Oregon Ethics CPE For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

With more than 500,000 registered businesses, Oregon brings an exceptional opportunity for CPAs to accelerate their professional growth. However, to maintain and improve their employability, CPAs also need to renew their licenses in a timely manner.

Oregon CPA ethics is something that you need to prioritize all the time, whether you’re trying to become a CPA or keep your license active in the state.

With that in mind, we’ve created this page to provide you with all the important information related to ethics for Oregon CPAs. From Oregon CPA ethics exam and Oregon CPA CPE requirements to meeting your Oregon CPE requirements, we’ll discuss everything on this page.

Oregon Board of Accountancy

Let’s get started.

As mentioned above, Oregon CPA ethics plays an extremely important role both before and after you obtain your CPA license in the state. To understand its importance in getting your CPA license, you need to know the process of becoming a CPA in Oregon.

Let’s take a look.

· Meeting your education requirements that include completing 225 quarter hours or 150 semester hours together with earning a bachelor’s degree from a college with proper accreditation.

· Passing all the sections of the Uniform CPA Exam.

· Gaining one year of full-time practical experience in the accounting field. If you prefer part-time employment, you must complete 2,000 hours of experience within a period of one year. Whether you take the full-time or part-time route, your employment must be directly supervised by a licensed CPA.

· Passing the Oregon CPA ethics exam.

It’s important to note that you must earn the required experience, pass the Uniform CPA Exam, and clear the ethics exam within eight years from the date the state board of accountancy office receives your application.

You can get more information about these by visiting the official websites of the Oregon Board of Accountancy.

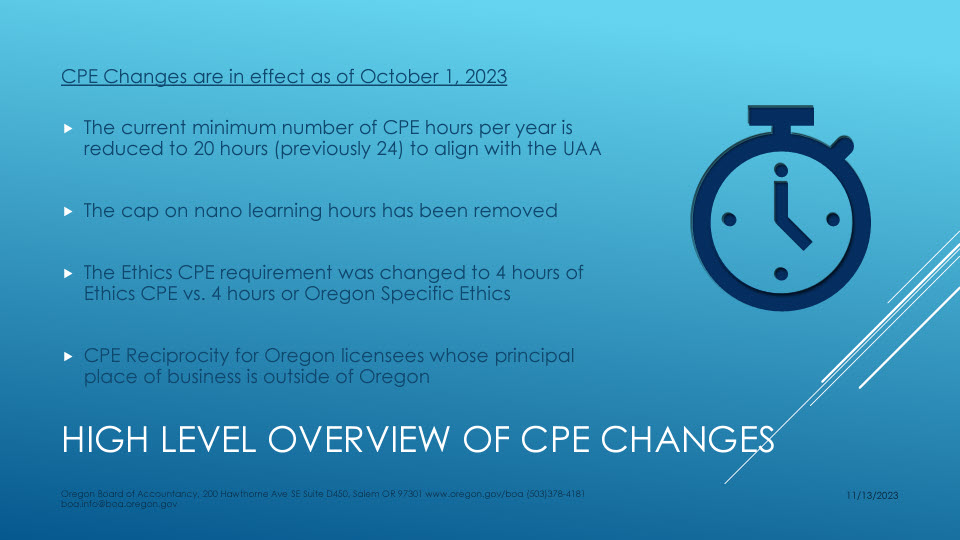

Oregon state board of accountancy follows a biennial license renewal cycle, meaning you must meet all your Oregon CPE requirements within two years.

Here’re the details of the Oregon board of accountancy CPE requirements including Oregon CPA ethics.

· You must earn 80 CPE credits every two years when pursuing Oregon board of accountancy CPE.

· Among these 80 Oregon CPE credits, four credits have to be earned in Oregon-specific ethics.

· You must earn at least 24 credits each year.

· You must take the Oregon CPA ethics course from a board-approved sponsor.

· If you take self-study courses to meet your Oregon CPA CPE requirements, the sponsors must be listed on the NASBA National Registry.

