Non Profit CPE Courses For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

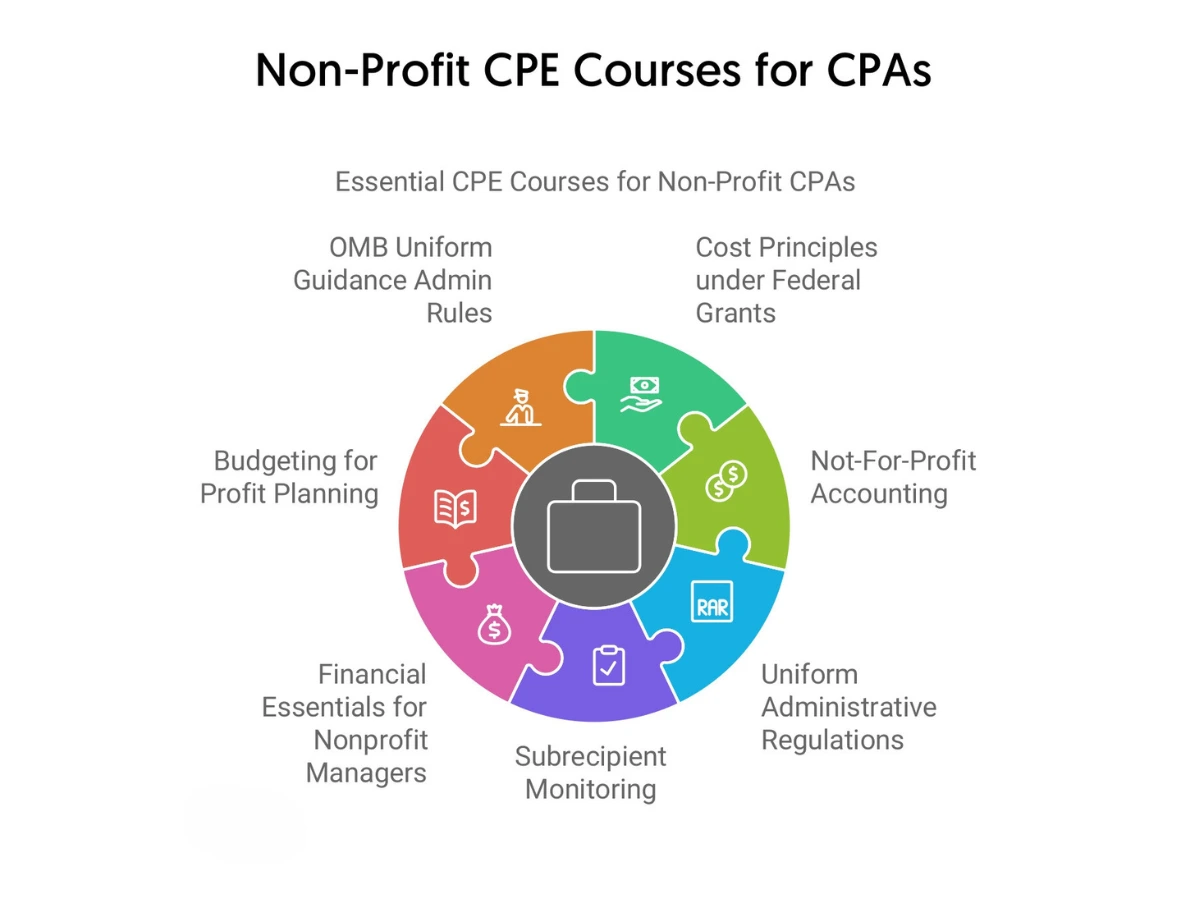

This page offers online CPE courses designed for CPAs and accountants focused on non-profit (not-for-profit) accounting, reporting, and compliance. It helps professionals maintain accuracy, transparency, and ethical standards in nonprofit financial management while earning CPE credits. All courses are available online through self-study, making it easy to stay current with evolving not-for-profit accounting regulations.

1. Who is this list of CPE courses for?This list is specifically designed for CPAs, accountants who work with or plan to work for nonprofit and not-for-profit organizations, including those involved in finance, auditing, and management functions.

2. What is this list of CPE courses about or what problem does this course solve?These courses focus on nonprofit accounting principles, reporting requirements, and compliance guidelines that help professionals ensure transparency, accountability, and accuracy in the financial operations of nonprofit organizations.

|

3. Why is this list of CPE courses important to a CPA, Accountant, or IRS Enrolled Agent?It equips accounting professionals with the knowledge and technical skills necessary to comply with tax-exempt regulations, prepare accurate financial statements and tax returns, and maintain donor confidence through transparent reporting.

4. When is this list of CPE courses relevant or timely?These courses are continually relevant as nonprofit financial and tax regulations evolve; they are particularly valuable for professionals needing up to date knowledge to meet annual continuing education requirements or adapt to regulatory updates.

|

5. Where can this list of CPE courses be found and accessed?All nonprofit accounting CPE courses are available online at CPEThink.com, where learners can select, purchase, and complete self-study programs directly from the site.

