IRS Ethics CPE For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

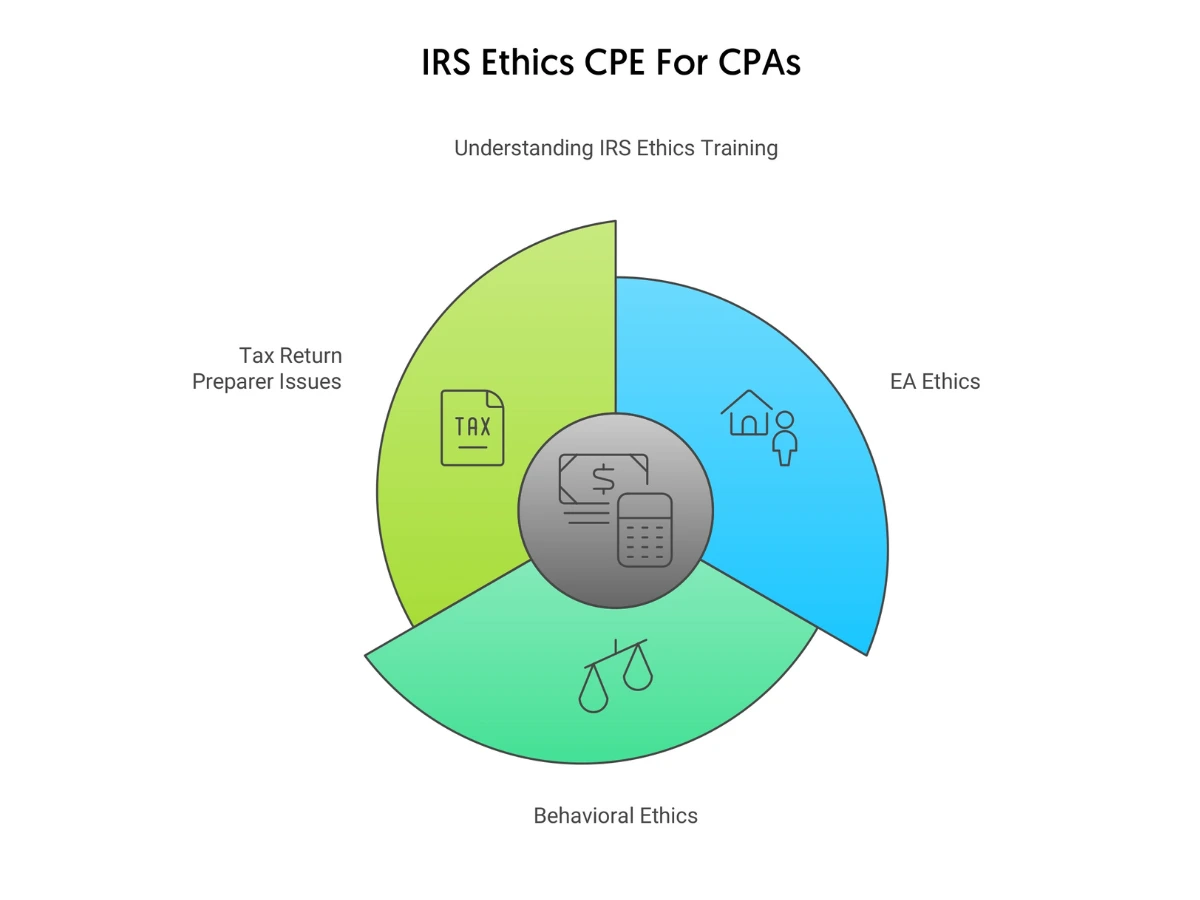

We have IRS EA and non-EA Ethics courses, all IRS Ethics CPE courses are listed below.

The EA Ethics coures are titled as EA Ethics.

Every taxpayer wants to engage a knowledgeable and competent tax professional who can serve the role of a trusted tax advisor and represent them before the IRS efficiently. As trusted advisors of tax-related matters, tax preparers are expected to maintain the highest standards of professionalism and follow ethical principles when offering professional services.

