Georgia Ethics CPE for CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

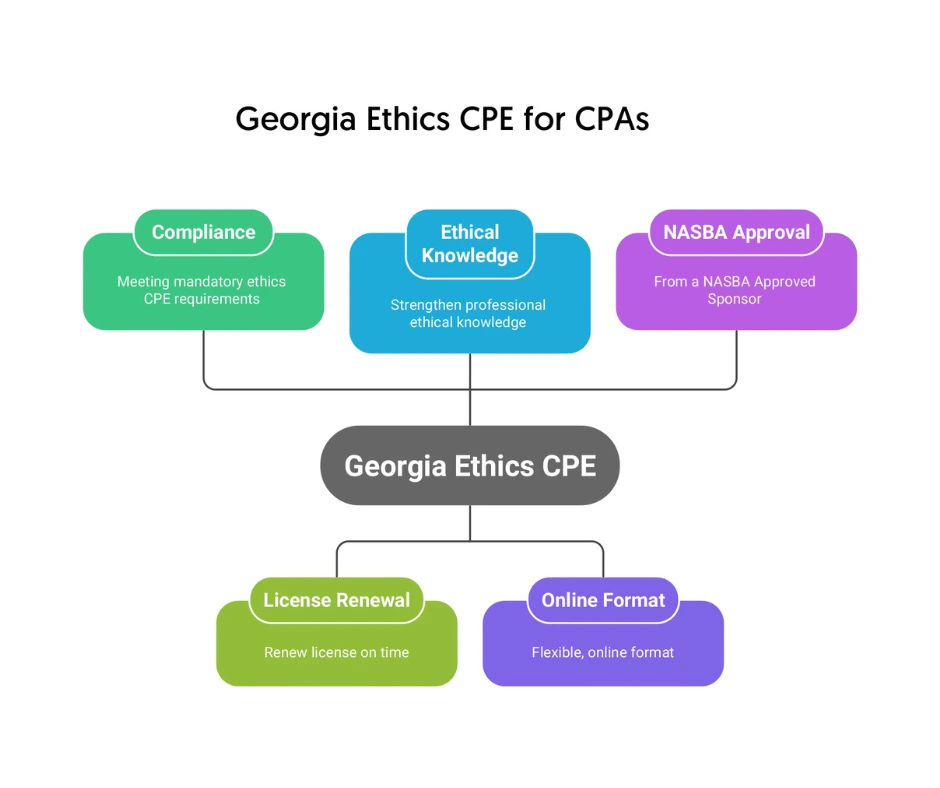

This page offers Georgia CPAs a focused solution for meeting their mandatory ethics CPE requirements. With a self-study ethics course tailored to Georgia’s rules, CPAs can stay compliant, renew their license on time, and strengthen their professional ethical knowledge—all in a flexible, online format and from a NASBA Approved Sponsor.

1. Who is this list of CPE courses for?This list of courses is designed for Georgia-licensed CPAs who must meet the Georgia State Board of Accountancy’s ethics CPE requirements.

2. What is this list of CPE courses about or what problem does this course solve?It provides Georgia-specific professional ethics CPE courses that satisfy the mandatory 4-credit ethics requirement, helping CPAs avoid non-compliance and license issues.

|

3. Why is this list of CPE courses important to a CPA, Accountant, or IRS Enrolled Agent?It is important because completing a Georgia-focused ethics CPE course is required for license renewal, and failure to do so can lead to loss of licensure.

4. When is this list of CPE courses relevant or timely?These courses are most relevant during Georgia’s biennial CPE reporting cycles, which end on December 31 of odd years, and when renewing a CPA license.

|

5. Where can this list of CPE courses be found and accessed?They are available online at CPEThink.com as NASBA approved sponsor, self-paced programs tailored to Georgia CPAs.

6. How is a list of CPE courses like this consumed or used?CPAs select and complete self-study ethics courses online, pass the final exam, and earn downloadable certificates to meet Georgia’s ethics CPE requirements.

|

Once you’ve obtained your Georgia CPA license, you must start earning CPE credits to fulfill the CPE requirements of the Georgia State Board of Accountancy. Completing Georgia CPE ethics is a mandatory part of these requirements.

As Georgia CPE ethics requirements are somewhat different than those in many other states, you need to have a clear understanding of them to advance your CPA career with trusted Georgia ethics CPE.

To help you out, this page will discuss every important thing associated with Georgia CPA ethics CPE. However, before delving deep into ethics CPE for Georgia Certified Public Accountants, some important things should be noted.

Here’s an in-depth look at the CPE ethics Georgia.

Georgia CPA ethics is designed for:

By utilizing the knowledge of Georgia CPA CPE on ethics and integrity acquired from this page, you can efficiently steer clear of the challenges of:

The information on this page becomes relevant:

You can apply the information on this page regarding CPE ethics Georgia in:

The importance of Georgia CPE ethics cannot be emphasized enough. Because:

To solve the aforementioned problems efficiently, you should follow these steps.

When it comes to completing your Georgia ethics training with approved content, you must take Georgia ethics CPE courses. This is because the Georgia State Board of Accountancy doesn’t pre-approve any sponsors or courses for CPE. Therefore, you and your Georgia ethics CPE sponsor are solely responsible for ensuring the courses meet Georgia CPE ethics requirements.

Acquiring the CPE credits for ethics required by the Georgia Board of Accountancy from a provider listed on the NASBA Registry helps ensure that they’ll be counted toward fulfilling your Georgia CPE ethics requirements.

If you want to improve your ethical knowledge efficiently, you must join a trusted Georgia ethics CPE provider for accounting professionals. A provider, equipped with a robust team of expert authors and instructors, typically offers high-quality Georgia CPA ethics CPE programs designed for license renewal compliance.

Not only do such programs help you complete CPE credit hours in ethics for Georgia CPAs efficiently, but they also help elevate your professional competence easily.

Are you looking for affordable ethics CPE for Georgia license renewal? Or, do you need fast and reliable ethics CPE for Georgia CPAs? Or, want to know how to fulfill Georgia’s ethics CPE rules for CPAs most conveniently? Online Georgia CPE ethics is the answer to all these questions.

With Georgia CPE ethics online programs, it becomes easier than ever to fulfill Georgia ethics CPE requirements with approved courses. By completing courses on ethics CPE for Georgia CPAs with downloadable certificates and clearing the final exams, you quickly get the credits to meet your requirements.

Another notable benefit of choosing self-paced Georgia ethics CPE training is the ability to improve your knowledge and skills as per your requirements and preferences. Apart from helping you pursue affordable ethics CPE in Georgia, self-paced online Georgia ethics CPE classes let you master the ethical components at your own convenience.

So, if you want to pursue the best ethics CPE for Georgia-licensed CPAs, go with online ethics CPE approved by the Georgia Board of Accountancy.

At CPEThink.com, we’re dedicated to providing you with high-quality Georgia CPE ethics. With us, you can efficiently boost your ethical knowledge with self-paced Georgia CPA CPE.

If you want more information on Georgia CPA ethics CPE, feel free to contact us.

Check out what other customers are saying.