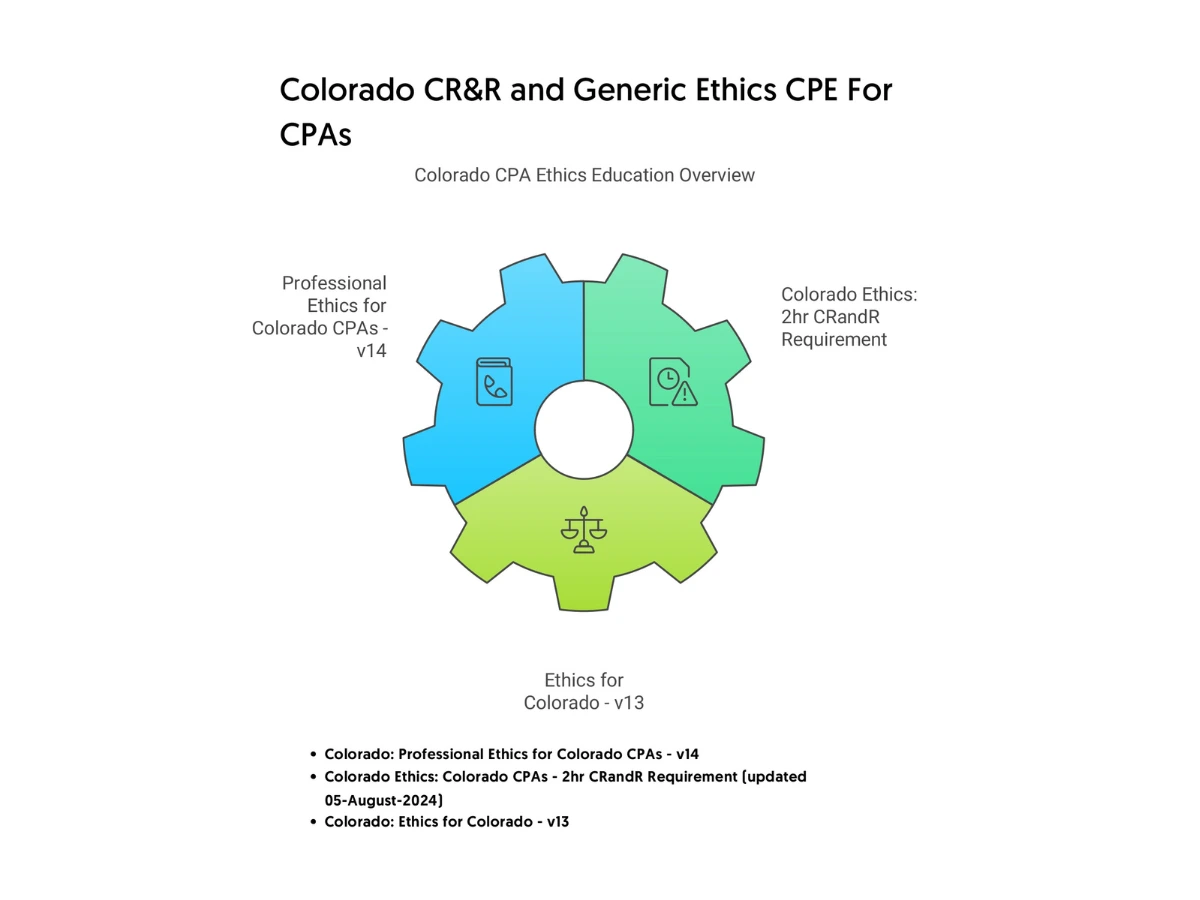

Colorado CR&R and Generic Ethics CPE For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

Needless to say, the efficacy of accounting practices relies on compliance with ethical guidelines as much as it does on other fields of study. Ethical standards and guidelines form the backbone of the accounting profession.

If you’re a Colorado CPA trying to ensure that each of the services you offer to your clients adhere to the ethical guidelines, you must prioritize pursuing Colorado CPE ethics. While meeting your ethics requirements is mandatory to keep your license active, prioritizing it also provides you with several benefits.

Perhaps you already know that CPE requirements, including the ones associated with ethics, vary from one state to another. However, in Colorado, you’re also required to pass a Colorado CPA ethics exam to receive your CPA license.

If all these sound a bit complicated, we’re here to help. We’ve created this page to help you get a clear idea of both the CPA ethics exam Colorado and Colorado CPA ethics requirement in terms of CPE.

Let’s get started.

In simple words, Colorado CPE ethics refers to the educational activities that you need to complete to fulfill the ethics requirements set forth by the Colorado State Board of Accountancy. Since this is a mandatory requirement for all active CPA license holders in the state, non-compliance with it may cause you to face disciplinary actions.

When choosing a CPE sponsor to fulfill your Colorado CPA ethics requirement, you also need to ensure some crucial aspects related to Colorado CPE ethics programs. We’ll discuss these in detail in one of the next sections.

Clearing the AICPA ethics exam Colorado is a must to obtain your Colorado CPA license. The exam is aimed at testing the comprehension of the ethical guidelines of a CPA. Here are the essential things you need to know about the Colorado CPA ethics exam.

