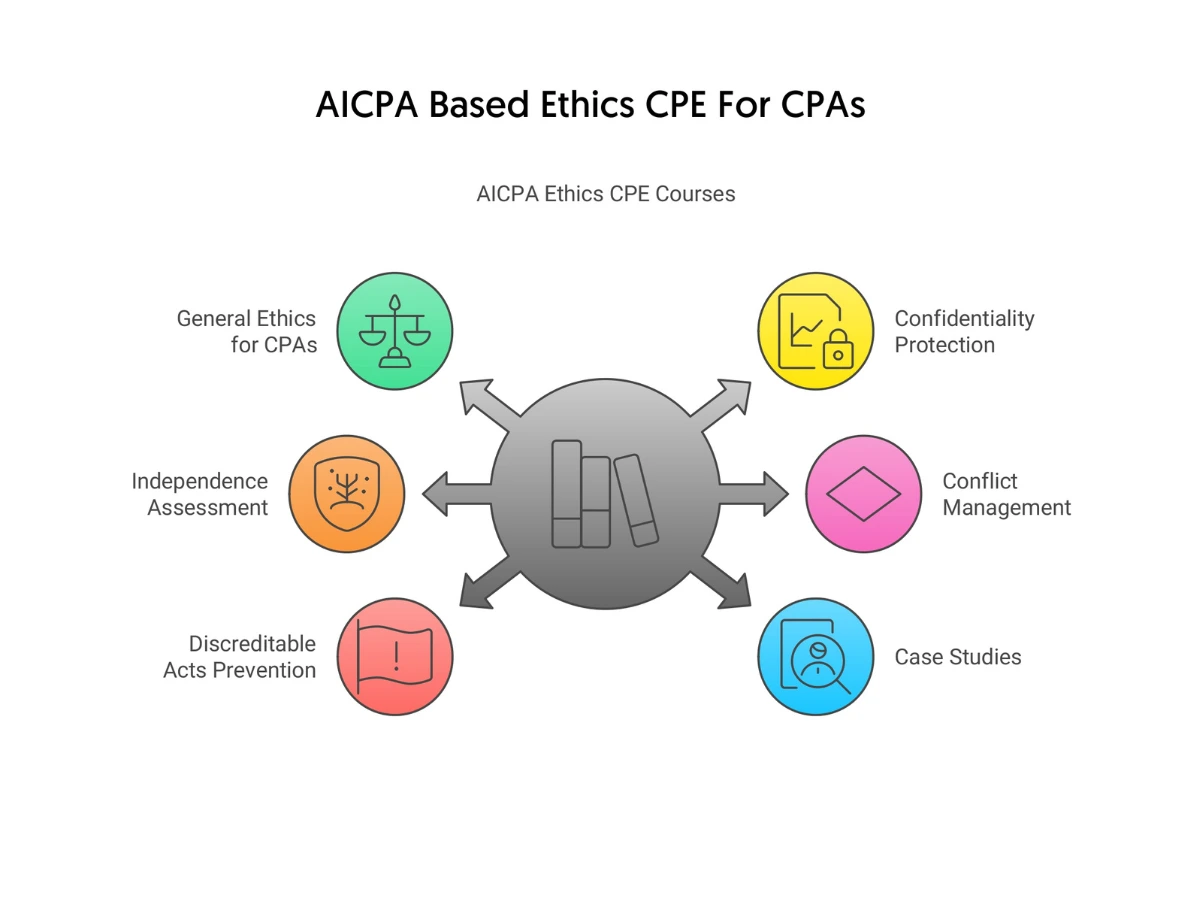

AICPA Based Ethics CPE For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

In today’s fast-paced and dynamic business landscape, CPAs frequently face several ethical challenges. To deal with those challenges efficiently, it’s a must to have a clear comprehension of ethical standards and principles. Irrespective of your exact professional role, pursuing AICPA based CPA ethics will help you achieve this goal efficiently.

This will help you develop a solid understanding of the AICPA code of professional ethics, which, in turn, will equip you to navigate the ethical challenges effectively while enhancing your overall professional competence.

On this page, we’ll discuss all the vital things related to the AICPA ethics code. From the fundamental principles of the AICPA code of ethics and the key benefits of taking AICPA ethics programs to a couple of effective tips to select the provider to pursue AICPA ethics CPE and more, you’ll have much better insights into AICPA based CPA ethics after reading this page.