6. How is a list of CPE courses like this consumed or used?These courses are typically taken as self-study modules that participants complete at their own pace, allowing CPAs to earn CPE credits while applying practical nonprofit accounting and auditing concepts in their professional roles.

|

Nonprofit organizations have a primary goal of supporting a particular mission instead of generating profits for their shareholders and owners. These organizations typically depend on funds from contributions, fundraising events, program revenues, grants, etc.

To make the most out of their limited resources, nonprofit organizations need accurate and effective accounting processes. If you’re working for one of these organizations or thinking about joining one, this page is for you.

Here, we’ll discuss all the vital things you need to know about non profit accounting CPE. From the definition of nonprofit CPE and its importance to the skills you need to focus on developing when taking nonprofit CPE programs, how to choose the right CPE nonprofit programs, and more, you’ll get to know everything after completing this page.

Let’s get started.

Nonprofit CPE refers to the CPE nonprofit accounting programs that help you master the specific guidelines that govern the accounting processes of nonprofit organizations. By pursuing nonprofit accounting CPE, you’ll learn all these guidelines along with the right methods to maintain different types of documentation to ensure the accounting processes of your organization are accurate.

Basically, non profit accounting CPE is all about learning the unique methods by which these organizations plan, maintain, and report their financial activities. While for-profit organizations mainly focus on generating profits, nonprofit organizations primarily focus on accounting’s accountability aspect. As a result, they typically follow a specific set of procedures and rules that help them remain accountable to their contributors and donors.

As mentioned above, nonprofit organizations have to comply with specific federal income tax laws to maintain their status as tax-exempt entities. Since the rules and regulations in the accounting world change frequently, taking nonprofit CPE courses is your best option to keep abreast of them.

However, meeting tax purposes isn’t the only purpose of pursuing nonprofit CPE. When you master all the guidelines that govern nonprofit accounting, you’ll be able to help your organization’s management accomplish its mission efficiently.

Here are the top reasons why you should prioritize pursuing non profit accounting CPE courses online and enhance your professional competence.

For any nonprofit organization, it’s extremely important to maintain accurate balance sheets and revenue and expense statements. The accuracy of these documents helps these organizations prepare correct financial statements that they can use when working with funding organizations, contributors, creditors, and banks.

With the help of nonprofit CPE programs, you’ll be able to master all the relevant accounting principles and guidelines that you need to follow to prepare accurate financial statements for your organization.

Without having a clear picture of the financial status of a program, it’s simply impossible to figure out whether a program has been successful or not. By maintaining accurate financial records, you’ll help the management evaluate a program’s performance. It’ll also help them create strategies to improve future programs.

Preparing accurate tax returns is among the most important responsibilities of accountants working for nonprofit organizations. This is also one of the most vital reasons you need to prioritize taking CPE nonprofit programs.

The financial records of your organization have to substantiate its income, credits, and expenses on Form 990 series along with other tax returns. You should also keep in mind that sometimes, the IRS wants to inspect the financial records and books of organizations with tax-exempt status.

By applying the knowledge gained from CPE nonprofit accounting programs, you’ll be able to prepare tax returns accurately and help speed up IRS examinations.

Pursuing nonprofit accounting CPE will help you maintain detailed, clear financial records for your organization. This will help maintain their transparency to donors, volunteers, board members, and the public, upholding trust in your nonprofit’s activities.

Maintaining accurate records of donor contributions will also help your organization build trust and personalize communications while helping them get the right tax benefits.

While pursuing nonprofit CPE can help you master a varying range of skills, some of them are essential to enhance your competence in nonprofit accounting. Here, we’ve jotted down the top skills that’ll help you attain this goal.

CPAs working for nonprofit organizations need to have the skills required to prepare and interpret financial statements, forecasts, and budgets properly. You also need to be proficient in preparing financial reports that adhere to nonprofit accounting standards, GAAP, and grant and donor requirements. Analyzing and communicating the financial performance to your nonprofit’s stakeholders is another skill you should try to develop.

When it comes to the planning and decision-making processes of a nonprofit organization, the management needs reliable and relevant financial information and valuable recommendations from its accounting department. By applying your knowledge gained by taking nonprofit CPE courses, you’ll be able to help your management team understand the internal and external factors that may affect the organization’s financial performance.

You’ll also be able to provide the team with in-depth information about the impact and risk of different projects, programs, and initiatives while advising it on the appropriate allocation of resources.

Accountants working for nonprofit organizations should strive to follow ethical principles and values. They should also try to ensure their professional activities serve the best interests of their nonprofits and their stakeholders.

You also need to keep abreast of and comply with all the relevant regulations, laws, codes of conduct, and policies that are applicable to your organization and sector. You should try to ensure that your nonprofit remains compliant with reporting, tax, and audit requirements. However, when pursuing nonprofit CPE, you’ll learn all the relevant guidelines and principles that’ll make these things easy for you.

