Missouri Ethics CPE for CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

This page gives Missouri CPAs a clear, state-specific option for meeting their required two hours of ethics CPE. It explains the state’s reporting rules, highlights the available course, and helps CPAs decide whether this offering matches what they need for license renewal and audit readiness.

1. Who is this list of CPE courses for?It is for Missouri-licensed CPAs who must complete state-specific ethics education to maintain an active license.

2. What is this list of CPE courses about or what problem does this course solve?It provides a Missouri-focused ethics course that helps CPAs meet the exact two-hour ethics requirement within the state’s overall CPE rules.

|

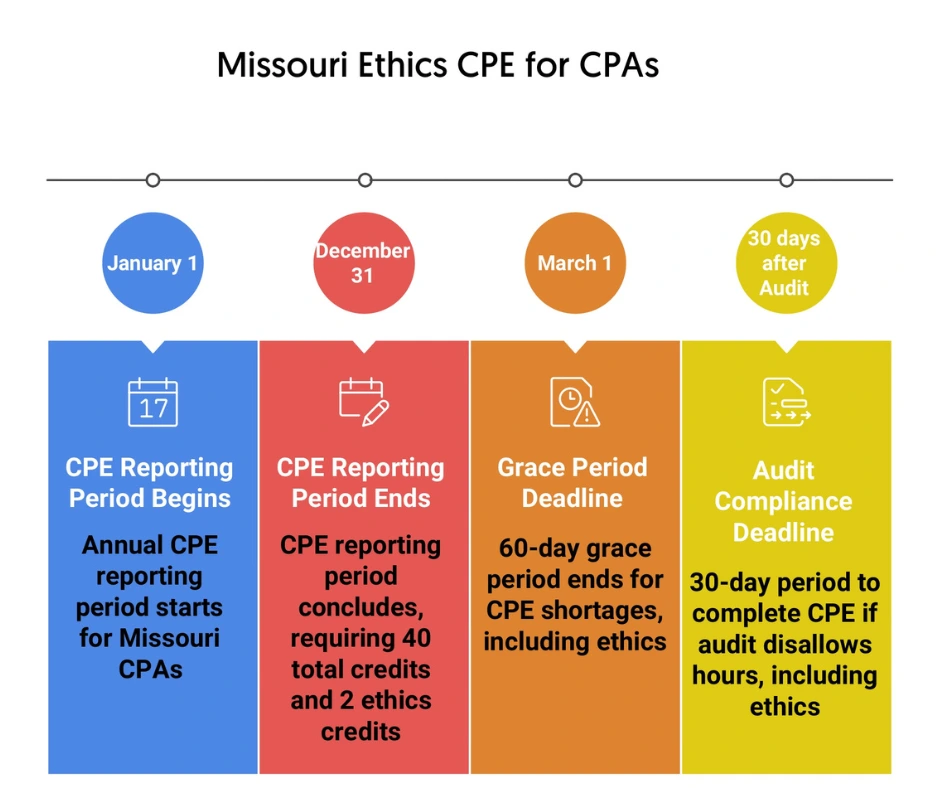

3. Why is this list important to a CPA, Accountant, or IRS Enrolled Agent?It offers the specific training Missouri CPAs need to stay compliant during annual reporting, including situations involving audits or grace period shortages.

4. When is this list relevant or timely?It applies during Missouri’s annual CPE reporting cycle of January 1 to December 31 and during biennial license renewal.

|

5. Where can this list be found and accessed?It is available directly on the Cpethink.com Missouri ethics page.

6. How is a list like this consumed or used?CPAs select the listed course, complete it through self-paced study, and apply the earned ethics credits toward Missouri’s required totals.

|

All Missouri CPAs need to pursue to maintain the active status of their licenses. Completing Missouri ethics CPE courses for CPAs is mandatory for staying compliant with Missouri CPA ethics CPA requirements.

However, Missouri CPE ethics requirements are slightly different from many other jurisdictions, which makes it extremely important to have a clear comprehension of them. If you want to enhance your understanding of ethical compliance in Missouri and meet your Missouri CPA ethics CPE requirement easily, read this page carefully.

On this page, we’ll discuss all the vital details related to ethics CPE for Missouri Certified Public Accountants. We’ll start with CPE ethics Missouri requirements.

When it comes to fulfilling Missouri CPA ethics CPE requirements, you must adhere to the following guidelines.

If you want to know how to fulfill Missouri’s ethics CPE rules for CPAs or what is required for Missouri ethics CPE, hope this section has answered all your questions.

If you want to advance your CPA career with trusted Missouri ethics CPE and gain expertise in professional ethics for Missouri CPAs efficiently, it’s a must to join a sponsor that’s known for offering the best ethics CPE for Missouri-licensed CPAs.

Here, we’ve jotted down some practical benefits that you can gain by joining such a provider.