It’s also important to mention that when browsing AICPA’s website, ensure that the course’s title has “For Licensure” at its end. This is because AICPA offers several other courses that are solely intended for meeting CPE requirements.

Now that you’ve got a clear comprehension of the Colorado CPA ethics exam, it’s time to learn about some effective ways to prepare for it.

The AICPA ethics exam Colorado is timed, meaning you need to familiarize yourself with its format so that you can answer all the questions within the limited time frame. You should also try to get a clear understanding of the types of questions that you’ll need to answer.

Since the Colorado CPA ethics exam is administered by the AICPA, it’s best to focus on the study material offered by it. The topics covered in the course are designed to help aspiring CPAs prepare for the exam efficiently. Therefore, it’s strongly advisable to use the material as your primary resource for study.

Even though the time you need to invest in preparing for the exam is incomparable with the massive amount of time you need to devote to complete Colorado CPE ethics and other programs, you still should have a realistic study schedule. This will help you internalize the topics and retain information effectively.

As the exam is timed, you must be able to manage your time efficiently. Ideally, you should figure out a certain amount of time that you’ll invest to answer each question. Focusing on one question for a significant period of time may affect your performance in the exam.

In this section, we’ll discuss all the vital things associated with Colorado CPA ethics requirements in relation to CPE. Let’s take a look.

In addition to these, it’s important to remember that no CPE sponsor or Colorado CPA ethics course is pre-approved by the board. This essentially means that you’re fully responsible for ensuring that whatever program you take to fulfill your Colorado CPA ethics requirement, complies with the joint AICPA/NASBA Standards and Board Rules.

It’s also vital to mention that if you have CPA licenses in multiple states, including Colorado, you may be able to fulfill the requirements of all those state boards if your coursework adheres to the CPE Standards. However, there’s no guarantee that if a state board accepts your CPE, other boards will do the same automatically.

As suggested by the board, you must keep documentation for all your CPE programs, including Colorado CPE ethics, for at least five years from the completion of a reporting period. While you don’t generally need to submit documentation to the board, you may need to do it if the board asks for it or you’re selected for an audit.

Whether you’re taking the “Professional Ethics: The AICPA’s Comprehensive Course (For Licensure)” course to clear the Colorado CPA ethics exam or any other program to meet your Colorado CPE ethics requirements, your documentation must contain these pieces of information:

Apart from helping you keep your license active, pursuing Colorado CPE ethics can help improve your professional competence and strengthen your position as a CPA who delivers professional services in compliance with ethical guidelines.

Here are the real-life benefits of prioritizing meeting your Colorado CPE ethics requirement on time and efficiently.

When dealing with the financial statements of an individual, business, or organization, CPAs must adhere to all the applicable legal and regulatory guidelines. Non-compliance with these guidelines may lead to legal actions against both you and your client. However, by using your knowledge and skills acquired from Colorado CPE ethics programs, you’ll be able to follow all the ethical principles when offering professional services, ensuring you and all your clients remain compliant with the guidelines.

For any CPA, maintaining public trust is one of the primary responsibilities of their professional roles. Compliance with ethical principles will enable you to provide the public with accurate financial information. This will help maintain public trust while upholding the reputation of the accounting profession.

Unethical accounting practices not only can lead to legal actions but they may also cause financial loss and reputational damage to your clients. The programs you complete to meet your Colorado CPE ethics requirements will help you become proficient in following all the ethical principles and mitigating the risks.

In the accounting profession, compliance with ethical guidelines serves as one of the key features of professionalism. This will demonstrate your commitment to the profession and your willingness to serve the best interests of your clients.

With the availability of many CPE sponsors offering Colorado CPA ethics courses, it sometimes becomes quite difficult to identify the right one. Here are a couple of tips that will help you with this.

As mentioned earlier, you’re fully responsible for ensuring that the programs you take to fulfill your Colorado CPA ethics requirement will be accepted by the board. Therefore, it’s best to join a sponsor that’s listed on the National Registry of CPE Sponsor of NASBA.

To become listed on this registry, a sponsor needs to prove that its programs comply with the Standards. So, joining one from the registry gives you an assurance of the availability of high-quality programs.

CPE sponsors that have been offering Colorado CPE ethics programs for years typically have a solid team of experienced authors and instructors. As a result, you can rest assured of receiving quality study materials when fulfilling your Colorado CPA ethics requirements. Additionally, adept authors and instructors have the ability to explain complex topics in an easily comprehensible way, which will help you internalize them efficiently and retain the information for a long period of time.

We hope that this page has provided you with enough information about Colorado CPE ethics and equipped you with the details you need to appear for the Colorado CPA ethics exam with confidence. If you want to obtain more information about how the experts at CPEThink.com can help you with your Colorado CPA ethics requirement, contact us today!

Cpethink.com offers the best on line reputation and testimonials of any on line CPE sponsor. However don't take our word for this, go to https://www.cpethink.com/cpe-reviews or see below for some of our more recent buyer reviews.

These are reviews several of our existing and past buyers have given.