The AICPA code of professional ethics contains the fundamental ethical standards for all CPAs. Additionally, many states require their CPAs to pursue AICPA ethics CPE as part of fulfilling their CPE requirements.

By pursuing AICPA based CPA ethics from a reputable sponsor instead of taking AICPA free ethics CPE courses from an inexperienced provider, you’ll be able to master AICPA ethical standards efficiently.

The AICPA Code of Ethics PDF file contains 227 pages. This means going through the whole document will essentially be a time-consuming activity. On the contrary, by completing courses on the AICPA ethics code from a trusted CPE sponsor, you’ll be able to learn the key principles quickly and effectively.

The AICPA code of ethics is divided into three parts. Let’s take a look.

All professional accountants are subject to this part. This outlines the basic principles of professional ethics. This also lets you understand a conceptual framework that you’ll need to use to detect, assess, and take measures to remove threats to adherence to the principles.

This part outlines additional material that’s applicable to professional accountants in business when they offer professional services. This also applies to professional accountants when they offer professional services in accordance with the firm, whether as an owner, employee, or contractor.

This part outlines additional material that’s applicable to professional accountants in public practice when they deliver professional services.

When pursuing AICPA based CPA ethics, you’ll get a detailed comprehension of these fundamental principles.

You need to maintain honesty and straightforwardness in each of your business and professional relationships. You shouldn’t have any association with any information that you think has a misleading or false statement. Additionally, you shouldn’t associate with any information that you think is deceptive by omission.

You shouldn’t share professional information with others without obtaining specific permission or having a professional or legal responsibility to do so.

You need to continuously try to enhance your professional knowledge and skills as per the latest advancements in techniques, rules, and practice. You also need to ensure that your subordinates get the right supervision and training.

You should always stay away from conflicts of interest and shouldn’t be influenced by other people when making professional decisions.

You must always adhere to the appropriate regulations and laws. You must also try to maintain the reputation of the accounting profession.

Here’re the key benefits of pursuing AICPA based CPA ethics.

As noted above, some states accept AICPA ethics courses to fulfill their ethics requirements. If your state board also does the same, you’ll be able to meet your AICPA ethics CPE requirements by taking courses on the AICPA code of professional ethics.

For any CPA, one of the primary responsibilities is to provide the stakeholders with appropriate financial information. By applying your knowledge of the AICPA ethics rules, you’ll be able to maintain public trust and help them make informed financial decisions. With the help of the AICPA ethics codification project, you’ll be able to spot, assess, and address threats to adherence to the principles. This will help eliminate the probabily of a loss of public trust in the profession.

By learning the AICPA ethics code, you’ll be able to develop and maintain trust in the relationships with your clients while demonstrating a high degree of professionalism. When you actually follow the principles outlined in the AICPA ethics PDF when offering professional services, it’ll exhibit your commitment to maintaining the reputation of the profession and your willingness to serve your clients in the best possible manner.

Every CPA needs to adhere to regulatory and legal requirements when they prepare financial statements. By applying your knowledge of AICPA professional ethics, you’ll be able to ensure that the financial statements you prepare are correct. This will help both you and your firm avoid legal actions that may arise from non-compliance with the requirements.

Not only can non-compliance with the requirements lead to legal actions but it may also cause irreversible damage to your reputation and financial loss for the stakeholders. Compliance with the AICPA ethical principles will help mitigate these risks and safeguard your stakeholders.

There’s no shortage of CPE providers that offer AICPA based CPA ethics programs. However, as these programs will need you to invest effort, time, and money and contribute to your professional competence, you should try your best to select the right CPE provider.

If you’re wondering how to do that, here’re two tips that should be of good help.

When you join a provider that has been in the industry for many years, you can stay assured that you’ll receive quality content from it. In the competitive landscape of CPE providers, it isn’t an easy thing to maintain a good reputation for years. Therefore, this will help you get an assurance that you’ll be able to take high-quality courses on the AICPA Code of Professional Ethics.

The quality of your sponsor’s customer support becomes extremely important when you decide to pursue AICPA ethics CPE online. Even though reputable sponsors try their best to ensure that their platforms function smoothly at all times and that their students don’t face any issues when using them, you cannot be fully sure. In those situations, the presence of a top-tier, knowledgeable customer support team will be of paramount importance.