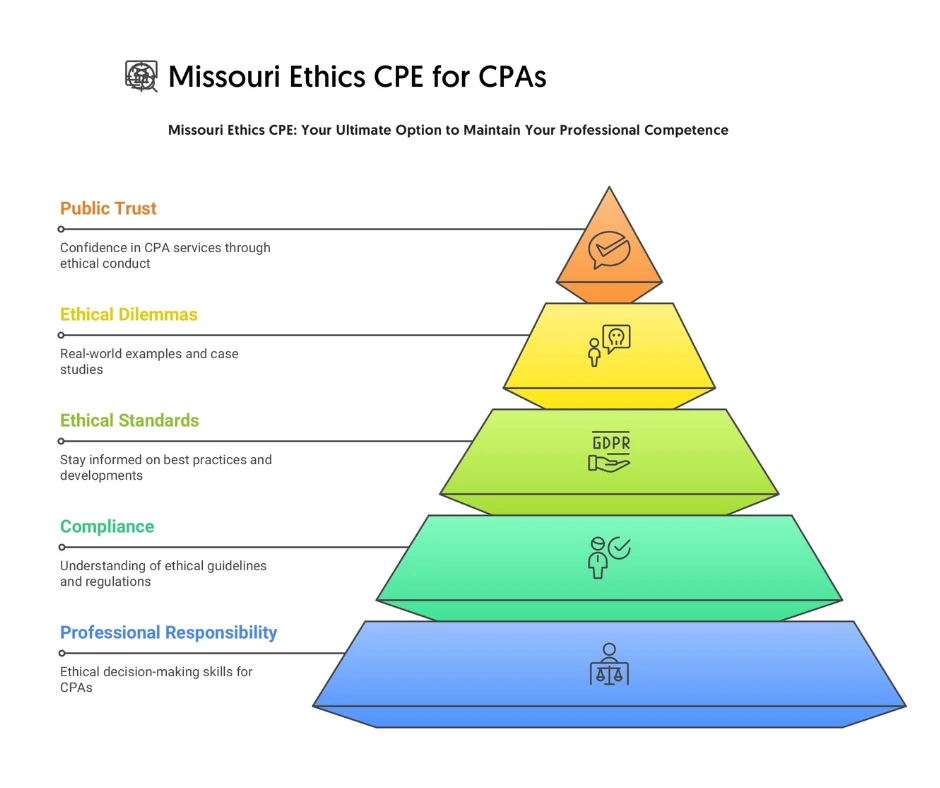

Every CPA has a professional responsibility to act responsibly and ethically. By pursuing state-specific ethics CPE for Missouri license renewal from a top-rated sponsor, you’ll be able to fulfill Missouri ethics CPE requirements with approved courses. Furthermore, the Missouri CPA ethics course for CPE credit will provide you with the skills and knowledge to make ethical decisions in difficult situations.

When you pursue Missouri CPA ethics CPE designed for license renewal compliance from a trusted CPE provider, you get access to high-quality courses. Courses covering Missouri CPA CPE on ethics and integrity will help you develop a robust understanding of the latest ethical guidelines and regulations. Such a comprehension will help you maintain your CPE license while avoiding any disciplinary actions.

Pursuing Missouri Board-approved ethics CPE for license renewal isn’t just about getting CPE credit hours in ethics for Missouri CPAs. Instead, it’s also about staying informed about the best practices and latest developments in Missouri ethics CPE. Equipped with these key factors, you’ll be able to provide your clients with top-notch services.

It isn’t uncommon for CPAs to face ethical dilemmas when in challenging situations. However, courses on CPE ethics Missouri offered by a leading CPE sponsor will have real-world examples and case studies. These will help you learn the ways to use ethical principles in real-life situations and make ethical judgments.

In the accounting profession, ethical conduct is extremely important for maintaining public trust. By pursuing ethics CPE Missouri CPAs need for license renewal and taking professional responsibility courses for Missouri CPAs, you’ll become well-versed in ethics. As a result, the public will have more confidence in your services.

Are you struggling to find high-quality Missouri ethics CPE? Are you looking for affordable ethics CPE for Missouri license renewal? Are the limited options for ethics CPE in Missouri making it challenging for you to complete your Missouri ethics training with CPE-approved content? If you say “yes” to any of these, pursuing online Missouri CPE ethics is your ultimate option.

However, not all Missouri CPE ethics online providers offer high-quality programs. If you want to take online Missouri ethics CPE classes from a leading sponsor, these couple of tips will help you out.

Once you’ve shortlisted some providers that offer Missouri CPA ethics CPE, you need to see which one of them offers flexible online Missouri ethics CPE courses for busy professionals. Perhaps the best way to do this is to read what their past customers have written about their programs.

If you’re wondering why is Missouri ethics CPE so expensive, you should focus on joining a provider that offers affordable Missouri ethics CPE that fits your schedule. This will help boost your ethical knowledge with self-paced Missouri CPA CPE.

If you need fast and reliable ethics CPE for Missouri CPAs, it’s best to join a provider with many years of experience in this industry. With such a sponsor, it’ll be easy for you to pursue affordable and quick CPE that meets Missouri Board of Accountancy rules.

Hopefully, this page has equipped you with all the essential information related to Missouri ethics CPE. Use this knowledge to find approved ethics CPE for Missouri CPAs and master ethical standards with Missouri-specific CPE for CPAs. If you need any further information regarding how to meet Missouri CPE requirements for CPA ethics or need to find top-quality Missouri CPA ethics requirement CPE solutions, feel free to contact us.

Check out what other customers are saying.