Fraud CPE Courses For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

Please Note: These Fraud CPE credits satisfy the California Board of Accountancy (CBA) fraud requirement.

For any business or organization, fraudulent financial activities trigger several threats, from financial losses to damage to reputation and loss of trust. To detect and prevent fraud, companies typically turn to accountants who are experts in fraud detection and prevention.

If you’re a CPA and thinking about enhancing your knowledge and skills in detecting and preventing fraud, pursuing fraud CPE is your ultimate option. Whether you take fraud CPE free or paid programs, you’ll learn the methods and procedures to shield your organization from the threat of fraud.

It’s also important to mention that in some states, pursuing fraud CPE is mandatory for CPAs who carry out certain responsibilities. For instance, if you’re licensed in California and subject to A&A (accounting and auditing) or government CPE requirements, you must complete four hours of fraud CPE for California CPA every two years. These fraud CPE courses must equip you to prevent, detect, and/or report fraudulent activities in financial statements.

As one of the top CPE providers, we regularly receive lots of queries from CPAs related to fraud CPE. Rather than answering each of them individually, we decided to create this page where you’ll get answers to all your vital questions.

Once you complete reading this page, you’ll also be in a far better position to select the right method to pursue fraud CPE. In a later section, we’ll discuss different methods, from fraud CPE free self-study courses and free fraud CPE webinars to online Fraud Magazine CPE quizzes and fraud-related CPE seminars.

Let’s get started.

Since accounting fraud costs businesses a huge amount of money along with causing irreversible damage to them, it becomes extremely important for them to enlist the expertise of competent CPAs. With the help of your knowledge and skills gained from paid or free fraud CPE programs, you’ll be able to help these businesses navigate complex financial landscapes and ensure their economic health.

Even if you aren’t required to take fraud courses to fulfill your CPE requirements, such as pursuing fraud CPE for California CPA, it’ll still be prudent to complete CPA fraud CPE programs. This is because possessing the knowledge and skills to safeguard companies against financial discrepancies and mismanagement can increase your employability to a great extent. We’ll thoroughly discuss the real-life benefits of taking the right fraud course CPA later.

