Arizona CPE Courses for CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

This page provides Arizona CPAs with a complete, easily accessible list of CPE courses to meet state specific renewal requirements. It helps licensed professionals understand Arizona’s CPE rules, fulfill mandatory ethics and subject area credits, and efficiently complete required coursework through flexible online learning options, all in one place.

1. Who is this list of CPE courses for?This list of CPE courses is designed for Certified Public Accountants (CPAs) licensed in Arizona who must meet the Arizona State Board of Accountancy’s continuing professional education requirements, as well as accountants and finance professionals seeking to enhance their technical and ethical competencies. 2. What is this list of CPE courses about or what problem does this course solve?The list provides Arizona specific continuing education options covering areas such as accounting, taxation, ethics, auditing, and emerging technologies, helping CPAs fulfill their biennial 80-hour CPE obligation while staying compliant with state board regulations. |

3. Why is this list of CPE courses important to a CPA, Accountant, or IRS Enrolled Agent?It is essential because completing these courses ensures that Arizona CPAs maintain their license, remain in good standing with the Arizona Board of Accountancy, and stay current on professional standards and developments in accounting, finance, and ethics. 4. When is this list of CPE courses relevant or timely?This list is relevant year-round, but particularly important as CPAs approach their license renewal deadlines, the last business day of their birth month in either an even or odd year depending on their license cycle. |

5. Where can this list of CPE courses be found and accessed?These Arizona CPE courses are available on the CPEThink.com website, where CPAs can browse, purchase, and complete self-study and video-based courses online, or subscribe to unlimited learning plans for greater flexibility. 6. How is a list of CPE courses like this consumed or used?CPAs select, purchase, and complete self-study, text based, or video based CPE courses directly through the website; upon completion, they receive credits that count toward their Arizona CPE reporting requirements. |

Arizona is known for its pro-business environment that generates a wide range of possibilities for finance professionals. The presence of large companies fosters an inherent need for competent CPAs who can help these organizations with their financial activities.

If you’re a CPA in Arizona and want to enhance your professional competence, your only option is to focus on your learning. And pursuing Arizona CPA CPE requirements with a reputable CPE sponsor by your side is the best thing you can do to continually update your skill sets.

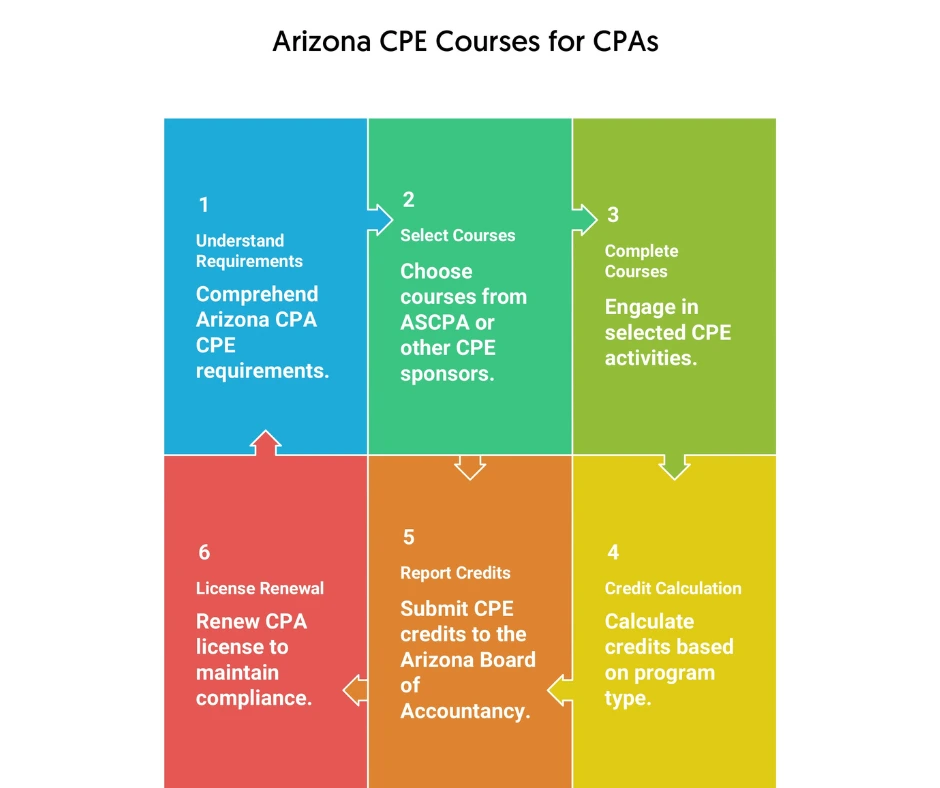

However, Arizona state CPE requirements are significantly different than those in many other jurisdictions. Therefore, before you embark on your Arizona CPE journey, it’s strongly advisable that you develop a clear comprehension of your Arizona CPA CPE requirements.

Whether you want to complete Arizona Society of CPAs CPE programs or take courses from other CPE sponsors, understanding the guidelines will help you pursue Arizona Board of Accountancy CPE efficiently.

To help save you time and effort, we’ve created this page that contains all the vital information related to the Arizona State Board of Accountancy CPE. These pieces of information will greatly help you experience a smooth Arizona CPA CPE journey.

Arizona has a biennial license renewal and CPE reporting period. If you aren’t eligible for CPE reciprocity, you need to comply with these Arizona CPE rules.