If you too are a tax preparer and want to master the ethical principles and values that necessarily govern your profession, taking an IRS ethics course from a reputable sponsor is your best option.

On this page, you’ll get a clear understanding of different aspects of ethics as they apply to tax preparers. From an overview of the IRS Ethics Handbook to the importance of taking high-quality IRS ethics courses, reasons to choose a self-study IRS ethics course over an IRS ethics webinar, and more, we’ll discuss several important aspects of IRS EA and non-EA ethics.

Let’s start with the basics.

The objective of taking an IRS ethics CPE course is to comprehend the ethical guidelines that you need to follow in your day-to-day practice. These IRS ethics training programs will help you understand and adhere to the IRS Circular 230 regulations.

The IRS Circular 230 regulations govern the activities of enrolled agents (EAs) when they represent their clients before the IRS. Here, it’s vital to mention that taking this course is a mandatory requirement for enrolled agents. For other tax professionals, this is optional but highly recommended.

The IRS Ethics Handbook comprises rules that apply to all IRS employees excluding Chief Counsel and contractors. Here are the important things you need to know about it.

In addition to these, it contains clauses related to the IRS Code of Ethics such as “Performance of Duty” and “Observation of Duty Hours.”

Here are the practical benefits of completing quality IRS tax preparer ethics programs.

As a tax preparer, you’re required to deal with sensitive financial information of your clients and each of your professional activities should serve their best interests. By applying the knowledge and skills gained from your IRS ethics course, you can maintain high ethical standards in all your professional activities. This will essentially help you develop trust and credibility with your clients, which may result in referrals and long-term relationships.

IRS tax preparers who demonstrate high ethical standards get to build a robust professional reputation over time. It significantly helps in increasing their earning potential and bringing new career opportunities their way.

Every tax preparer has the responsibility to adhere to all the applicable regulations and laws which include local and state tax laws and the IRS tax code and regulations. Whether you take an IRS ethics course or an IRS ethics webinar, you’ll learn how to avoid IRS ethics violations while staying compliant with all these regulations and laws. This will help you avoid any potential regulatory or legal issues.

The tax system is reliant on taxpayers voluntarily adhering to all the tax regulations and laws. When the tax preparers of the taxpayers uphold ethical standards, they indirectly help the public maintain trust in the tax system.

As a tax preparer, you’re responsible for safeguarding the interests of your clients. You’re also required to maintain the confidentiality of their financial information. By completing your IRS ethics training properly, you’ll be able to maintain both of these efficiently.

When completing your IRS ethics CPE course, you’ll also get a detailed overview of the IRS Ethics Handbook and its several important aspects such as when is ethics approval required for an IRS employee and how their manager should respond to it.

If you search online using the phrase “IRS ethics training,” you’ll mainly get two types of results: self-study IRS ethics courses and IRS ethics webinars. Both these options come with some pros and cons. In this section, we’ll discuss why numerous tax practitioners choose a self-study IRS ethics course over a webinar.

With self-study courses, there’s no need to keep aside some time to attend an event to get your IRS ethics credits. You’re free to complete the study materials at your own pace. Additionally, live webinars are sometimes hosted during business hours. So, for a busy tax practitioner, it may be difficult to attend them.

While every IRS tax preparer ethics course has a final exam that you must pass to get your credits, it won’t be difficult if you study diligently.

In general, self-study IRS ethics courses are made available at a price cheaper than webinars. As a result, for cost-conscious tax practitioners, the former turns out to be a better option than the latter.

When it comes to self-study courses, you can access the study materials as soon as you purchase them. However, with live webinars, you’ve to wait till they’re hosted. So, if you’re in a hurry to complete your IRS ethics training, it may be better to opt for a self-study IRS ethics course.

Many learners prefer to have hard copies of the study materials so that they can highlight certain areas, take notes, etc. when completing them. This is can only be possible with self-study IRS ethics courses. With IRS ethics webinars, there’s no way to do these things.

