New York State Board of Public Accountancy | CPE for CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

This page outlines how the New York State Board of Accountancy regulates licensing, sets CPE rules, and enforces ethics and practice standards. It gives CPAs a clear view of New York’s annual CPE reporting rules, triennial ethics requirements, sponsor approvals, and conditions for those supervising attest or compilation work, so they can stay compliant year after year.

1. Who is this list of CPE courses for?It is for New York CPAs, CPA candidates, firms, and CPAs from other states who need to understand New York State Board of Accountancy rules and CPE requirements.

2. What is this list of CPE courses about or what problem does this course solve?It explains the Board’s responsibilities and the structure of New York’s CPE rules, helping users avoid reporting errors and compliance issues.

|

3. Why is this list of CPE courses important to a CPA, Accountant, or IRS Enrolled Agent?It clarifies New York’s annual reporting, triennial ethics, sponsor approval rules, and credit requirements needed to keep a license active.

4. When is this list of CPE courses relevant or timely?It is useful during annual CPE planning, triennial renewal, ethics-course selection, sponsor verification, and when supervising attest or compilation work.

|

5. Where can this list of CPE courses be found and accessed?It applies to all of New York State and to CPAs elsewhere who maintain a New York license and must meet New York’s CPE rules.

6. How is a list of CPE courses like this consumed or used?Users select approved sponsors, meet annual and triennial CPE requirements, verify ethics provider approval, and follow Board procedures for compliance and credential verification.

|

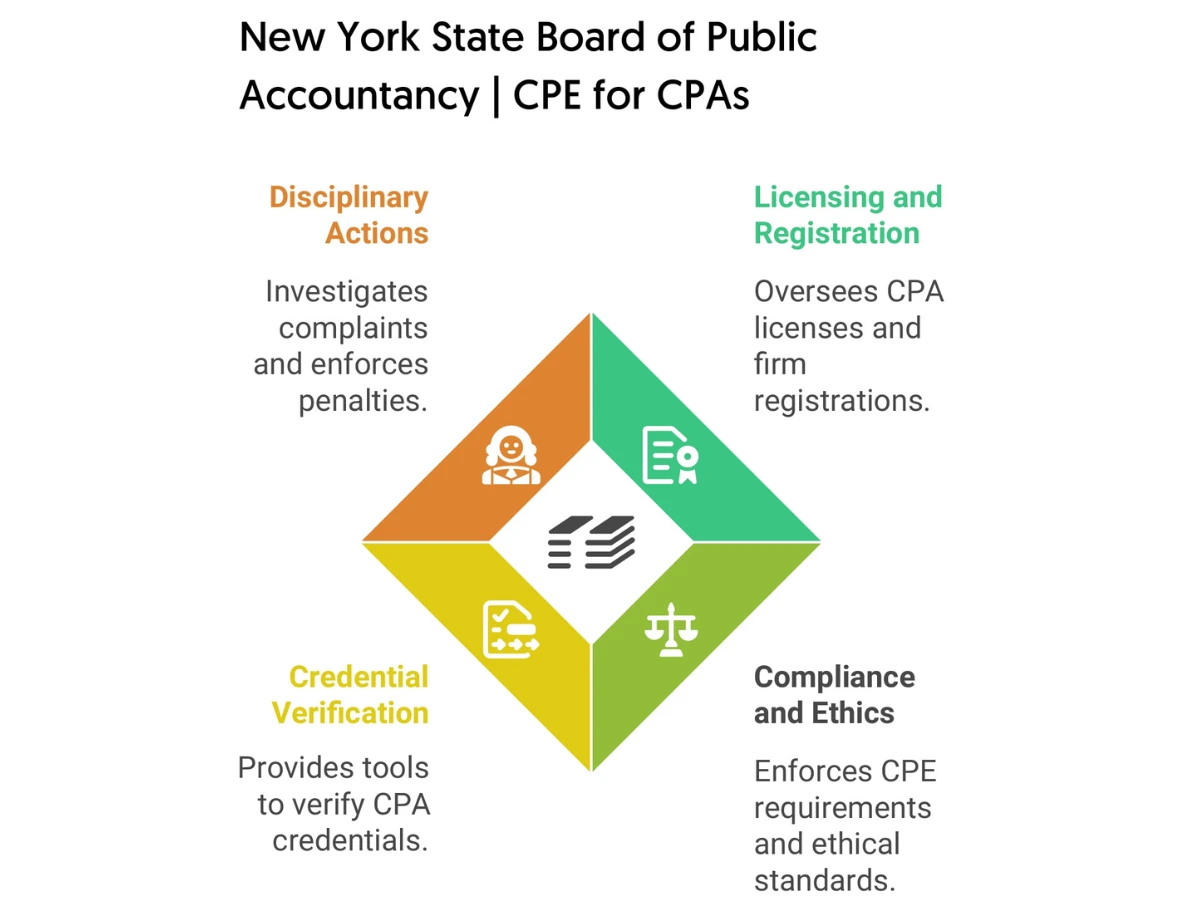

The New York State Board of Accountancy functions under the NYSED Office of the Professions. If you’re a CPA licensed in New York or one whose principal place of business is outside of it, this guide is for you.

Here, you’ll get all the information necessary to meet your New York State CPA requirements. But before we delve into these, here are some important information about the State of New York Board of Accountancy.

The regulatory authority is responsible for:

New York State CPA license requirements are quite different from those in many other jurisdictions. Therefore, you should take note of and meet them for smooth CPE reporting and license renewal processes.

It helps:

A clear understanding of the rules and regulations set forth by the New York State Board of Accountancy helps:

You can apply this information when:

It’s essential because:

With this guide, you can effectively navigate New York State CPA requirements and maintain your license. Even if you’re associated with a public accounting firm, you can use the information to ensure accountability and public trust.

Check out what other customers are saying.