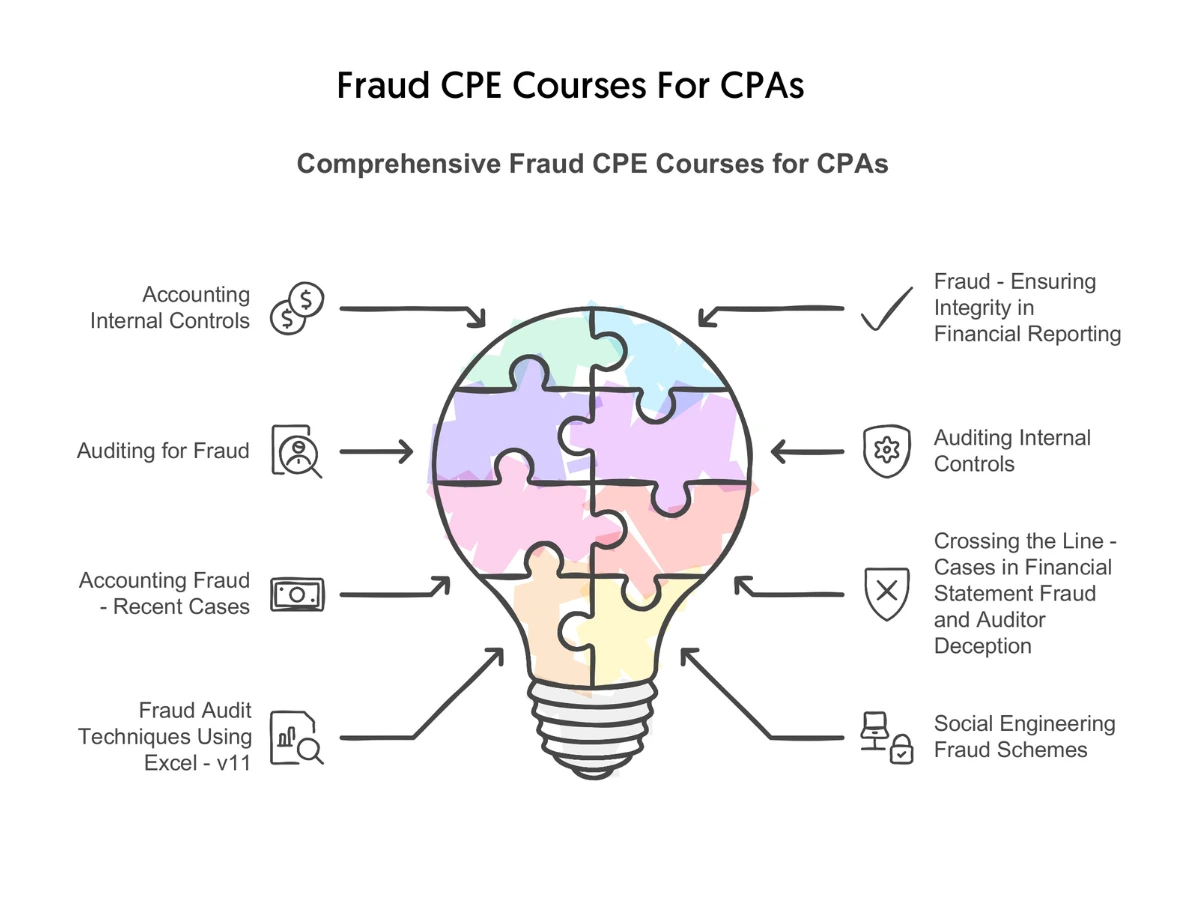

In general, fraud CPE courses cover these topics:

We’ve already discussed that if you’re a California CPA and subject to fulfill A&A or government CPE requirements, it becomes mandatory for you to obtain four credits in fraud CPE every two-year license renewal period.

Here’re some other important things you need to remember when pursuing fraud CPE for California CPA.

According to corporate fraud statistics, businesses lose millions of dollars every year because of fraud. This makes it evident why organizations of all sizes try to employ CPAs who have expertise in preventing and detecting fraud.

In this section, we’ve jotted down two key reasons why you should prioritize taking fraud CPE free or paid programs.

Since CPAs with expertise in fraud prevention and detection are in high demand, completing quality fraud courses will help increase your earning potential significantly. You may also want to join the domain of forensic accounting, which will enable you to carry out high-level auditing. Overall, pursuing fraud CPE has the potential to help expedite your professional growth.

When you complete fraud CPE free or paid courses, it helps your clients understand that you’re committed to enhancing your knowledge and skills in the field. They’ll also understand that you’re well-equipped to handle your responsibilities with higher levels of competence and confidence than other accountants who don’t take the importance of fraud CPE courses seriously. This will help you gain more credibility and professional visibility.

Due to the high demand for fraud CPE, CPE providers and many accounting organizations offer different methods to pursue it. Here, we’ll take a closer look at the methods mentioned in the title of this section to help you make an informed decision.

Free fraud CPE webinars come with a couple of notable benefits. Needless to say, the first one is that you get to obtain some CPA fraud CPE credits absolutely for free. The second one is that you don’t need to pass any final exam to get those credits. You only need to prove your active participation in them to obtain them.

On the downside, free webinars are often conducted during business hours. Therefore, if you’re working full-time, attending them may not be feasible for you always. Additionally, if you cannot actively participate in the webinars for whatever reason, you won’t receive your credits.

Offered by the ACFE (Association of Certified Fraud Examiners), online Fraud Magazine CPE quizzes give you excellent opportunities to get 10 fraud CPE credits. You need to select a quiz set from the available ones, purchase it, read featured articles in the magazine that relate to the year of your quiz set, and complete five quizzes with a minimum score of 70% to receive your credits.

If you’re thinking about choosing this method, you need to keep a few things in mind before making the final decision. First, you must complete all your quizzes within the online quiz set of a single year. Second, you won’t receive any partial credit for passing individual quizzes. This means that you’ll have to pass all five quizzes to obtain your credits. Third, Fraud Magazine CPE isn’t registered with the NASBA. Therefore, if your state board requires you to pursue fraud-related CPE from a NASBA approved provider, this method may not be the best option for you.