When it comes to taking an IRS ethics course, many tax practitioners search for free options. While taking a free course certainly helps you save some money, it also comes with a couple of drawbacks. Let’s see why your focus shouldn’t be solely on free IRS ethics training programs.

It’s quite difficult to find free IRS ethics courses that cover important topics such as the IRS Ethics Handbook or IRS Code of Ethics and the latest trends in the tax world. Therefore, if your goal is to learn such topics, a free IRS ethics training program may not be of much help.

On the other hand, paid IRS ethics programs cover the entire spectrum of the field. Whatever subject you want to learn, you can do that efficiently. If you’re thinking about the cost, some reputable sponsors, including CPEThink.com, offer high-quality IRS ethics courses at affordable prices. Enrolling with one of them will help you master the desired topics within a reasonable budget.

Sometimes, free courses aren’t created by experienced authors. This means they may not help you get an in-depth understanding of a particular topic or may not cover all the aspects of a complex subject. Since the tax field is filled with many complex subjects, it’s strongly advisable to search for paid IRS ethics programs that will help elevate your professional competence.

You already know that to obtain your IRS ethics credits by attending an IRS ethics webinar, you must complete some activities that will prove your active participation in it. Sometimes, free webinars come with technological glitches that make them quite difficult to attend. If you cannot understand the content or fail to answer the questions correctly, you won’t get any credits.

On the contrary, sponsors that offer paid webinars strive to ensure that the attendees get to make the most out of them. Here, it’s also important to mention that paid webinars are often presented by renowned instructors who can bring a wealth of knowledge to the table. This may not be always the case with free webinars.

Even if free IRS EA and non-EA ethics programs have some downsides, they offer two crucial benefits as well. First, you get to obtain credits for free. And second, you can evaluate the quality of the programs offered by a particular sponsor. Since you don’t need to pay anything to take these courses, you can take several of them and decide on the right sponsor for your future programs.

Choosing the right sponsor is absolutely crucial to making the most out of your IRS ethics course. However, with a massive number of providers offering these programs, it often becomes an uphill and time-consuming task. In this section, our experts have jotted down some valuable tips to help you out.

In the competitive field of CPE sponsors, quality has to be a provider’s number one priority if it wants to operate for many years. So, joining an experienced sponsor helps ensure the quality of the programs. By enrolling in its IRS ethics CPE courses, you can rest assured of learning quality content.

The quality of a sponsor can easily be evaluated by taking a look at the ratings and reviews it received from its past customers. Many positive ratings and reviews stand as a testimony to the quality of a particular sponsor.

Some reputable CPE sponsors offer quality IRS ethics programs at steep price points. Some providers also offer these courses as part of their subscription packages. Choosing any of these providers may not take much time to increase your cost significantly.

When you join a sponsor that offers quality IRS ethics CPE courses at affordable prices and as individual programs, you get to master the topics without breaking the bank. Undeniably, buying a subscription package helps you get access to several courses at discounted prices. However, this may not make any sense if you only need or want to get IRS ethics credits.

Things in the tax field change quickly and hence, it’s a must to choose a sponsor that keeps on adding new programs to its catalog or updates its courses as and when required. This helps ensure that you always learn the latest information and keep abreast of the rules and regulations. Not only will this help you serve your clients better but will also help enhance your professional reputation.

At CPEThink.com, our goal is to offer the best IRS ethics courses in the industry at affordable prices. During our journey of two decades, we’ve garnered an unequaled reputation for helping tax practitioners stay up-to-date with the latest changes in the field and serve their clients most efficiently.

If you desire to get more information about the IRS tax preparer ethics programs we offer, feel free to reach us.

Cpethink.com provides the finest online credibility and reputation and testimonials of any on line CPE provider. However don't take our word for this, go to https://www.cpethink.com/cpe-reviews or see here for some of our latest customer testimonials.

These are reviews many of our current and previous clients have left.