IFRS CPE Courses For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

Do you aspire to become a valuable asset to companies that have a presence in multiple countries? Are you interested in mastering the global accounting framework that has been adopted by over 144 countries and jurisdictions worldwide?

If your answer is a “Yes” to any of these, you certainly need to focus on pursuing International Financial Reporting Standards or IFRS CPE. By taking IFRS Online Courses, you can position yourself as a trusted CPA to multinational organizations while outperforming your competitors easily.

As one of the top IFRS CPE sponsors, we frequently receive different types of queries from CPAs regarding IFRS accounting. Rather than replying to them individually, we decided to come up with this post that’ll help you learn every vital aspect of IFRS CPE.

Let’s get started.

To understand IFRS CPE, it’s important to understand IFRS first. Developed by the IASB (International Accounting Standards Board), IFRS stands for International Financial Reporting Standards. These standards suggest how an event should be reported in companies’ financial statements or a specific transaction should be treated.

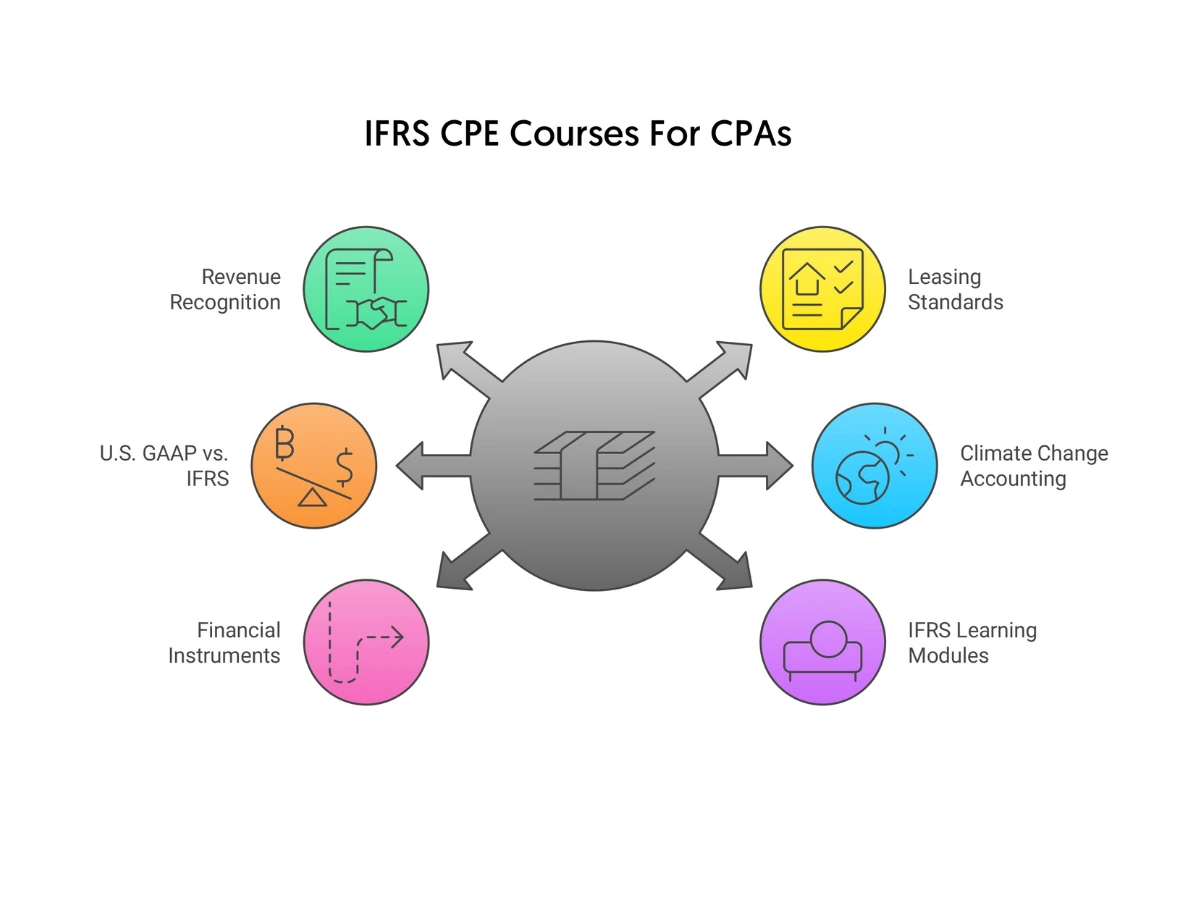

As you’ve probably assumed, IFRS CPE is about taking IFRS CPE courses to expand your knowledge in the field while earning some CPE credits. By choosing a leading IFRS CPE provider, you should be able to master different IFRS-related areas such as IFRS accounting, GAAP vs. IFRS, and more.

