COVID-19 and The CARES Act CPE Courses |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

The CARES Act was enacted into law by the U.S. federal government on March 27, 2020. It includes measures related to payroll tax credits, income tax, and loan programs, and provides relief for businesses, individuals, not-for-profits, etc. As a CPA you must have noticed that the COVID-19 pandemic has severely impacted the financial situations of your clients.

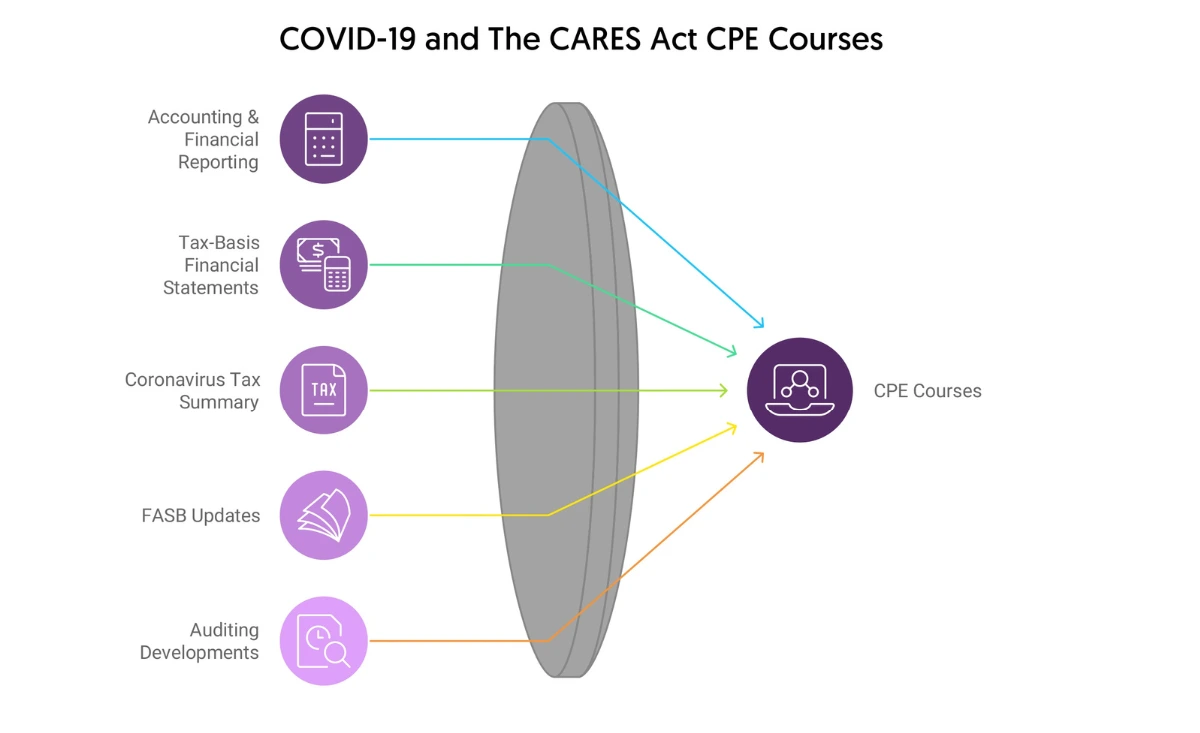

Moreover, the CARES Act has many provisions that might substantially impact the financial reporting of organizations that apply U.S. GAAP. To help your clients sail through the challenges, it’s crucial to develop a robust understanding of the CARES Act by taking CARES Act COVID-19 CPE training Courses:

Stay up to date with CPE that is current and topical on the CARES Act and Covid-19 topics that related to you.

While it isn’t possible to predict the complete extent of the pandemic’s impact on the world of business, mastering the key provisions of the CARES Act will surely help strengthen your position as a trusted financial advisor.

As the CARES Act is very detailed and long, it’s quite difficult to take a thorough look at it and understand its most important provisions, especially when you’re having a hectic schedule. Fortunately, online CARES Act COVID-19 CPE courses typically summarize those provisions to help you learn them quickly and enhance your professional expertise.

For instance, one provision related to payroll tax credit helps eligible employers to keep their employees on the payroll. The CARES Act also aims to provide small businesses with crucial funding required to keep them running. It includes the PPP or Paycheck Protection Program that makes a loan program of $349 billion available to eligible small businesses.

The key objective of this program is to help qualifying employers cover their payroll costs by giving them loans. Under the CARES Act, help is also offered to businesses, families, and workers through different provisions. There’re many other provisions such as support for the healthcare system, support for large and mid-sized businesses, etc as well that you can expect to learn by taking courses on CARES Act COVID-19 for CPAs.

Client and Customer Reviews.