Texas State Board of Public Accountancy | CPE for CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

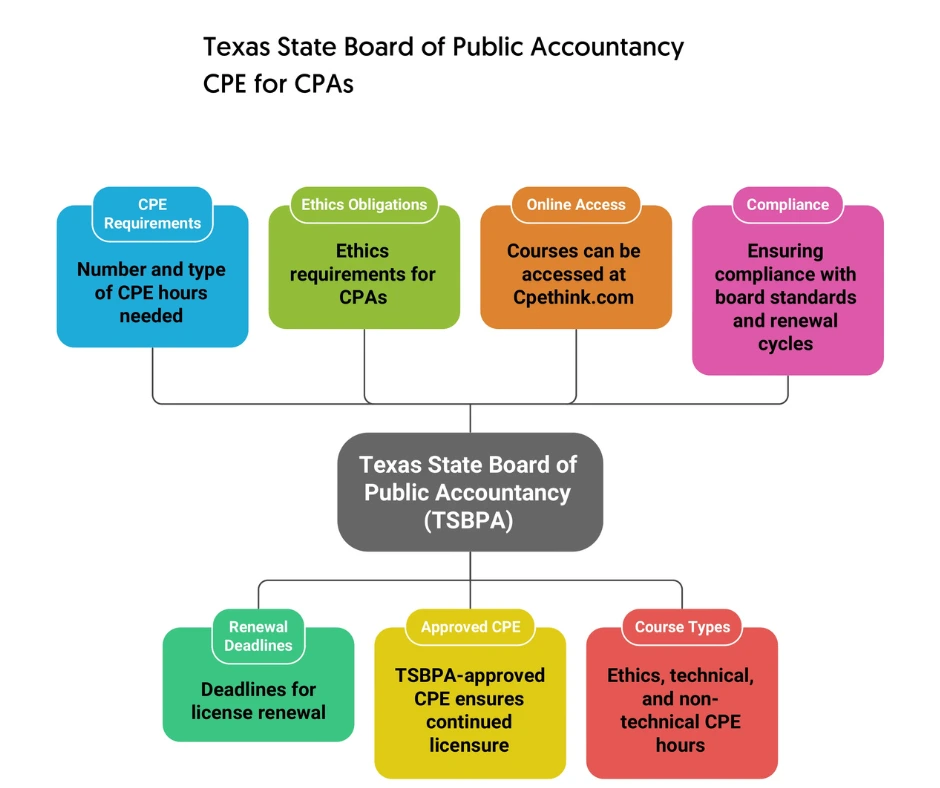

This page explains how Texas CPAs can meet the Texas State Board of Public Accountancy’s (TSBPA) continuing education requirements. It outlines the number and type of CPE hours needed, renewal deadlines, and ethics obligations. Whether you’re newly licensed or renewing your CPA credential, this guide helps you understand exactly what courses to take, when to take them, and how to stay compliant with Texas regulations.

1. Who is this list of CPE courses for?This list of CPE courses is designed for licensed CPAs in Texas, aspiring CPAs preparing for licensure, and accounting professionals who must comply with the Texas State Board of Public Accountancy (TSBPA) continuing education requirements.

2. What is this list of CPE courses about or what problem does this course solve?These courses focus on helping Texas CPAs meet mandatory CPE requirements, including ethics and technical subject hours, to maintain active licensure and uphold professional competence as required by the TSBPA.

|

3. Why is this list of CPE courses important to a CPA, or Accountant?This list is crucial because completion of TSBPA-approved CPE ensures continued licensure, ethical compliance, and adherence to Texas regulations—essential for practicing legally and maintaining client trust.

4. When is this list of CPE courses relevant or timely?These courses become relevant when CPAs are approaching their license renewal date (which coincides with their birth month) or during any part of their three-year CPE reporting period.

|

5. Where can this list of CPE courses be found and accessed?The courses and related information can be accessed at Cpethink.com for online consumption and download as a PDF.

6. How is a list of CPE courses like this consumed or used?Texas CPAs use this list to plan and complete the required ethics, technical, and non-technical CPE hours through online programs, ensuring compliance with board standards and renewal cycles.

|

In Texas, the accounting profession is regulated by the Texas State Board of Public Accountancy (TSBPA). It issues CPA licenses to qualified persons, enforces professional conduct, sets the rules for practice, and sets requirements for CPE that all CPAs must comply with to maintain their licenses. It can also investigate and discipline accountants for violating board rules or the Public Accountancy Act.

If you’re an active Texas CPA license holder, you’ve come to the right page. Here, we’ll discuss all important things related to the TSBPA CPE.

Before delving deep, here are some important things you need to know.

The Texas State Board of Public Accountancy (TSBPA) aims to help:

These courses help address the challenges of:

The information and guidance offered by the Texas State Board of Accountancy become relevant when you’re:

The information from the Texas State Board of Public Accountancy (TSBPA) applies to Texas, as the TSBPA is the regulatory authority for public accountancy here. If your principal place of business is located outside Texas, it may also apply to you when you want to fulfill Texas State Board of Public Accountancy CPE requirements.

It’s important to take note of the information provided by the TSBPA because:

To address the aforementioned problems, you can:

Check out what other customers are saying.