If you want to enjoy unequaled flexibility when pursuing fraud CPE, there’s hardly any option better than free self-study fraud courses. You just need to opt for the courses, go through the study materials at your own pace, clear the final exams, and you’re done. You’ll get your certificates of completion almost instantly.

Another notable benefit of taking a self-study fraud CPE free course is that you’ll be able to evaluate the quality of the content of your chosen sponsor. This will be of great help if you want to purchase other courses from the same provider down the road.

Just keep in mind that you won’t get much room for procrastination with self-study courses. These courses come with a validity period of one year and you’ll have to pass the final exams within that. Or else, you may not be able to stay compliant with your requirements.

If your objective is to fraud CPE credits and expand your professional network simultaneously, you may want to attend fraud-related CPE seminars. Since these seminars are often attended by CPAs working in different industries, you may also be able to explore new career opportunities.

Here, it’s important to mention that the participation fees for these seminars tend to be quite high. Therefore, if your organization doesn’t bear the cost, it may not be a cost-effective option for you.

Now that you know different methods to pursue fraud-related CPE, let’s take a look at what you should be able to do after completing the programs.

When it comes to fraud prevention, the presence of robust internal controls is of paramount importance. Not only do these controls strengthen the financial structure of an organization but they also minimize the probabilities of fraudulent activities. You’ll be able to develop a culture of financial accountability within your organization by implementing these controls.

Fraud CPE free or paid programs will enable you to implement strategic risk assessment strategies to identify vulnerabilities in your organization’s financial processes. You’ll be able to assess potential risks and take preventive measures to mitigate them, safeguarding the company from the negative consequences of fraud.

With the help of different advanced techniques, you’ll be able to thwart fraudulent activities. Two of these techniques generally include data analytics and thorough auditing procedures. By leveraging the power of data analytics tools, you’ll be able to spot irregularities that may be an indication of potential fraud. On the other hand, detailed auditing procedures will help you spot and mitigate the risks triggered by fraudulent activities.

When it comes to pursuing fraud CPE, you’ll find a large number of providers offering fraud CPE free and paid courses. Now the question is how you can select the right provider for your courses. Even if it’s a free fraud course CPA, you’ll still need to invest time and effort to complete it. Therefore, it’s best to consider some important things before making a final decision.

The size of a provider’s content library is one of the most vital things you need to consider before joining it. This is because you’re required to complete many other CPE programs in addition to fraud CPE courses. Therefore, it’s best to join a sponsor that already has many different CPE courses in its content library. This will essentially save you from the hassle of joining multiple CPE sponsors.

You should also verify whether or not the sponsor regularly updates its existing courses. The accounting field is ever-evolving and hence, taking up-to-date courses is a must as long as you want to keep abreast of the changes in the industry.

Different authors and instructors create and deliver content in different ways. When a sponsor has a significant number of authors and instructors on its team, the learners get to absorb the content in different ways. So, the more authors and instructors your provider has, the better.

If your chosen provider doesn’t have proper accreditations from appropriate governing bodies, it’ll be a complete waste of time, money, and effort, no matter how many fraud CPE courses you take from it. Therefore, double-check that the sponsor is accredited by regulatory bodies such as NASBA, IRS, etc.

If you’re thinking about pursuing fraud CPE online, it’s a must to ensure that the platform has a simple user interface. Even if the sponsor offers a large number of courses, you should be able to find the right fraud course CPA quickly. It’ll also be better if you can see an overview of the course mentioning the topics it covers.

Some states require their CPAs to complete state-specific courses to meet their requirements. Apart from the example of fraud CPE for California CPA, many state boards have made it mandatory for their CPAs to complete state-specific ethics courses. If your state board has any such requirements, it’s advisable to join a provider that offers state-specific courses.

If you want to pursue fraud CPE in an efficient yet cost-effective manner, CPEThink.com is here to help. We offer high-quality fraud CPE courses at affordable price points so that you can meet your requirements and enhance your professional competence conveniently and within your budget.

If you want to get more information about our courses, feel free to contact us.

Check out what other customers are saying.