Fixed Asset CPE Courses For CPAs |

| The Last Self-Study CPE Website You Will Ever Need (Click for Subscriptions) |

This page provides CPAs, accountants, and IRS Enrolled Agents with a curated list of online Fixed Asset CPE courses focused on asset valuation, depreciation, and reporting. Each course helps professionals maintain compliance, improve their fixed asset accounting expertise, and fulfill their CPE requirements conveniently through self paced study on CPEThink.com.

1. Who is this list of CPE courses for?This list is for CPAs, accountants, bookkeepers, and IRS Enrolled Agents seeking to strengthen their understanding of fixed asset accounting and reporting to meet their continuing professional education requirements. 2. What is this list of CPE courses about or what problem does this course solve?The courses address the complexities of fixed asset accounting, valuation, depreciation, and reporting. Helping professionals ensure accurate financial statements and compliance with accounting standards. |

3. Why is this list of CPE courses important to a CPA, Accountant, or IRS Enrolled Agent?Accurate fixed asset accounting directly impacts a company’s financial health and compliance; these courses teach professionals to manage, value, and report fixed assets correctly to prevent costly errors. 4. When is this list of CPE courses relevant or timely?These courses are relevant year-round for fulfilling annual CPE requirements, staying updated with evolving asset accounting standards, and maintaining professional licensure or IRS continuing education status. |

5. Where can this list of CPE courses be found and accessed?The courses are available on CPEThink.com, where learners can browse, purchase, and complete the online self study materials at their own pace. 6. How is a list of CPE courses like this consumed or used?Learners select and complete online text or video-based modules, earn CPE credits upon successful completion, and apply the knowledge directly to real world accounting and financial reporting practices. |

Almost every business or company has some kinds of fixed assets that it uses for its operations and for conducting business. Among all the factors, the total value of fixed assets of a company plays the most important role when it comes to estimating its worth.

Moreover, its financial accounting will remain incomplete without the precise value of its fixed assets. Therefore, if you can improve your fixed asset accounting knowledge by taking fixed asset CPE, accelerating your professional growth will become much easier, especially if we think about the whopping 31.7 million small businesses in the country as of 2020 (source: SBA.gov).

These courses are aimed at helping you understand the essential facts about fixed assets, which you’ll be able to learn by completing fixed asset CPE courses so that you can make an informed decision.

