Yellow Book Auditing CPE For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

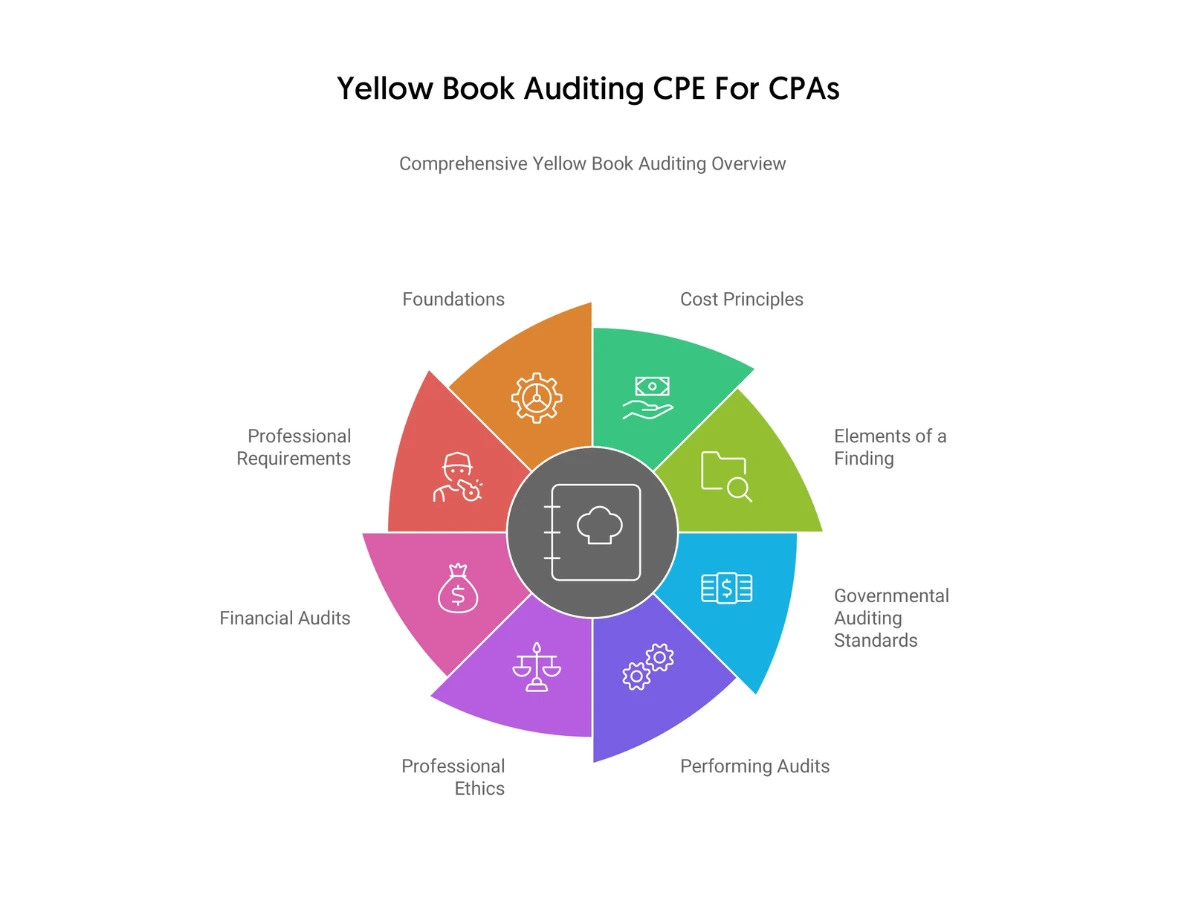

The U.S. GAO (Government Accountability Office) issues the GAGAS (Generally Accepted Government Auditing Standards). The book containing these standards is commonly known as the “Yellow Book.” As one of the premier CPE sponsors, we frequently receive many queries from CPAs and government auditors about Yellow Book auditing.

Instead of answering each of them individually, we decided to create this page where you can find all the important aspects of auditing Yellow Book. From the requirements of Yellow Book audits to the various aspects of Government Auditing Standards Yellow Book and more, you’ll have all the crucial information at your fingertips after reading this page.

Let’s start with the basics.

If you’re a CPA or auditor who conducts audits of government organizations, activities, programs, etc., and non-government organizations and nonprofit organizations that receive government assistance, you must follow the Government Auditing Standards the Yellow Book mentions when delivering professional services. In simple words, this activity is called Yellow Book auditing.

By enhancing your knowledge and skills in auditing Yellow Book, you can master the framework for conducting error-free government audits. The Government Auditing Standards in Yellow Book are designed to help auditors deliver professional services in a high-quality manner. This essentially helps improve the effectiveness and accountability of operations carried out by government entities.

Now that you know what is a Yellow Book audit, it’s time to understand the real-life benefits of conducting Yellow Book audits.

When an auditor conducts Yellow Book auditing, it’s understood that the audit is being carried out in accordance with the strict government-approved standards. This helps improve the reliability of the audit engagement and makes it more acceptable to the public.

In the above section, where we discussed what is Yellow Book audit, we mentioned that Yellow Book audits are required for both government organizations and non-government organizations that receive financial assistance from the government.

When audit engagements are performed with adherence to the Government Auditing Standards Yellow Book, it provides taxpayers and other people with an assurance that they’re following a set of standards that promote public accountability.