Now that you have an overview of IFRS CPE, let’s try to understand the reasons behind the skyrocketing demand for IFRS CPE Courses.

· They help you learn how to compare financial statements easily

All countries have their own versions of GAAP (Generally Accepted Accounting Principles) that businesses operating in those countries use to assess and prepare financial statements. However, the data in financial statements remains different in different countries based on their individual principles and guidelines.

This makes the comparison of the financial performance of two companies operating in two different countries extremely difficult. By following the rules and guidelines of IFRS accounting, organizations can follow the same accounting pattern, which essentially makes the process of analyzing and comparing the financial statements of multinational companies easier.

· They help you learn the process of highly transparent reporting

By pursuing IFRS CPE, you’ll see that IFRS operates on a principle-based concept instead of a rule-based concept. One downside of the rule-based concept is that while it may prove to be favorable for one entity, it can leave a negative impact on the opposite entity.

However, with a principle-based concept, equality and transparency remain intact throughout the process. IFRS CPE courses will help you learn how to represent complete and relevant information in the financial statements, giving a transparent picture with the minimal scope of manipulation.

· They help you understand complex accounting procedures easily

IFRS accounting framework breaks down complex accounting processes into easily comprehensible procedures. You’ll also learn how to report financial data easily in a better manner.

· They help you learn how to prepare reliable financial records

When you prepare financial records using the knowledge and skills gained through IFRS CPE, your books of accounts tend to be more accurate, reliable, and appropriate according to the reporting standards. This quality financial data helps investors in making better economic decisions.

When investors have a clear picture of financial statements and company reports, they can make wise decisions with regard to their investments. This becomes possible due to the universal and singular language of IFRS accounting that makes it easy to comprehend the actual financial health of a company.

· They help you learn how to track the flow of financial transactions

When financial statements are prepared following a uniform set of standards, it becomes easy to record fund-related information and track the flow of financial transactions. This also helps to achieve a level of security for both direct and indirect foreign investments between multiple nations. This is a must when you get into heavy financial transactions or deal with significant assets.

In addition to these, IFRS CPE courses will help you learn how to prepare financial records that anyone from across the globe can understand. With IFRS accounting, financial statements become more recognizable for potential collaborators and investors, which facilitates business growth and brings about trade on a worldwide level.

Since the single set of accounting principles makes the present financial position of every entity very transparent and clear, it develops a great level of trust amongst all the involved parties. This also helps to develop the confidence of the global stakeholders of a company.

IFRS accounting act as a multi-layer set of guidelines and rules that companies follow when performing accounting activities. Here’re two real-life uses of IFRS accounting.

· The availability of uniform accounting principles

Companies that have a presence in multiple countries are required to follow the principles of IFRS accounting when carrying out business activities and representing their financial data. Failing to do this may lead them to face substantial penalties. This helps to improve the trustworthiness of an organization.

· It acts as a financial tool

As noted above, IFRS CPE courses help you master the process of preparing financial records while maintaining accuracy, efficiency, and data transparency. This helps to maintain public interests and facilitate the world economy’s trust, sustainability, and growth. Following the global baseline also aids in eliminating any conflicts or errors.

When pursuing IFRS CPE, you can see that several IFRS CPE courses revolve around the topic of IFRS vs. GAAP. To master the concept of IFRS accounting, it’s extremely important to know the differences between these accounting methods.

However, it’s vital to have a clear overview of each before delving deeper into the differences. We’ve already discussed IFRS accounting, so, here’re a few lines on GAAP.

Developed by the FASB (Financial Accounting Standards Board), GAAP (Generally Accepted Accounting Principles) stands for a set of principles that must be followed by public companies in the U.S. when preparing their financial statements. The measures are created to ensure zero or minimal inconsistency in the financial statements that public companies submit to the U.S. SEC.

The GAAP makes it easy for investors to compare the financial statements of different public companies in order to make informed investment decisions.

So, in the context of GAAP vs. IFRS, the basic difference is that the former is followed by the majority of U.S. companies, while the latter is followed by companies in many countries other than the United States.

While these accounting standards share several similarities, they also have differences between them. Here’re brief overviews of the key ones about which you can learn in detail when pursuing IFRS CPE.

· Concept of accounting standards

The first thing about GAAP vs. IFRS you should know is how they evaluate the accounting processes. Under GAAP, very specific procedures and rules govern the accounting process, which offers minimal scope for interpretation.

On the other hand, IFRS comes with principles that should be followed and interpreted by companies as per their best judgment. As a result, the same situation may be interpreted in different ways by the companies.