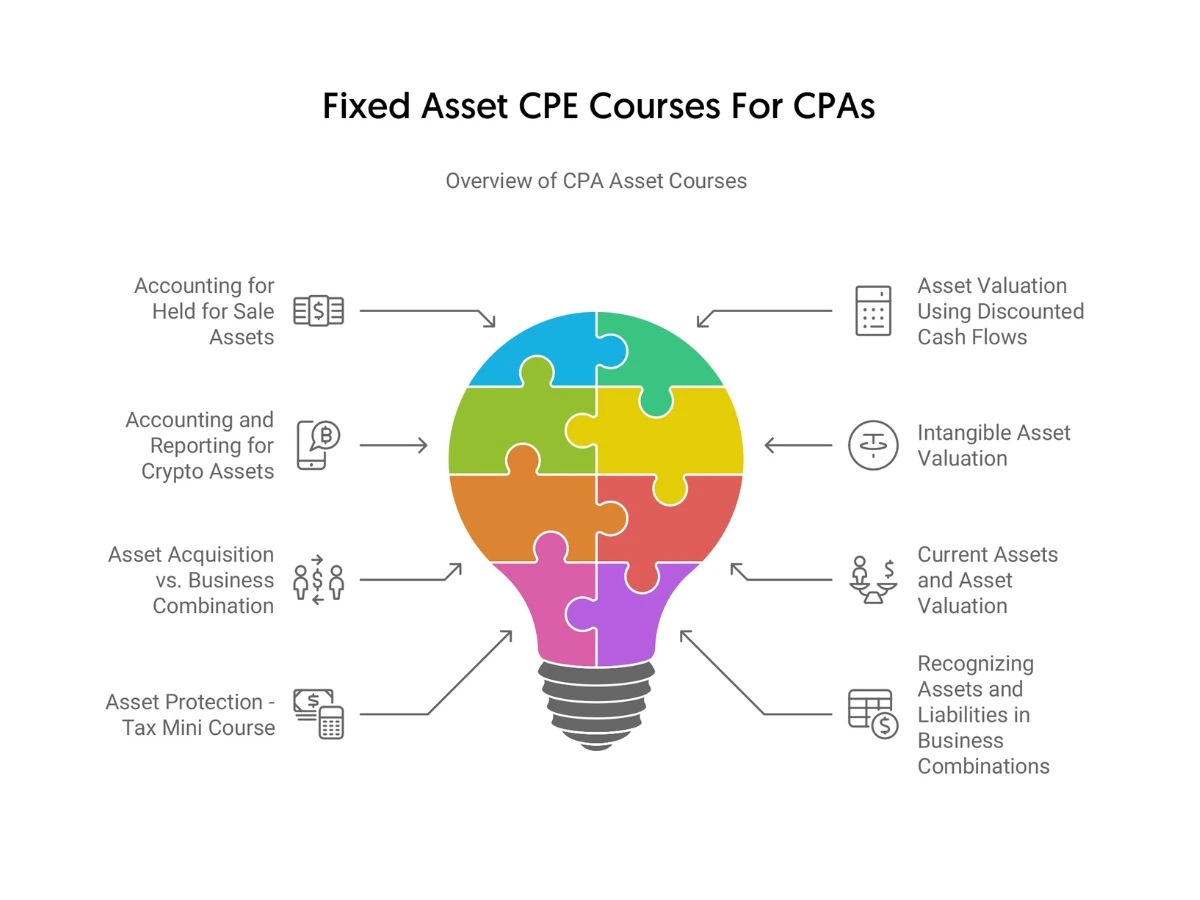

Fixed asset CPE courses are designed to equip the learners with a robust understanding of various concepts encompassing fixed assets. Some of the most important ones include types of fixed assets, fixed asset purchases, fixed asset thresholds, depreciation for taxes, bonus depreciation, and fixed asset dispositions.

You’ll also learn about security for fixed assets, fixed asset disclosures, fixed asset record keeping, fixed asset tracking, fixed asset auditing, asset retirement obligations, interest capitalization, fixed asset controls, among others.

Upon successful completion of fixed asset CPE courses, you should be able to describe different concepts and terminologies associated with fixed asset accounting and understand the treatment of fixed assets in a company’s books of account.

You should also be able to recognize the concepts utilized to assess fixed assets in capital budgeting, recognize the methods utilized for depreciating fixed assets, understand the processes to track fixed assets along with the situations where they’re most effective, etc. Within a business, fixed assets might belong to the biggest asset groups.

Therefore, fixed asset accounting requires skills that are different from the ones needed for other assets, and online fixed asset CPE is designed to equip you with them.

Fixed assets not only help a company generate revenue and increase profitability but also provide a clear picture of its performance. This is the reason why investors closely monitor a business’s fixed assets before investing in it.

Fixed assets come with specific implications on the financial statements of a business. For instance, fixed assets may include software, computer equipment, furniture, buildings, vehicles, machinery, and land. Apart from land, all other fixed assets depreciate. The income statement of a company mentions this depreciation while reducing its net income.

On a business’s balance sheet, fixed assets generally appear as PP&E (property, plant, and equipment). Upon purchasing a fixed asset, the business records its cost on the balance sheet as an asset. As fixed assets lose value over time (other than land), the item would get decapitalized from the balance sheet during its useful life.

When a fixed asset is sold or purchased using cash, the company’s cash flow statement reflects it. Sales of fixed assets are considered an inflow of cash while their purchases as an outflow of cash. Note that fixed assets are noncurrent assets meaning they aren’t expected to be sold or consumed within one year.

As you can see, for a company, fixed asset accounting is one of the fundamental tasks. Just a single error in it may result in great consequences, which may damage the company’s overall value. If you’re looking to master this intricate process, enrolling in fixed asset CPE courses is the best thing you can do.

These are reviews many of our recent and previous clients have left.