Revenue Recognition CPE For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

For any business that sells products, revenue recognition is a quite simplified process. This is because it can recognize the revenue when an item is sold and the customer pays for it. However, revenue recognition can become complicated when a business offers an ongoing exchange of services. If you, as a CPA, are associated with a company that belongs to the latter league, taking revenue recognition CPE courses can help you tremendously.

It’ll help you recognize the revenue for your company accurately and hence, streamline its financial performance. Let’s take a quick look at the importance of revenue recognition CPE courses.

Find Revenue Recognition courses below today!

Unlike what some may think, accurate revenue recognition isn’t only crucial from a regulatory standpoint. While smaller businesses may not consider its actual importance, in reality, this information is vital to investors, shareholders, and financial institutions.

It’s one of the key factors considered by prospective investors when they determine the value of a business. From the company’s viewpoint, accurate revenue reporting plays an important role in gaining valuable insights into its financial performance. With a complete view of the revenue and cash flow, it can make informed long-term business decisions. According to the FASB, a business should record the revenue when the process, from which revenue is being generated, has been completed instead of when the payment is actually obtained.

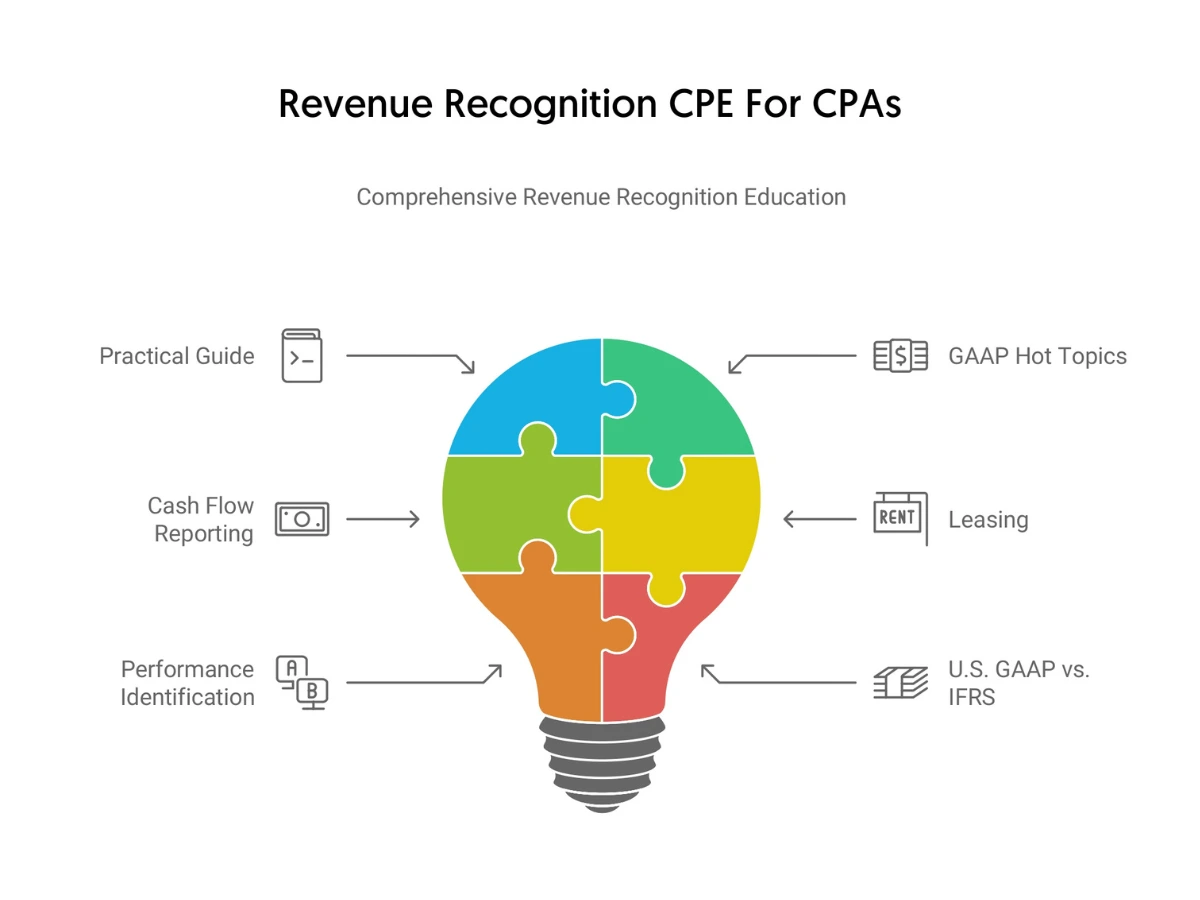

Therefore, it can be said that probably the most crucial reason to maintain accurate revenue recognition is that it helps a business monitor how much revenue is coming in and how much cash is going out in real-time. By pursuing revenue recognition CPE courses online or through other formats, you’ll be able to learn how the ASC 606 transforms the way a business recognizes different types of revenue by using a 5-step process along with various ancillary topics.

In short, revenue recognition CPE courses are designed to help you resolve issues with revenue recognition confidently while letting you earn CPE credits to fulfill the CPE requirements of your state accountancy board.

Cpethink.com's online reputation and customer reviews are the best of of any on line CPE sponsor. Please check out https://www.cpethink.com/cpe-reviews