· Difference regarding the balance sheet

The method of formatting a balance sheet differs between the U.S. and other countries. Under GAAP, companies need to list current assets first, while under IFRS, companies need to start with non-current assets.

These standards also have different approaches to dictating the balance sheet’s categories. As per GAAP, accounts need to be listed according to the order of liquidity. It prioritizes how conveniently and quickly the accounts can be converted to cash. Here, the items are arranged in the order of most liquid to least liquid.

Under IFRS, the order gets reversed and appears as least liquid to most liquid.

· Difference regarding the cash flow statements

The way the cash flow statement of a company is prepared also differs under these accounting standards.

As per GAAP, companies should classify interest paid and interest received as operating activities. As per IFRS, a company can select its own policy regarding the classification of interest depending on what’s considered appropriate by it. This means a firm can place interest paid either in the financing or operating section of its cash flow section while placing interest received in either the investing or operating section.

The same applies to dividends as well. According to GAAP, dividends paid should be placed in the financing section, while dividends received in the cash flow statement’s operating section. Under IFRS accounting, categorizing dividends is dependent on the choice of the firm. It can place dividends paid either in the financing or operating section while dividends received either in the investing or operating section.

· Difference in inventory valuation methods

Another key aspect of IFRS vs. GAAP lies in the way they deal with inventory valuation. Companies commonly use three methods to value inventory. These are FIFO (First In First Out), LIFO (Last In First Out), and weighted average.

Under GAAP, all of these three methods are allowed. However, under IFRS, firms can only use the FIFO and weighted average valuation methods.

· Difference in the process of recognizing revenue

When it comes to the process of recognizing revenue, GAAP is stricter than IFRS. Firms that follow the former need to first determine whether revenue has been earned or realized. GAAP also has specific rules regarding the process of revenue recognition in different industries. Here, the accountant cannot recognize revenue until the exchange of an item or service has been completed.

On the contrary, when adhering to IFRS in accounting processes, the accountant can recognize revenue upon the delivery of the value. Under IFRS, all transactions of revenues are grouped into four categories: provision of services, sale of goods, construction contracts, and the use of the assets of another entity.

· Difference in the method of asset revaluation

Sometimes, assets experience a decline in their value because of technological or market-related factors. This causes them to fall below their current values in the company’s account, and the accountant classifies it as a loss on impairment. However, the value of an asset may increase after recognizing the loss if the factors, which caused the reduction, don’t exist anymore.

As per GAAP, the accountant cannot write back the asset’s value once it has been impaired. However, IFRS accounting allows the accountant to revaluate certain assets up to their actual cost and adjust for depreciation.

· Difference in classification of liabilities

When following the GAAP accounting standards, accountants can classify liabilities either into non-current or current liabilities, based on the duration the company receives to repay the debts. If the company expects to repay some debts within the next twelve months, they need to be classified as current liabilities. If the repayment period for some debts goes beyond twelve months, they need to be classified as long-term liabilities.

When following IFRS in accounting procedures, the accountant can group current and long-term liabilities together.

When pursuing IFRS CPE, you’ll learn about several important standards developed by the IASB. IFRS CPE courses commonly cover IFRS 9, IFRS 15, and IFRS 17. Here’s what each of these standards signifies.

· IFRS 9

This standard covers the measurement of asset impairment, financial instruments, and hedge accounting. IFRS 9 outlines the way an entity should measure and classify financial liabilities, financial assets, and some contracts to sell or buy non-financial items.

· IFRS 15

The IFRS 15 standard outlines the principles that are applied by an entity at the time of reporting information regarding the amount, uncertainty, timing, and nature of cash flows and revenue that are generated from contracts with customers.

· IFRS 17

This standard defines the principles regarding insurance contracts’ recognition and measurement, as well as their presentation and disclosure. The IFRS 17 comes with the objective of ensuring that an entity shares relevant information that appropriately represents those contracts.

With the trade increasingly moving beyond the national boundaries, presenting an entity’s financial statements according to international reporting standards has become a must. And to master the difficult field of IFRS, you have to focus on pursuing IFRS CPE.

We hope this post has briefly touched upon all the important aspects of IFRS CPE and answered questions like what is IFRS, the difference between GAAP and IFRS, and more. You’ll be able to learn about all these in detail by taking IFRS CPE courses from a leading CPE sponsor.

If you want to learn more about how our courses can help you master IFRS accounting, contact us today.

Cpethink.com offers the top online reputation and customer reviews of any online CPE supplier. However, don't take our word for it, go to https://www.cpethink.com/cpe-reviews or see here for some of our recent buyer reviews.

These are reviews some of our present and previous buyers have made.