If a nonprofit’s performance cannot be measured and assessed properly, it becomes nearly impossible for its management to make the right strategic decisions. You need to be proficient in using the right tools, metrics, and KPIs (key performance indicators) to provide the management with valuable insights into the organization’s financial health.

Based on your information, the management will be able to come up with an effective performance management system. In turn, this will help your nonprofit have the right strategy in place to accomplish its mission.

Regardless of the size of your nonprofit organization, you’re required to communicate with a diverse range of stakeholders on a daily basis. These stakeholders generally include board members, donors, auditors, team members, beneficiaries, and volunteers.

You need to be able to help all these individuals maintain trust in your nonprofit by providing them with clear financial information about it. You should also be proficient in collaborating with other teams and departments within your organization and external parties if required.

Nonprofit accounting is a constantly evolving and dynamic field that requires continuous learning and development. By completing CPE nonprofit programs from a leading sponsor, you can stay up-to-date with the trends and changes in this specific aspect of the accounting profession. Pursuing CPE in nonprofit accounting is your ultimate option to improve your knowledge, acquire new skills, deal with new challenges efficiently, and explore better career opportunities.

Just do a quick online search using the phrase “nonprofit CPE courses,” and you’ll see that a large number of CPE sponsors offer these programs. With so many providers and programs available out there, it sometimes becomes an uphill task to decide which one you should join.

To make this easy for you, we’ve compiled some effective tips in this section. Following these tips will help you find the right non profit accounting CPE courses and programs quickly and efficiently.

If you want your nonprofit accounting CPE credits to be counted toward meeting your CPE requirements, you must ensure that your chosen provider has all the required approvals and accreditations from the appropriate authorities.

Ideally, you should join a provider that’s listed on NASBA’s National Registry of CPE Sponsors. Taking CPE nonprofit accounting programs from one of these providers ensures that you’ll be able to use your nonprofit CPE credits to fulfill your CPE requirements.

The credibility of the author/instructor of a nonprofit accounting CPE program is another vital thing you need to ensure before joining it. Credible and experienced authors and instructors have the ability to explain complex accounting topics in an easily comprehensible way, which essentially helps the learners internalize them quickly and effectively.

Most leading CPE sponsors maintain transparency in terms of disclosing the credibility of the authors/instructors of their nonprofit CPE courses. In most cases, you just need to go through the program details to learn the credibility of its author or instructor.

Many reputable CPE providers clearly display the reviews from their past customers on their websites. By reading them, you’ll get a clear comprehension of the quality of their nonprofit CPE programs. Additionally, you should check your shortlisted sponsors’ reviews on external review websites.

When doing this, see the overall rating received by your chosen sponsors. Joining a CPE provider with a large number of positive reviews and a high overall rating ensures the quality of its programs. For instance, we at CPEThink.com have been successfully able to maintain an unparalleled rating of 4.9 out of 5.0. This serves as a testimony to the top quality of our nonprofit accounting CPE courses.

It’s a widely known fact that the costs of nonprofit CPE courses greatly vary from one sponsor to another. If you want to get a significant number of nonprofit CPE credits and join a sponsor that offers programs at steep price points, the overall cost of your CPE will naturally go up.

On the contrary, if you join a provider that offers high-quality courses at reasonable prices, you’ll be able to take CPE nonprofit programs within your budget. Therefore, do enough research to ensure that your chosen sponsor maintains a balance between quality and affordability.

If you want to pursue nonprofit CPE and meet your other CPE requirements in the most cost-efficient manner, purchasing a CPE subscription package is your ultimate option. Depending on the package you choose, you may be able to take nonprofit CPE courses at prices significantly lower than their actual ones.

Some premier sponsors, including CPEThink.com, have unlimited CPE subscription packages. Purchasing one of these may help you fulfill all your CPE requirements at a highly reasonable cost.

While different learning formats are available to pursue nonprofit CPE, self-study programs and webinars have emerged as the most popular options. Here’re the things you need to know about these to make an informed decision.

When your goal is to complete CPE nonprofit accounting programs at your own pace, there’s hardly any option better than self-study courses. You just need to buy the course, complete the study materials, and clear the final exam to get your nonprofit CPE credits.

If you want to get your credits by completing the study materials in a virtual classroom setting, you should attend live webinars. Just keep in mind that live webinars are generally held during business hours and hence, they may interfere with your professional responsibilities.

In addition to these, self-study nonprofit CPE courses usually come at price points lower than the costs of attending live webinars. So, remember this factor if you’re thinking about attending nonprofit CPE webinars.

We hope that now you’ve got a clear idea of nonprofit CPE and the essential aspects that encompass it. If you want to learn more about how the experts at CPEThink.com can help you pursue CPE in nonprofit efficiently and in a completely hassle-free manner, contact our team today!

Cpethink.com has the best online reputation and reviews of any online CPE provider. But don’t take our word for it, go to https://www.cpethink.com/cpe-reviews or see below for some of our recent customer reviews.

These are reviews some of our current and past customers have left.