Florida Board of Public Accountancy | CPE for CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

This page outlines how the Florida Board of Accountancy regulates CPAs, what the state requires for license renewal, and how Florida’s CPE rules work. It’s a practical reference for anyone who needs to keep their Florida CPA license in good standing or confirm how the Board handles ethics, auditing, reporting cycles, and compliance.

1. Who is this list of CPE courses for?It is for Florida CPAs, CPA candidates, firms, and non-resident CPAs needing clear guidance on Florida Board of Accountancy rules and CPE requirements.

2. What is this list of CPE courses about or what problem does this course solve?It explains how the Board functions and what CPE obligations Florida CPAs must meet, helping users avoid compliance issues.

|

3. Why is this list of CPE courses important to a CPA, Accountant, or IRS Enrolled Agent?It clarifies the rules governing license renewal, CPE content requirements, and Board expectations.

4. When is this list of CPE courses relevant or timely?It is useful during CPE planning, renewal periods, license reactivation, and when checking reciprocity conditions.

|

5. Where can this list of CPE courses be found and accessed?It applies to Florida, where the Board regulates CPAs and firms, with some relevance to non-resident CPAs seeking reciprocity.

6. How is a list of CPE courses like this consumed or used?Users apply it to understand CPE deadlines, select accepted providers, use DBPR reporting tools, and follow Board rules for maintaining an active license.

|

The Florida Board of Accountancy (Florida BoA DBPR) is responsible for overseeing CPAs and accounting firms in Florida and ensuring public trust and professional standards. It functions under the Florida Department of Business and Professional Regulation (DBPR). It has nine members, including seven CPAs and two consumer members who don’t have the CPA license.

If you’re a licensed CPA in Florida, this page will help you get a clear idea of the responsibilities and the CPE requirements set forth by the Florida Board of Accounting. With this knowledge, you’ll be able to fulfill Florida Board of Accountancy CPE requirements efficiently.

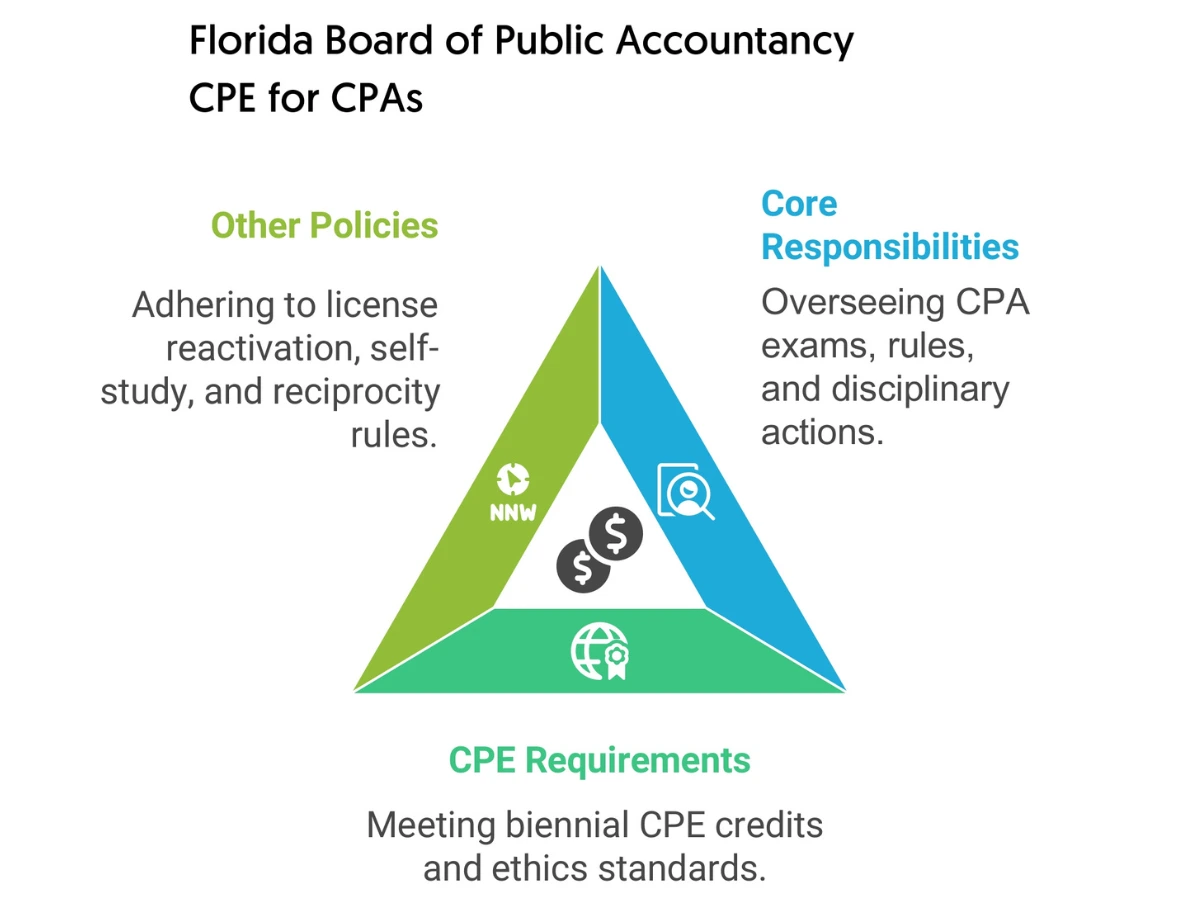

The Florida Board of Accountancy has three primary functions.

As an active Florida CPA, you need to comply with these CPE requirements set forth by the Board of Accountancy Florida.

In addition to meeting your CPE requirements, you need to adhere to these policies of the Florida Board of Accountancy (Florida BoA DBPR).

A strong understanding of the CPA Board of Accountancy Florida helps:

With information pertaining to the CPA Florida Board of Accountancy, you can:

You can use this information multiple times. Such as:

The information on the Board of Accountancy Florida primarily applies to the state of Florida, because the Board oversees CPAs and accounting firms operating here. It may also apply to other jurisdictions, especially when their CPAs are looking for CPE reciprocity.

Understanding the rules and regulations of the Florida State Board of Accountancy is essential because:

To address the above-mentioned problems, you can:

Check out what other customers are saying.