With the help of such a team, you’ll be able to deal with the issues efficiently without damaging your study. It’ll also be of great help if you can reach the team using multiple modes of communication.

These days, many U.S. accounting firms carry out multinational audits. These audits need to be done using the IESBA Code. The IFAC issued the IESBA Code that outlines ethical principles for IFAC members. While the AICPA Code of Professional Ethics and the IESBA Code share many similarities, they also have some major differences between them. Let’s take a look.

The IESBA Code offers a framework that’s mainly reliant on principles that can be applied to many different situations. On the contrary, the AICPA ethics code offers a framework that’s primarily dependent on specific guidelines and rules.

The IESBA Code is designed to be applied globally and it considers different standards, practices, regulatory, and legal requirements for different countries. On the other hand, the AICPA code of ethics only applies to the standards and principles in the U.S. and AICPA members.

The IESBA Code has more specific guidelines on handling non-compliance with the rules and regulations than the AICPA Code of Professional Ethics. The guidelines outlined in the AICPA ethics code are more applicable to AICPA members in the U.S.

You’re likely aware of the fact that there are several methods to pursue AICPA based CPA ethics. In this section, we’ll discuss four popular learning methods in detail to help you make an informed decision.

Numerous CPAs choose self-study courses to learn the AICPA code of professional ethics because of the unequaled flexibility they offer. You only need to select the right provider, buy the course you want to take, finish it on time, and obtain your credits. In most cases, these courses will be cheaper than attending in-person programs, webinars, and seminars/conferences.

Despite the benefits offered by self-study programs, you may find it difficult to complete them if you lack self-diligence. The absence of regular classes may trigger procrastination which can make it difficult for you to fulfill AICPA ethics CPE requirements on time.

If you prefer to pursue AICPA ethics CPE in an actual classroom setting, you may want to join in-person programs. Attending these programs will also help you complete the courses on time and expand your professional network.

Just remember that in case you need to travel to and from another location to attend these programs, it may quickly increase your overall cost of pursuing CPE.

Many CPAs choose webinars to learn the AICPA code of professional ethics because they can attend the events at their convenience and get the credits by completing some formalities. The presence of a live instructor also makes it easy for them to have their queries clarified immediately.

One problem with webinars is that if you cannot attend them properly, neither will you learn the AICPA ethical standards properly nor will you receive your credits. However, if you join a reputable provider and have a stable Internet connection on your end, this shouldn’t be a problem.

If you want to learn the intricacies of AICPA based CPA ethics from industry leaders and obtain a significant number of credits in one go, attending seminars/conferences may be the right option for you. Since these events are attended by CPAs working in different industries, you’ll also be able to grow your professional network.

Just remember that the participation fees for seminars/conferences tend to be quite high. This means that if you’re a cost-conscious CPA and the participation fees won’t be paid by your firm, attending them may not be a feasible option for you.

Irrespective of the learning method you choose to pursue AICPA ethics CPE, it may become difficult for you to complete the courses on time. Here’re two tips that’ll help you learn the AICPA ethics code efficiently.

Since you’re required to complete the programs within a specific time frame, having a realistic timeline will help you avoid procrastination. When setting the timeline, remember to consider your other obligations such as work, family, etc., and unforeseen circumstances.

Whether you prefer to study in the morning or late at night, having a practical study schedule is an effective method to pursue AICPA ethics CPE efficiently. It’s important to mention here that studying for CPE courses isn’t the time to test new patterns. Instead, it’s advisable to stick to a schedule that has worked for you in the past.

AICPA based CPA ethics is one of the most vital elements of the accounting profession. Maintaining compliance with the AICPA code of professional ethics not only will help expedite your professional growth but will also help stand out from your peers.

At CPEThink.com, we offer several high-quality courses on the AICPA ethics code. If you want to start your journey right away, browse them and take the ones you want. If you need more information about them, contact us today!

Cpethink.com has the finest online credibility and reputation and reviews of any on-line CPE provider. However, do not believe our word for this, go to https://www.cpethink.com/cpe-reviews or see below for some of our current client testimonials.

These are reviews some of our present and previous buyers have left.