Sometimes, private and public entities take part in government programs jointly. There are also some activities that are jointly carried out by multiple jurisdictions. In these instances, conducting Yellow Book auditing helps maintain uniformity. Since the Government Auditing Standards the Yellow Book mentions are uniform, they help eliminate any scope for variation.

In some instances, government and nonprofit organizations are required to have Yellow Book audits. For organizations that receive grants, auditing Yellow Book may be a requirement mentioned in the grant agreement. Sometimes, debt agreements may also need organizations to comply with the Government Auditing Standards in Yellow Book.

In the U.S., most audits are performed according to the Generally Accepted Auditing Standards (also known as the AICPA audit standards). In addition to this, many government organizations and nonprofits sometimes become subject to Yellow Book audits.

This section explains the instances where your organization may need to have audits that are conducted in accordance with the Yellow Book auditing guidelines.

Once you know when is a Yellow Book audit required, it’s time to learn about the rules and standards associated with auditing Yellow Book. Here’re the main standards that Yellow Book auditing revolves around.

Typically, financial audits, performance audits, and attestation examinations become subject to Yellow Book audit requirements. Here’re brief overviews of these types of audits.

The key objective of conducting financial audits is to ensure that the financial statements of an entity are prepared in accordance with the GAAP. This category also includes auditing compliance with regulations.

When it comes to performance audits, Yellow Book Government Auditing Standards help auditors systematically examine the relevant pieces of evidence that help conduct an independent evaluation of the performance of a government entity, activity, function, or program.

Attestation examinations may encircle a diverse range of both financial and nonfinancial subjects. These examinations can be part of performance audits or financial audits.

In addition to these, some engagements may be a combination of the aforementioned types. For instance, an external auditor may perform audits of government grants and contracts with private entities when the Yellow Book audit threshold is reached or exceeded. In these instances, the auditor may examine financial, performance, and attestation aspects.

So far, we’ve been discussing different aspects of auditing Yellow Book. Now, let’s delve deeper into the Yellow Book audit CPE requirements. If you’re an auditor who delivers professional services according to the GAGAS, you’ve to get a certain number of CPE credits in Yellow Book auditing.

Let’s take a look.

We’ve just discussed that pursuing CPE in subjects related to Yellow Book audits is a mandatory requirement for auditors who follow the GAGAs. However, besides meeting CPE requirements, there are several other advantages of mastering the Government Auditing Standards in Yellow Book.

Yellow Book auditing is one of the most complex aspects of the accounting and finance world. Therefore, whether you only conduct audits or do it along with other professional activities, you’ve to keep abreast of the Government Auditing Standards the Yellow Book defines. And this can only be attained through prioritizing Yellow Book CPE.

Remaining compliant with ethical guidelines is simply a must for auditors. The Yellow Book helps you deal with ethical dilemmas efficiently. The primary five principles it covers include integrity, public interest, proper use of government resources, information, etc., and professional behavior. By demonstrating your commitment to maintaining ethical conduct, you can uphold the trust of your clients and other stakeholders.

Every CPA is aware of the rules and guidelines that govern government audits. However, when you pursue Yellow Book auditing CPE, you get a complete understanding of these rules and guidelines, which enable you to manage public sector audits more efficiently.

As mentioned above, Yellow Book audits are required in several different instances. Therefore, if your goal is to advance your career as an auditor, mastering the subjects related to Government Auditing Standards in Yellow Book can bring better professional opportunities your way.

Trust and confidence are two key pillars of auditing. When you remain compliant with your Yellow Book CPE requirements, it helps your clients understand that you’re committed to delivering the highest level of professional services. This essentially helps foster long-term professional relationships with clients while making you a trustworthy resource for them.

In the ever-evolving auditing field, it’s essential to stay up-to-date with the latest trends and industry best practices. When you pursue Yellow Book auditing CPE from a leading sponsor such as CPEThink.com, you can rest assured that you’ll get to learn all the latest happenings in the industry.

Once you complete a few Yellow Book auditing CPE programs, the next big thing you need to focus on is managing the credits efficiently. While the GAO doesn’t require auditors to report their CPE to it, the leaders at your audit firm may want to review it to ensure that you’re adhering to the Government Auditing Standards in Yellow Book. Additionally, you may need to submit your CPE-related documents to your state board if you become subject to a CPE audit.

In this section, our experts have jotted down a couple of strategies that you can try to manage your credits in an error-free manner.

If you don’t want to utilize a CPE tracker, simply create a folder dedicated to the CPE information related to auditing Yellow Book. Whenever you complete a Yellow Book auditing CPE program and get the credits, store all the relevant information in this folder. If some of the documents come in the form of hard copies, remember to store their scanned copies in it.

You can also store the folder in the cloud. This will help you access it anytime and from anywhere.

Perhaps the easiest way to track your Yellow Book credits is to utilize a good CPE tracker. These tools are designed to track all your credits. Since they store information about all the CPE requirements of every state board, you’ll be able to track your CPE compliance efficiently.

Whether you take the digital or manual route to maintain the information about your Yellow Book CPE, be sure to keep these documents.

We hope that we’ve covered all the essential aspects of Yellow Book auditing on this page. If you feel confident enough and want to start pursuing auditing Yellow Book CPE right away, start browsing our collection of high-quality courses.

In case you need more information about Yellow Book audits, feel free to reach us anytime.

Cpethink.com provides the best online reputation and customer reviews of any online CPE sponsor. However don't believe our word for this, go to https://www.cpethink.com/cpe-reviews or see below for some of our current customer reviews.

These are reviews some of our current and previous buyers have made about our online courses.