Arizona CPA ethics CPE requirements substantially differ from those in many other states. Every two-year period, you’re required to obtain four CPE credits in ethics. These must include at least one credit in each of these.

If you take an ethics program that’s developed or taught by a co-worker or your employer, you won’t receive any credits.

Here’re the things related to subject areas you must keep in mind when fulfilling your Arizona CPE requirements.

You’ve just seen that it’s mandatory for you to earn a minimum of 16 credits through classroom programs or live/interactive webinars to meet your Arizona CPA CPE requirements. Mainly, you get two options to fulfill this requirement. First, you can join a well-reviewed CPE sponsor and second, you can complete Arizona Society of CPAs CPE programs.

However, before choosing one of these options, you need to be aware of some benefits offered by each of them.

As a member of the Arizona Society of CPAs, you can save 25% on the majority of CPE webcasts and seminars that are conducted throughout the year. You can also get an additional 15% discount by registering for programs by May 31.

Additionally, the ASCPA offers free webinars that you can attend to obtain some Arizona CPE credits for free. The ASCPA has some preferred CPE providers joining who will help you enjoy exclusive member savings.

The membership period of the Arizona Society of CPAs runs from 1st May to 30th April. Your membership dues will vary depending on the period you join the society. For licensed CPAs, these are the current membership dues.

One of the major advantages of joining a leading CPE sponsor to meet Arizona CPE requirements is that there’ll be no mandatory membership fees that you’ll have to pay. Reputable CPE sponsors like CPEThink.com are also known for offering quality Arizona CPA CPE programs at affordable rates. Therefore, you won’t have to worry about paying a hefty amount of money to meet your Arizona CPA CPE requirements.

Notably, some renowned CPE sponsors have subscription packages choosing one of which will help you save more. For instance, at CPEThink.com, we have unlimited subscription packages that’ll let you access all our self-study courses and free webinars. By paying a one-time fee, you’ll be able to take whatever course you want at a substantially discounted rate. You’ll be able to obtain a virtually unlimited number of courses using our unlimited subscription packages.

Since the state board of accountancy doesn’t pre-approve any CPE sponsor, it’s the responsibility of the CPAs to ensure that completing a CPA license program in Arizona will help them receive CPE credits. Here’re the factors that usually make a program eligible for CPE credits.

You’re allowed to take self-study programs to meet a certain portion of your Arizona Board of Accountancy CPE requirements. However, the programs must comply with the provisions we mentioned above. The providers of the programs also need to maintain written records of the participation of each student. Additionally, they need to maintain the program outline’s records for three years after its end.

You need to follow these methods to calculate your credits when pursuing Arizona CPE.

You won’t get any credit for repeat participation in any course or seminar during your registration period.

You can get credits in one-half or one-fifth increments as long as the program is part of an ongoing series associated with a particular subject. Also, the segments need to be connected by an overarching course the duration of which has to be at least 50 minutes. Additionally, you must complete all the segments within one CPE reporting period.

Let’s see the credit calculation methods pertaining to different methods of meeting Arizona CPE requirements.

By completing an hour of a self-study program, you’ll get one CPE credit.

You may be able to obtain a maximum of 40 CPE credits during every renewal period by serving as a discussion leader or CPE lecturer. It’s vital to note that if you claim credits for writing and publishing books or articles together with providing this service, you may not be able to obtain more than 40 credits. Here’re the things you need to remember when using this method to fulfill your Arizona CPA CPE requirements.

Completing one quarter hour and one semester hour will let you earn 10 credits and 15 credits, respectively. Completing one hour of a non-credit program will help you get one credit.

If you complete introductory computer courses to meet Arizona Board of Accountancy CPE requirements, you may obtain up to 20 credits during every renewal period.

Using this method, you may earn up to 20 credits during every renewal period. However, if you also claim credits for serving as a discussion leader or CPE lecturer, 40 will be your maximum combined CPE credits in one renewal period. Here’re the guidelines you need to keep in mind when using this method to pursue Arizona CPE.

You can obtain up to four credits in one renewal period by finishing nano-learning courses.

If you don’t reside in Arizona but want to renew your Arizona CPA license, the board may consider you compliant with the Arizona CPE requirements if you’ve fulfilled the CPE requirements for renewing your license in your primary place of business’s jurisdiction.

In that case, however, you’ll need to provide the board with evidence of your CPE compliance with your primary place of business’s jurisdiction. You’ll need to submit a signed statement to the board along with your renewal application.

In case you don’t live in Arizona and your jurisdiction doesn’t have any CPE requirements in place, it becomes mandatory for you to meet all Arizona CPA CPE requirements to renew your license here.

You may receive partial or full exemption from Arizona CPE requirements by the board on the basis of these grounds.

If you get selected for an audit by the board, you must provide it with some details related to your Arizona CPE within 30 days. These include:

You must maintain all your CPE records for at least three years from the completion of a registration period.

If the board finds that you’re non-compliant with your Arizona CPE requirements, you may need to face administrative penalties or suspension until you cure your CPE deficit.

Now that you’ve got a clear comprehension of all the important details and guidelines related to Arizona CPE, it’s time to start meeting your Arizona CPE requirements. We have a large collection of quality courses that’ll help you fulfill your Arizona CPA CPE requirements efficiently and affordably. You only need to choose your preferred courses and you can start focusing on your learning immediately.

If you need any more help with Arizona CPA CPE, contact us, and we’ll be happy to answer your queries.

Check out what other customers are saying.