· You aren’t allowed to report more than 16 credits in non-technical CPE. If you report more credits than this limit, they won’t be considered by the Oregon state board of accountancy. This may lead to a failure in meeting the minimum yearly Oregon CPE requirements i.e. 24 CPE credits.

· You can carry forward a maximum of 20 CPE credits. It’s important to note that while carry-forward credits may help you lower the total number of CPE credits required to meet your Oregon board of accountancy CPE requirements, you may not be able to use them toward fulfilling your minimum annual requirement. Moreover, these credits won’t be categorically considered technical or non-technical ones.

Here’re the things you must keep in mind when planning your Oregon CPA ethics CPE.

· If your primary place of business isn’t located in Oregon, you may meet Oregon ethics CPE requirements by demonstrating adherence to the professional conduct and ethics requirements of your actual jurisdiction. Oregon state board will accept the number of CPE credits that fulfill the ethics requirements of that jurisdiction, as long as it requires you to complete an ethics program to renew your license.

· If your primary place of business isn’t located in Oregon and your actual jurisdiction doesn’t need you to complete an ethics program to renew your license, you must meet Oregon CPA ethics requirements to fulfill your Oregon CPA CPE requirements.

Whether you need help in meeting your Oregon CPE requirements, you can visit the Oregon Society of CPAs CPE catalog.

Accounting is an integral part of the business world, and maintaining your license by meeting your Oregon CPA CPE requirements can bring you some exceptional opportunities. Here, we’ve jotted down the real-life advantages of keeping your CPA license active in Oregon.

· Better short-term opportunities

Thanks to its superb business-friendly climate, Oregon has become a sought-after destination among businesses of all sizes and types. To navigate the complex world of accounting, companies in Oregon continue looking for competent CPAs.

Not only does this lead to more job opportunities but also helps you choose from a diverse range of industries. Whether you want to work in a private enterprise, government organization, non-profit, or independently, you can choose the option you prefer.

· Better opportunities in the long run

These days, a lot of companies in Oregon prefer to hire CPAs for higher-level positions. For instance, if you want to become a manager in a public accounting firm, you must hold an active CPA license. If you want to move into the C-suite in a large organization, an active CPA license will help you reach the position faster than those who fail to meet their Oregon CPA CPE requirements on time.

If you’re interested in opening your own accounting firm, an active CPA license will help your potential clients understand that you have the knowledge and skills to complete their jobs efficiently.

In short, regardless of the mode of work you choose, your active license will greatly help you shorten the time to achieve success.

· Increased potential for better salary and benefits

While your industry and experience level will play major roles in determining your income potential, as an active CPA, you can stay assured of being able to earn significantly more than your non-CPA counterparts throughout your professional career.

You’ll also be in a position to negotiate your salary and benefits to enjoy a more rewarding professional career.

· Job stability at all times

The accounting world is evolving rapidly and the business world is constantly adapting to new technologies. As a result, it has become more important than ever to ensure job stability in the future.

Although some repetitive accounting processes are getting automated, CPAs with strong critical-thinking abilities and other valuable skills will always govern the professional environment in the accounting and finance domains.

In your effort to meet your Oregon CPE requirements, you get to sharpen all valuable skills required to strengthen your position in the industry. Even if there are economic downturns, your active CPA license will ensure your job stability within the profession throughout your career.

Because of their excessive demand, a large number of CPE sponsors offer Oregon CPA ethics programs. This sometimes makes it quite difficult to choose the right program to meet your Oregon CPA CPE requirements in the most efficient manner.

To help you out, we’ve reviewed lots of CPE sponsors and shortlisted eight Oregon CPA ethics programs. Here, you’ll find the costs, associated credits, and other important details of these programs to make an informed decision.

· Surgent

Surgent offers two self-study Oregon CPA ethics courses (four credits each) at $79 and $139 respectively. It has a large collection of courses that can help you meet all your Oregon CPA CPE requirements.

