Oregon CPE Courses for CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

Whether you’ve recently obtained your CPA license in Oregon or have been in the field for many years, pursuing Oregon continuing education is a must to keep your license active. It’ll also help you maintain your professional competence and credibility.

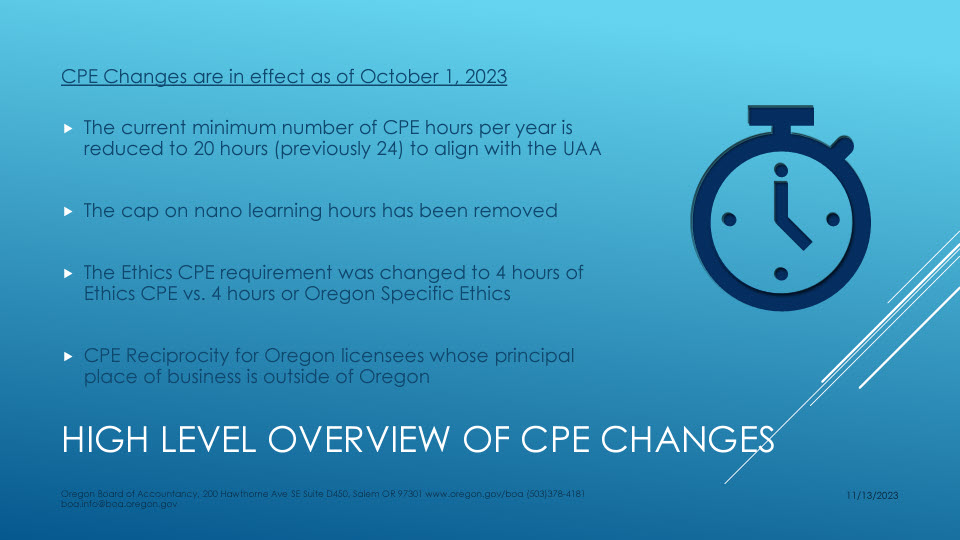

However, Oregon CPA continuing education requirements are somewhat different from many other jurisdictions. Therefore, you should have a clear understanding of these requirements to be able to plan your CPE efficiently.

On this page, you’ll find all the important details related to Oregon CPE requirements. With this as your handbook, you should be able to embark on and continue your study effectively and confidently.

Oregon Board of Accountancy

Let’s get started!

Here’re the general guidelines you need to keep in mind when meeting Oregon Board of Accountancy CPE requirements.

Here’re the ethics-related details you need to remember when pursuing Oregon CPA CPE.

If you’re an active licensee, here’re the things you must remember when pursuing Oregon Board of Accountancy CPE. Whether you want to pursue the Oregon Society of CPAs CPE or choose a NASBA approved sponsor to obtain your Oregon CPE credits, be sure to remember these guidelines.

If you have an inactive license, you’re required to comply with these guidelines.

All other guidelines remain the same as those applicable to active licensees.

If you’re a retired licensee, you don’t need to pursue Oregon CPE and report your credits.

If you’re a municipal auditor, you must comply with these guidelines.

Here’re the technical and non-technical subjects that you need to focus on when pursuing Oregon CPA CPE. However, subjects other than these may be allowed by the board if they help improve your professional competence.

If you prefer to take live CPE courses to fulfill Oregon Board of Accountancy CPE requirements, make sure that your sponsor complies with these guidelines.

Here’re the calculation methods that you need to follow when obtaining Oregon CPA CPE credits.

The board allows half credits. When you take a live course, you can obtain one-half credit by completing 25 minutes of it.

If you serve as a speaker, discussion leader, or instructor to meet your Oregon CPA CPE requirements, your credits will be your time of presentation plus up to two times of preparation time for it.

If you take credit courses in a college or university, you’ll get 10 credits for completing one quarter hour and 15 credits for finishing one semester hour. If you take non-credit courses, you’ll get one CPE credit for every classroom hour. Note that, these courses have to be in technical subjects.

You already know that you must provide the board with proof of completion of CPE programs to claim your CPE credits. You also need to keep documents related to the completion of every CPE program for at least five years after finishing them.

Your every proof of completion has to contain these pieces of information.

If you work as a speaker, discussion leader, or lecturer, your proof of completion must have these pieces of information.

If you choose the following methods to meet Oregon Board of Accountancy CPE requirements, your evidence of completion needs to contain some relevant pieces of information. These include:

You may have noticed that pursuing Oregon CPE is slightly more complicated than in many other states. The presence of several guidelines makes it a must to join the right sponsor.

Here’re a couple of methods to ensure this.

It’s always advisable to join a sponsor that has years of experience in the industry. A reputable sponsor will most likely have a robust team of authors and instructors and offer high-quality courses to help CPAs pursue CPE efficiently.

Since pursuing Oregon CPA CPE is already an expensive affair, you should search for and join a provider that maintains a balance between quality and affordability. This will help you meet Oregon CPA CPE requirements within your budget.

At CPEThink.com, we’ve been helping CPAs pursue CPE efficiently and affordably since 2004. We also have a broad variety of CPE subscription packages to help you lower your CPE cost. By choosing us as your sponsor for Oregon CPE, you’ll also be covered by our 100-day, 100% refund policy.

Contact us today to get more information about how we can help you fulfill Oregon CPA CPE requirements conveniently.

Check out what other customers are saying.