If you aren’t satisfied with the courses and want to get a refund, you must raise the request within ten days of making the purchase.

· CPA Self-Study

You can purchase the self-study Oregon CPE ethics course from CPA Self-Study for $39.99 to earn the four credits required to meet Oregon CPE requirements. However, it’s important to note that this sponsor doesn’t have many courses in its collection, meaning you may need to join another sponsor to meet your Oregon board of accountancy CPE requirements.

You can obtain a 100% refund from this provider by raising your request within thirty days of purchasing the course.

· myCPE

If you want to meet your Oregon CPE ethics requirements from myCPE, you must purchase one of its subscription packages. It has two subscription packages (each with a 1-year duration) available at $199/year and $299/year.

Although myCPE has a large course library that can be used to meet all your Oregon board of accountancy CPE requirements, it restricts your flexibility to join another provider to a good extent. Moreover, this provider doesn’t provide any refund after purchasing a subscription unless there’s a particular issue from its side.

· Western CPE

Western CPE has a self-study Oregon CPA ethics course (four credits) that comes in two formats. The online format costs $116 and the hard copy format costs $136. Since this provider has a large collection of CPE courses in different formats, you may be able to meet your Oregon CPA CPE requirements from it.

You cannot get a refund from Western CPE if you aren’t satisfied with the course. Instead, you can either choose to have store credit or transfer the amount to another course of less or the same value.

· MasterCPE

MasterCPE offers its self-study Oregon CPE ethics program (four credits) at $39.95. This provider also has many CPE courses in its collection, meaning you may not need to join another sponsor to meet your Oregon CPE requirements.

To get a 100% refund from MasterCPE for this course, you must raise the request within 90 days of purchasing it. However, you’ll only be able to get a refund as long as you don’t complete the course and receive the certificate.

· UltimateCPE

You can purchase the Oregon CPA ethics course (four credits) from UltimateCPE to meet your Oregon CPA CPE requirements. This is available in three different formats. The “Digital PDF + Exam” format is available at $59, while the “Textbook + Exam” and “Exam Only” formats cost $79 and $49 respectively.

However, you should think twice before joining this provider because it has 69 CPE courses in its catalog, meaning it may be very difficult to meet all your Oregon CPE requirements without joining another provider.

UltimateCPE has a 100%, 30-day refund policy. Shipping and handling charges will get deducted from your refund amount. You can also exchange this course with another one within 60 days of purchasing it. In that case, however, additional charges may apply.

· American CPE

American CPE offers its Oregon CPA ethics CPE course (four credits) in three different formats. The “Text and Exam” format comes at $59, and you can also purchase this format for Apple computers by paying the same amount. The “Printed Text” format is available at $79.

While American CPE doesn’t have a significantly large course library, you may be able to meet all your Oregon CPA CPE requirements from here. You can get a 100% refund minus shipping charges by raising the request within thirty days of purchasing the course. This sponsor also lets you exchange this course with another one of lesser or equal value.

· CPEThink.com

At CPEThink.com, we offer two self-study Oregon CPA ethics courses (four credits each) at $39.95 each. We have a large collection of CPE courses, meaning you’ll be able to meet all your Oregon CPE requirements comfortably.

Like all our other products, these courses also come with the industry’s best 100-day, 100% money-back guarantee. You can also get these courses at lower prices by choosing one of our unlimited subscriptions. In fact, our subscription packages are designed to help you take all our courses at prices lower than their individual costs.

Pursuing Oregon CPA ethics on time is the best way to meet your Oregon CPA CPE requirements within your renewal period. We hope that this page has provided you with sufficient information about the importance of the Oregon CPA ethics exam and Oregon CPE ethics in keeping your license active.

If you want to learn more about our Oregon CPA ethics courses, talk to one of our team members today!

Cpethink.com has the finest internet reputation and reviews of any on line CPE sponsor. However, don't take our word for it, go to https://www.cpethink.com/cpe-reviews or see here for some of our previous customer reviews.

These are reviews some of our existing and past clients have given.